For years, the world has been trending toward digital payments...

For years, the world has been trending toward digital payments...

And yet, as The Economist recently explained, banks have been slow to adopt this trend. This has led to the emergence of a new breed of banks...

Offerings like Nairobi-based Safaricom's M-PESA, a mobile-money service, have thrived during the shift. Other beneficiaries include Nubank, a digital lender in Brazil.

Across the globe, digital payments have begun to take hold. And this year, the trend has been accelerated by the coronavirus pandemic and the "At-Home Revolution" – the massive societal shift we've seen as consumers have moved their spending to the home.

During the initial lockdowns earlier this year, e-commerce boomed as customers were forced to shop online.

These digital trends persisted even during reopening. As part of the effort to reduce the spread of the coronavirus, governments in 31 countries have pushed to increase the number of contactless payments available to consumers.

Other businesses used the shutdowns to upgrade digital capabilities. For example, many gyms have moved from cash registers to direct debits.

Additionally, consumers are using peer-to-peer (P2P) services more frequently. Payments processed by Venmo grew 50% year over year in the second quarter. Food orders completed with Marqeta tripled between March and April.

Consumers are rapidly adapting to digital spending. And considering the ease and comfort of digital payments compared to cash, it's unlikely for these trends to reverse after the pandemic recedes.

We can see proof of this transformation all across the globe. In July, a third of Singapore's 18,000 street hawkers let consumers pay by scanning a QR code. This was an increase of 50% in just two months. And during February, less than 10% of U.K. businesses were cashless only... This number hit near almost 50% in April and has since settled at 37%.

Mobile wallets continue to take share where cash once dominated. Again, the At-Home Revolution has accelerated existing trends in the payment sphere... and banks need to adapt or face irrelevancy.

This is a powerful shift... and yet, emerging markets are behind the overall trend of digital payments.

This is a powerful shift... and yet, emerging markets are behind the overall trend of digital payments.

These regions have fewer cashless transactions than more developed countries. Emerging markets tend to be slower in adapting to these trends.

But one company seeking to jump-start this shift is Evertec (EVTC) – a transaction-processing business focused on Latin America and the Caribbean.

The company provides merchant acquiring services, which enable businesses to process payments. Evertec also services financial institutions to process credit, debit, and other payment methods.

Additionally, Evertec has business process management solutions to help banks move into the digital world.

Evertec also recently launched contactless payments through QR codes, and more than 400 businesses are already using the feature. Consumers can now simply scan a QR code with an app to make payments.

Evertec's services are essential in modernizing the payments system in Latin America and the Caribbean. And as more banks and customers in the region look to go digital, Evertec benefits.

Investors would expect a dominant regional provider of these essential – and booming – services would generate high returns.

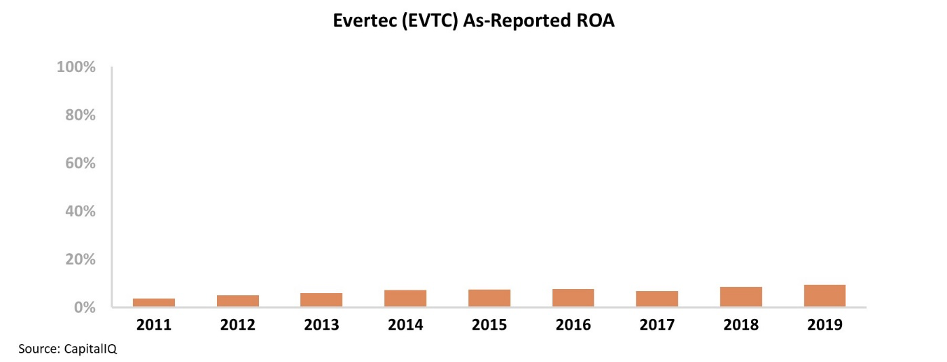

And yet, looking at the GAAP numbers, Evertec has average profitability at best. The company's as-reported return on assets ("ROA") was 9% in 2019... and has been roughly flat since 2012. Evertec appears unable to capitalize on the tailwinds in the digital payments industry.

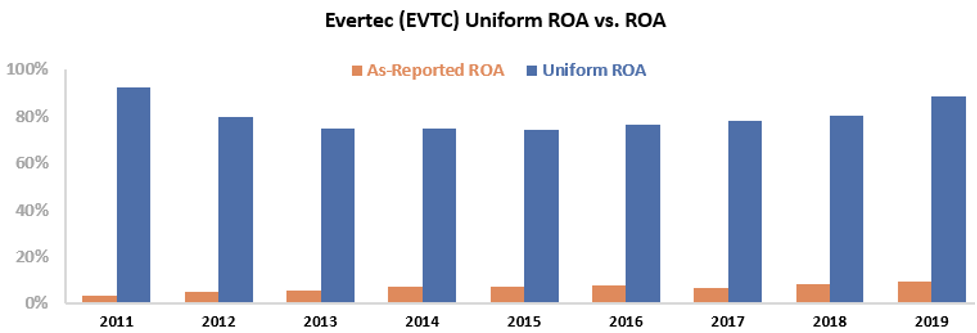

However, this picture of Evertec's profitability isn't accurate. Due to distortions in as-reported accounting – including the treatment of interest expense – Wall Street is missing the real story.

Evertec's Uniform ROA has been nearly 10 times the as-reported numbers since 2011. Just last year, the company's Uniform ROA was a robust 88%, compared to the as-reported 9%. Take a look...

Evertec has used its dominant position in Latin America and the Caribbean to generate high returns. But without Uniform Accounting, investors would miss this strong performance. Instead of understanding its robust profitability, they only see Evertec as a company with average returns.

And as emerging markets continue to accelerate the shift to digital payments, Evertec will continue to see growing tailwinds.

Regards,

Joel Litman

November 19, 2020

P.S. Whether it's working from home, playing at home, or supplying their home... folks are now spending billions of dollars every year to keep themselves happy, healthy, and productive – at home. And right now, my team and I have identified the best ways to take advantage of this trend. Learn how to gain immediate access to our research on the At-Home Revolution right here.

For years, the world has been trending toward digital payments...

For years, the world has been trending toward digital payments...