Editor's note: Our offices are closed on Thursday, November 23 and Friday, November 24 for Thanksgiving. Because of this, we won't publish Altimetry Daily Authority. Please look for your next edition on Monday, November 27.

Companies love to talk about how AI will help their businesses...

Companies love to talk about how AI will help their businesses...

Yet few have the results to back it up.

Data-driven consulting expert Palantir Technologies (PLTR) is one of the exceptions.

The company's entire business is built on an algorithm for finding patterns in data. Palantir has partnered with the U.S. government and some of the world's largest companies for years.

While it hasn't always talked about its services in terms of AI... that's what they are. And once AI mania swept the market, it didn't take long for investors to catch on.

During the third quarter, Palantir tripled the number of users on its AI platform. Its stock was up 150% through the first three quarters of 2023. And it wasn't done winning the market over...

Just last month, the company unveiled a strategy to completely dominate the AI market. Its stock jumped even further into the nosebleeds.

But if hearing Palantir's story makes you want a piece of the action, think again. Today, we'll look closer at how Palantir positioned itself to win in AI... and why investors should reconsider before buying in.

Palantir's AI isn't reserved for the Fortune 500 anymore...

Palantir's AI isn't reserved for the Fortune 500 anymore...

The company used to work mostly with ultra-large corporations and the U.S. government. In October, it found a way to appeal to companies of all sizes with what it calls "bootcamps."

The idea is Palantir will give companies access to its AI platform for a few days... at no cost. It's a commitment-free way for smaller businesses to try the tool.

The concept is already generating a lot of interest. Palantir expects to conduct 140 bootcamps by the end of November.

Investors are thrilled. The stock is up 34% since the start of October. Unfortunately, most of the upside is already behind Palantir.

Folks who are just finding out about Palantir today probably missed their chance...

Folks who are just finding out about Palantir today probably missed their chance...

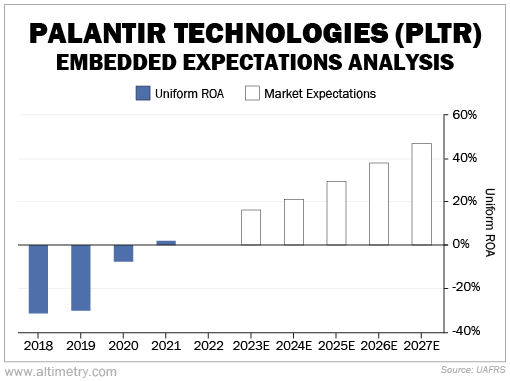

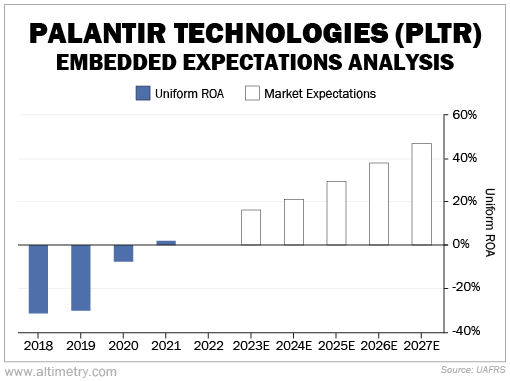

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Palantir's Uniform return on assets ("ROA") has never been above 2%. It was basically zero last year.

And yet, the market expects returns to reach 47% by 2027. Take a look...

The best software businesses and consultants tend to return between 40% and 50%, on average. So no matter what you consider Palantir to be, investor expectations are probably about as profitable as this company will ever get.

Of course, there's always a chance Palantir's returns could get even stronger... But that's a big bet to make for a company whose best-ever return sits at 2%.

The stock is already up triple digits this year... and investors are "all in." They already understand how big AI is for this company. And they've baked those lofty expectations into its share price.

Palantir's valuation is very likely closer to its top than its bottom. Think twice before jumping in today.

Regards,

Joel Litman

November 22, 2023

P.S.: While investors have poured billions of dollars into a handful of AI winners, they're missing out on plenty more. And there's still time to get in before these stocks take off...

I recently put together a brand-new report on five hidden AI "juggernauts" that could unlock a ton of value for your portfolio. Plus, I revealed five more potential ticking time bombs like Palantir... including one market favorite that might surprise you. Click here for the full details.

Companies love to talk about how AI will help their businesses...

Companies love to talk about how AI will help their businesses...