The global energy market was shaken by surprising news last month...

The global energy market was shaken by surprising news last month...

According to data from May, for the first time in nearly two years, Russia overtook the U.S. in natural gas exports to Europe.

This wouldn't have come as such a shock... if not for the fact that Europe is actually trying to lower its intake of Russian gas.

See, after Russia's invasion of Ukraine in February 2022, Russian President Vladmir Putin cut off a major natural gas pipeline to Europe. And Europe's reaction was to gradually replace Russian gas with gas from the U.S.

Since then, the U.S. has exported far more natural gas to Europe than Russia has...

In both 2022 and 2023, the U.S. supplied nearly half of Europe's natural gas imports. For reference, no other country supplied more than 14% of the total.

At first glance, you might think that Europe has given up on its stance against Russia and just gone back to its cheapest supplier.

However, as we'll explain today, this is really a one-off situation... driven by a handful of one-time factors. Despite what recent data may say, U.S. natural gas is likely to continue replacing Russian gas in Europe.

The U.S. natural gas industry has nothing to worry about here...

The U.S. natural gas industry has nothing to worry about here...

Russian gas exports to Europe exceeded the U.S. thanks to two compounding factors...

First, Russia sent more natural gas than normal through Turkey in May because of planned maintenance in June that shut off all deliveries to Turkey for at least a week.

Second, a major natural gas export facility in the U.S. underwent an outage.

In other words, May was an outlier.

On top of that, natural gas demand in Europe remains weak due to the record level of gas storage on the continent and higher temperatures during the spring and summer months.

These are short-term – if not one-off – events. And as demand in Europe picks up in winter, Russia simply won't be able to hold on to its share of Europe's natural gas supply.

As we said earlier, Europe is still trying to wean itself off of Russian gas because of rising geopolitical tensions with the region. At the same time, Russia also won't be able to keep up with the U.S. natural gas market...

U.S. natural gas production keeps rising, with more capacity expected to come online by the end of the year.

And even though President Joe Biden has quietly paused natural gas export growth, that won't last much longer. Once the election is over, whoever's in charge for the next four years will keep the energy flowing.

That's great news for Cheniere Energy (LNG)...

That's great news for Cheniere Energy (LNG)...

Cheniere is one of the largest natural gas producers and exporters in the U.S., mainly operating along the Gulf Coast.

The company also plays a critical role in the global energy market, supplying natural gas to more than 35 countries on five continents.

Yet, despite all the macro tailwinds we just mentioned, investors aren't as bullish on Cheniere as you'd expect...

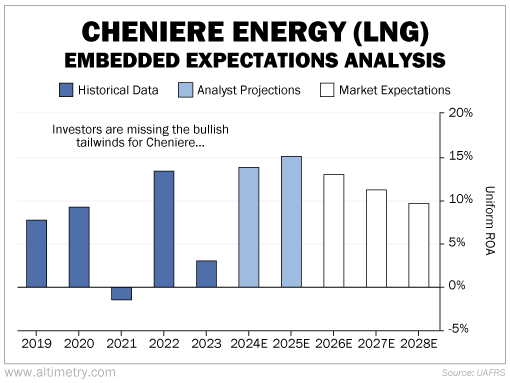

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Cheniere's Uniform return on assets ("ROA") was lower than historical levels in 2021 and 2023, primarily due to low natural gas prices.

Prices have jumped around a lot since the pandemic began. In 2021, natural gas demand was low, so prices fell... and Cheniere's Uniform ROA plummeted. When Russia invaded Ukraine, prices skyrocketed and Uniform ROA climbed to 14%.

Now that the U.S. is pumping out a lot more supply, prices have fallen back down. But remember, there are several tailwinds in place for the U.S. natural gas market...

Analysts expect Uniform ROA to reach 15% by 2025, as shown by the light blue columns in the chart below. Yet, the market expects Uniform ROA to fall below 10% by 2028. Take a look...

That's about what the company returned in 2020... the first year of the pandemic.

Unless we see a significant decrease in natural gas prices, investors' expectations are far too bearish.

The U.S. natural gas outlook is a huge boon for Cheniere...

The U.S. natural gas outlook is a huge boon for Cheniere...

Russia exceeding the U.S. in natural gas exports to Europe is a one-time event. As we explained, the U.S. is likely to take back its spot as the top supplier... and soon.

As an important player and a strong performer in the U.S. natural gas industry, Cheniere should benefit in a big way.

It wouldn't be surprising for the company to maintain its 2022 returns... or even increase its profitability moving forward.

Companies like Cheniere might prove to be intriguing buy opportunities for savvy investors looking to take advantage of the ramp-up in U.S. natural gas exports.

Regards,

Joel Litman

July 11, 2024

The global energy market was shaken by surprising news last month...

The global energy market was shaken by surprising news last month...