Borrowing is the fuel for growth – and it's finally making a comeback...

Borrowing is the fuel for growth – and it's finally making a comeback...

The stock market has made significant strides since the pandemic. While we saw a pullback in 2022, most years since the onset of COVID-19 have been marked by a steady rally.

But if you've been following the markets, you'll know there has been a key missing piece – borrowing.

Borrowing is how companies accelerate their growth. It allows businesses to invest faster, boost earnings, and in turn, fuel the market.

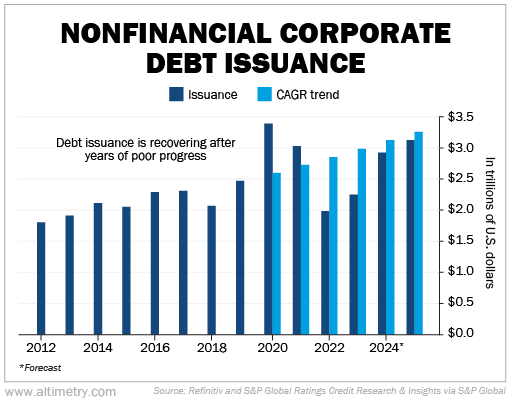

Yet for years, borrowing levels have been stagnant. Companies struggled to raise the capital they needed, and debt issuance barely grew. By 2023, total nonfinancial debt issuance was only slightly higher than levels seen in 2014, 2015, and 2018.

This year seems to have been a turning point... So today, we'll discuss how the recovery in borrowing could push the stock market to new heights.

The long-awaited debt recovery is here...

The long-awaited debt recovery is here...

Borrowing conditions are finally starting to improve. While companies have been turning to creative ways to access capital... the real breakthrough is happening now as debt issuance begins to recover.

The chart below shows the total issuance of nonfinancial corporate debt from 2012 through today, alongside a projection for 2024 and 2025.

Between 2012 and 2019, debt issuance followed a steady compound annual growth rate ("CAGR") of 4.65%. Then the pandemic hit. Debt issuance fell off a cliff, stalling the engine of corporate investment.

In 2023, total issuance barely scraped above the levels of 2014, 2015, and 2018 – essentially a decade of lost progress.

But in 2024, the story has begun to change. Debt issuance is projected to climb by a remarkable 17%, reaching levels not seen since the early part of the pandemic.

And by 2025, we expect nonfinancial debt issuance to return to the growth path we should have been following all along.

Take a look...

Borrowing is the lifeblood of corporate investment. Again, it allows companies to fund expansion, launch new products, and boost earnings.

Without it, businesses are forced to rely solely on cash flows... which slows the pace of innovation and market development.

For the first time in years, the pieces are falling into place for a sustainable bull market...

For the first time in years, the pieces are falling into place for a sustainable bull market...

The pandemic may have left a massive debt gap, but the recovery is finally here – and with it, the potential for unprecedented corporate and market growth.

At the same time, global debt markets are seeing robust growth. Again, bond issuance is projected to rise 17% in 2024 according to S&P Global, and another 4% in 2025.

This is exactly what the market needs to take the next step forward... debt recovery combined with easing credit conditions.

The road ahead looks promising. Debt-issuance trends suggest we're entering a period where the economy can finally support significant earnings growth.

As borrowing ramps up, businesses will regain the fuel they need to propel the market higher.

For investors, this is a great time to stay ahead of the curve. The market's next big move could be right around the corner.

Regards,

Joel Litman

December 18, 2024

Borrowing is the fuel for growth – and it's finally making a comeback...

Borrowing is the fuel for growth – and it's finally making a comeback...