Every day, new data emerge highlighting the surge in homebuying demand...

Every day, new data emerge highlighting the surge in homebuying demand...

We've said it many times here at Altimetry Daily Authority: With the coronavirus pandemic forcing people to stay at home more than ever before, they're seeking to upgrade their living situations.

They're looking to move from cramped cities to more spacious suburbs. This is leading to increased demand for homes and thus higher prices.

All of the data are showing this surge in demand isn't temporary. The pandemic has changed how people think about their homes and mortgages.

According to the Mortgage Bankers Association, mortgage applications jumped 9% in a week last month. This demand spike is highly unusual during what's normally the quietest time of the year. Traditionally, home sales peak in the spring and summer months as families look to move before the next school year.

Purchase applications were also 28% higher than the same week just a year ago. This frenzy of demand is noticeably higher than in the past.

In addition to an increased desire for more spacious living, low interest rates are helping fuel this boom. The average interest rate for a 30-year fixed-rate mortgage is comfortably below 3%, which is historically low. Rates are more than 100 basis points below where they were a year ago.

Consumers want to take advantage of low interest rates by signing new mortgages. They can lock in cheap rates and get the space upgrade they're looking for.

Ultimately, low interest rates and the increased flight from cities have created a booming housing market... and it's likely to continue.

All this homebuying means a surge in demand for materials used to make houses...

All this homebuying means a surge in demand for materials used to make houses...

These include lumber, lumber sheet goods, gypsum boards, insulation, and the multitude of fasteners needed to build – and remodel – a house.

And that means companies like Builders FirstSource (BLDR) are reaping the benefits of this surging demand. Builders is a manufacturer and supplier of building materials, and handles new residential construction, repair, and remodeling services.

On top of the homebuying surge, many folks are renovating or adding on to their existing living spaces... and that means Builders will likely see stronger cash flows ahead.

But despite these strong fundamental factors, credit-ratings agencies consider Builders to be a high-risk business. Moody's (MCO) gives the firm a high-yield "B1" rating. This implies nearly a 25% chance that Builders will go bankrupt within the next five years.

Considering the tailwinds from the boom in housing construction and remodeling, this rating seems too pessimistic...

Considering the tailwinds from the boom in housing construction and remodeling, this rating seems too pessimistic...

Additionally, Builders only has one debt maturity – for a modest $50 million – over the next seven years. This is the kind of business primed for success with no risk on the horizon.

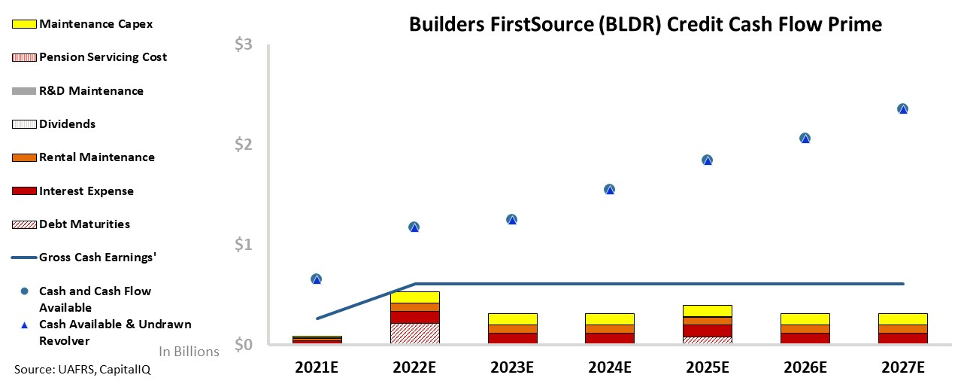

So to take a deeper look at Builders' true credit risk, we'll turn to our Credit Cash Flow Prime ("CCFP") analysis.

In the chart below, the stacked bars show Builders' obligations each year for the next seven years. We compare this to the company's cash flow (blue line) and cash on hand at the beginning of each period (blue dots).

The bottom bars are the hardest for Builders to "push off." These include costs such as debt maturities and interest expense. The higher bars are obligations that are more flexible, like maintenance capital expenditures ("capex") and share buybacks.

As you can see, the CCFP shows that Builders has a significant cash balance and a long debt runway...

Builders' cash flows alone are expected to exceed all obligations in every year going forward. Additionally, the company's expected cash balance provides an additional buffer.

Even with $50 million in debt due in 2022, Builders' cash flows are projected to be enough to meet these obligations. Builders would have trouble going bankrupt even if it tried.

This safety is why we give the company an investment-grade "IG3" rating – equivalent to an "A2" rating from Moody's. This rating implies a 1% risk of default within the next five years... It's a far cry from the nearly 25% risk indicated by rating agencies.

Moody's still appears to be caught up on the events of the Great Recession, where homebuilders were crushed. But by looking at the Uniform numbers, we can see that Builders – and the industry – aren't in the situation they were in 13 years ago... and Builders has virtually no credit risk.

Thanks to the power of Uniform Accounting, we can see how Builders' debt is far safer than the rating agencies would have investors believe.

Regards,

Rob Spivey

January 12, 2021

Every day, new data emerge highlighting the surge in homebuying demand...

Every day, new data emerge highlighting the surge in homebuying demand...