SoftBank (9984.T) just pulled off one of the biggest U.S. stock sales of 2025...

SoftBank (9984.T) just pulled off one of the biggest U.S. stock sales of 2025...

And it didn't involve a flashy initial public offering or an AI startup. Instead, the Japanese software giant offloaded 21.5 million shares of T-Mobile US (TMUS) for $4.8 billion.

This isn't the first time SoftBank has executed this kind of telecom play...

It acquired a majority stake in communications firm Sprint in 2013. And T-Mobile acquired Sprint in 2020, quietly building a telecom cash cow.

Since then, SoftBank has raked in $26 billion from its T-Mobile position.

Instead of investing more in telecom, SoftBank is cashing out and funneling lots of capital into AI.

Today, we'll explain why SoftBank's decision is well-timed... and why investors should be cautious about chasing T-Mobile higher right now.

What started off as a risky bet created a market leader...

What started off as a risky bet created a market leader...

T-Mobile quickly absorbed Sprint's assets, expanded its network, and lured customers away from Verizon Communications (VZ) and AT&T (T).

As a result, TMUS shares have surged nearly 180% from April 2020 through today. It has far outperformed both of those telecom peers and the S&P 500 Index.

SoftBank held on to its T-Mobile shares for years, while gradually trimming its stake. Now, it's using those proceeds to go "all in" on AI.

Earlier this year, SoftBank agreed to acquire AI semiconductor company Ampere for $6.5 billion. And it plans to invest $40 billion in ChatGPT creator OpenAI.

SoftBank set up this opportunity using a carefully timed exit...

The market doesn't expect T-Mobile to climb much higher from here...

The market doesn't expect T-Mobile to climb much higher from here...

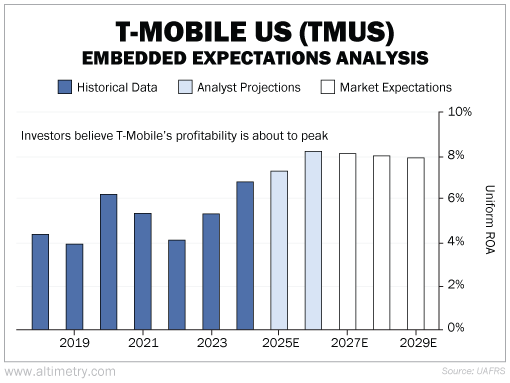

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

T-Mobile's Uniform return on assets ("ROA") has hovered around 5% – its cost of capital – for nearly two decades. It finally reached 7% in 2024 due to synergies with Sprint and improved operations.

Analysts expect T-Mobile's Uniform ROA to gradually increase and rise a bit above 8% by 2026. That would be the highest level in company history since 2005.

The market has a similar estimate through 2029, and it foresees a plateau. Take a look...

Simply put, investors understand that T-Mobile can't go much higher.

SoftBank is getting out of telecom at the right moment...

SoftBank is getting out of telecom at the right moment...

Instead of waiting around for diminishing returns, it's reallocating capital into AI infrastructure.

SoftBank is preparing to spend billions of dollars in the semiconductor space – the backbone of AI. And it's set to play a big role in OpenAI's growth.

It's unclear whether this bet will pay off in the long run. However, exiting a mature telecom company (like T-Mobile) and getting on the AI bandwagon seems like a reasonable strategy... with real moneymaking potential.

T-Mobile remains a solid operator, yet investors have already captured the easy gains.

SoftBank's recent move is a good reminder for investors... When a trade has played out, it's often wise to take profits and invest in the latest Big Tech trends.

Regards,

Joel Litman

July 22, 2025

P.S. People always ask me what I'm doing with my own money – especially at critical moments like right now. Normally, I don't share this type of information, but I've put together a summary of my three main investments. I strongly recommend these same investments to my family and friends, too. Click here to see if these three stocks make sense for you.

SoftBank (9984.T) just pulled off one of the biggest U.S. stock sales of 2025...

SoftBank (9984.T) just pulled off one of the biggest U.S. stock sales of 2025...