'Return to office plans' are postponed again…

'Return to office plans' are postponed again…

Last year was full of surprises. The development and approval of new COVID-19 vaccines was an amazing feat of science and gave much hope that the coronavirus pandemic would soon be over.

It seemed like life in the developed world was slowly but surely returning to normal in the middle of 2021. Restaurants were filling up, and Americans were traveling again in greater numbers.

Then the delta variant of the coronavirus emerged over the summer and reminded us how hard it is to root out the virus.

News of the strain's ability to spread more easily initially worried many scientists and business leaders, who halted or delayed return-to-office plans for the fall.

Yet many Americans still seemed confident enough to resume a sense of normalcy as the rollout of vaccines continued.

Coming into the final months of 2021, many companies firmly circled the first Monday of the new year as their target date for bringing workers back into the office.

Whether a few days in-person and a few days at home or completely back full-time, there appeared to be consensus in corporate America about the need to reconnect workers.

That all changed when news broke out from South Africa of another new strain called the omicron variant.

Corporate bosses changed their tune dramatically once again. Many parts of the U.S., particularly here in the Northeast, are seeing surging case levels.

This is causing many big companies like Fidelity Investments and Goldman Sachs (GS) to delay return-to-office plans... and more are likely to follow.

More delays spell trouble for this once-hot real estate giant...

More delays spell trouble for this once-hot real estate giant...

One company that has been desperate to conclude this "on again/off again" saga is the office space provider WeWork (WE).

The unconventional commercial real estate company went public through a $9 billion special purpose acquisition company ("SPAC") deal late last year after its first attempt in 2019 went up in flames.

Pre-pandemic, WeWork scrapped its plans to go public after investors raised serious concerns about its business model and the leadership of its CEO Adam Neuman.

WeWork was one of the world's largest "unicorns" when it was private, valued at $47 billion when it first tried to go public via its initial public offering ("IPO").

While the company had to take a serious haircut to go public in 2021, it was the right decision.

The hope for WeWork is that now the company can more easily access capital to help it survive the continued low demand for office space.

This is important because, as the delta and omicron variants have shown, return-to-office plans can be delayed or scrapped without much notice.

This places increasing pressure on commercial real estate operators like WeWork that face an uncertain future due to the At-Home Revolution.

On the one hand, less demand for office space as companies shift to a hybrid model could mean more businesses turn to WeWork for its flexible workspace options.

But more working from home may mean a severe reduction in demand for the company's offices.

Either way, the continued delay of return-to-work plans are placing a financial strain on WeWork that it might find hard to overcome, even with its public offering.

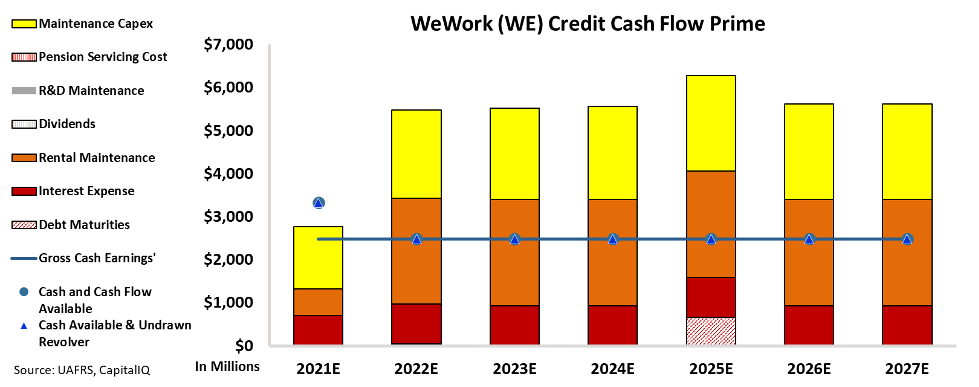

Fortunately, we can get a sense of the company's true credit risk by looking at our Credit Cash Flow Prime ("CCFP") analysis.

In the chart below, the stacked bars represent the company's obligations each year for the next five years. We compare these obligations against cash flow (blue line) as well as the cash on hand at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP shows us that WeWork faces serious risks if return-to-office plans continue getting delayed or are potentially scrapped altogether for another year or two.

That's because if the company's cash flows don't change for the better, they are forecast to fall below its massive rent obligations, interest expense, and other obligations going forward.

It looks like WeWork will have a roughly $3.5 billion shortfall in cash flows relative to obligations over each of the next five years if conditions don't change quickly.

In other words, the CCFP analysis shows us that WeWork will need access to capital, and a lot of it.

The company's recent SPAC deal simply isn't covering its massive obligations if conditions in the commercial real estate market don't improve anytime soon.

Whether you're an equity or a debt investor, it might be worth keeping an eye on this name in the coming quarters.

There's a tool for monitoring WeWork's profitability and 'unicorn' stocks...

There's a tool for monitoring WeWork's profitability and 'unicorn' stocks...

The Altimeter, a database of nearly 5,000 U.S.-listed companies, allows you to sift through easily digestible grades on each company. For example, WeWork received a "C" for its Valuations grade.

The tool acts as a "stock truth detector," applying our Uniform Accounting to reveal the real earning power of a particular stock... Understanding the true earnings potential of a company can help investors make a fortune on a stock that Wall Street has overlooked...

The annual subscription for using The Altimeter typically costs $1,200. But for a limited-time offer, you can access the database on a risk-free trial basis.

Learn more details about this special offer by clicking right here.

Regards,

Joel Litman

January 5, 2022

'Return to office plans' are postponed again…

'Return to office plans' are postponed again…