During the holiday season, offices tend to team-build alongside the festivities...

During the holiday season, offices tend to team-build alongside the festivities...

Many companies decorate the office, host holiday parties, and conduct other events to boost camaraderie. These have become a tradition for employees and a time for folks to reflect on the accomplishments of the year and the connections they built.

However, in the midst of the coronavirus pandemic, many of these options aren't available. Zoom (ZM) cocktail hours and trivia can serve as alternatives... But these aren't a one-for-one replacement of traditional festivities.

Additionally, the normal holiday ritual of holiday bonuses is getting cut in many places this year. The economic damage caused by the pandemic has prevented businesses from being able to afford these extra payouts. Companies are struggling just to hold onto their existing workers.

The coronavirus pandemic has disrupted so many of our normal interactions... especially over the holidays. While it is easy to fall into "new normal" habits, and those who can't be with close family and friends around the holidays may even be tempted to forget to celebrate, it's essential to find ways to keep employees, friends, and families motivated and in contact during these tough times.

That means it's more important than ever for us to reach out to each other. Managers and co-workers should be checking in on colleagues to make sure they have what they need. Families should be making calls to each other, even if they can't be together in person.

After all, especially in the midst of the pandemic, we all need to know that we're together in this.

My wife's employer is one place looking for festive alternatives...

My wife's employer is one place looking for festive alternatives...

Instead of the traditional gathering, her company sent everyone drink mixers to make together in a video conference.

The activity went great... but it was still difficult to replace the feel of interacting in person.

While all of us are struggling to feel normal in this new environment, there has been one big winner of this trend toward video social gatherings: Zoom.

With the year winding down, it's time to take a moment to analyze the company that will probably end up most synonymous with 2020.

Zoom's video-communications platform has taken the world by storm this year. As people turn to video calls for school, work, and social gatherings, the company has been a big winner.

The name "Zoom" has become the coveted "cognitive referent" – when a company's name becomes synonymous with a product of service – during the past few months. Businesses across the globe all aspire for this type of brand recognition.

When people talk about searching for something on the Internet, they often say to "Google" it – using Alphabet's (GOOGL) search tool. Zoom is occupying a similar space in video conferencing.

Individuals and businesses alike prefer Zoom for its simplicity and free features. Zoom users can get free access for meetings of a certain period of time, before upgrading to extend the time limit.

Investors might think such a global sensation would have industry-leading returns...

Investors might think such a global sensation would have industry-leading returns...

But GAAP metrics tell a different story.

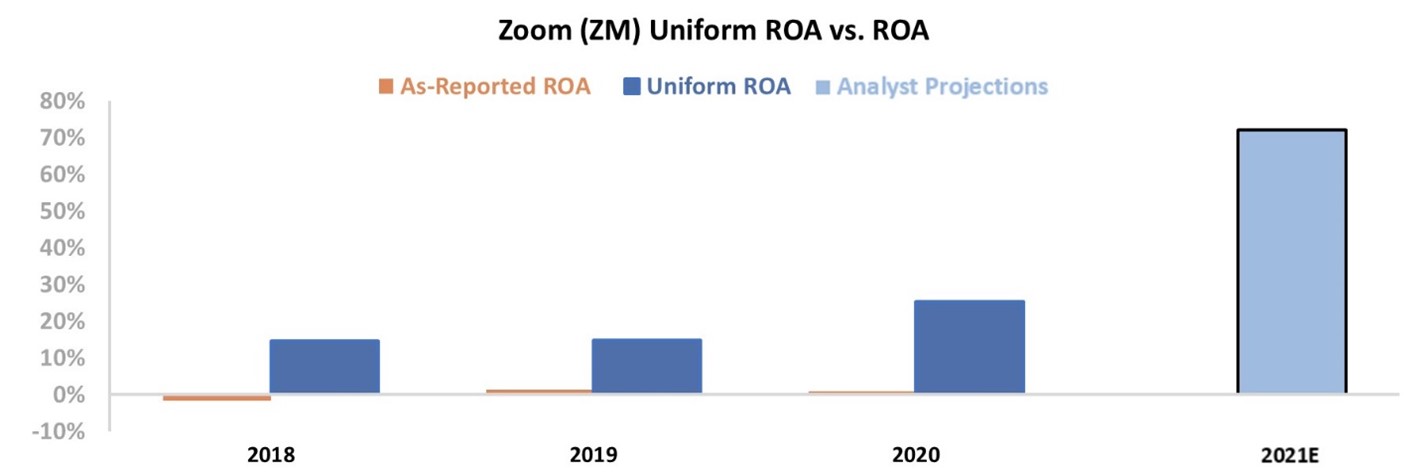

Zoom's as-reported return on assets ("ROA") was just 1% in its 2020 fiscal year, which makes it seem like the company hasn't been able to convert its industry star status to profitability.

And yet, due to distortions in as-reported accounting – including the treatment of goodwill – the market isn't seeing the real story.

Zoom's Uniform ROA has been at least 10 times the as-reported numbers going all the way back to 2018. Just this fiscal year, the company's Uniform ROA was 25%... and analysts forecast returns to rise to 66% in fiscal year 2021.

Zoom has been able to generate robust and growing returns... and analysts expect the company to continue its rise during the next fiscal year.

That might understandably make investors excited. Zoom's performance has been truly impressive... but the market doesn't pay for past performance. Looking ahead, it's critical to see what the market is expecting Zoom to accomplish in the coming years.

We can do that by using our Embedded Expectations Framework.

Most investors determine stock valuations using a discounted cash flow ("DCF") model. This uses assumptions about the future, which then produces the "intrinsic value" of the stock.

However, here at Altimetry, we know models with garbage-in assumptions only come out as garbage. Therefore, we turn the DCF model on its head with our Embedded Expectations Framework. We instead use the current stock price to determine what returns the market expects a company to make.

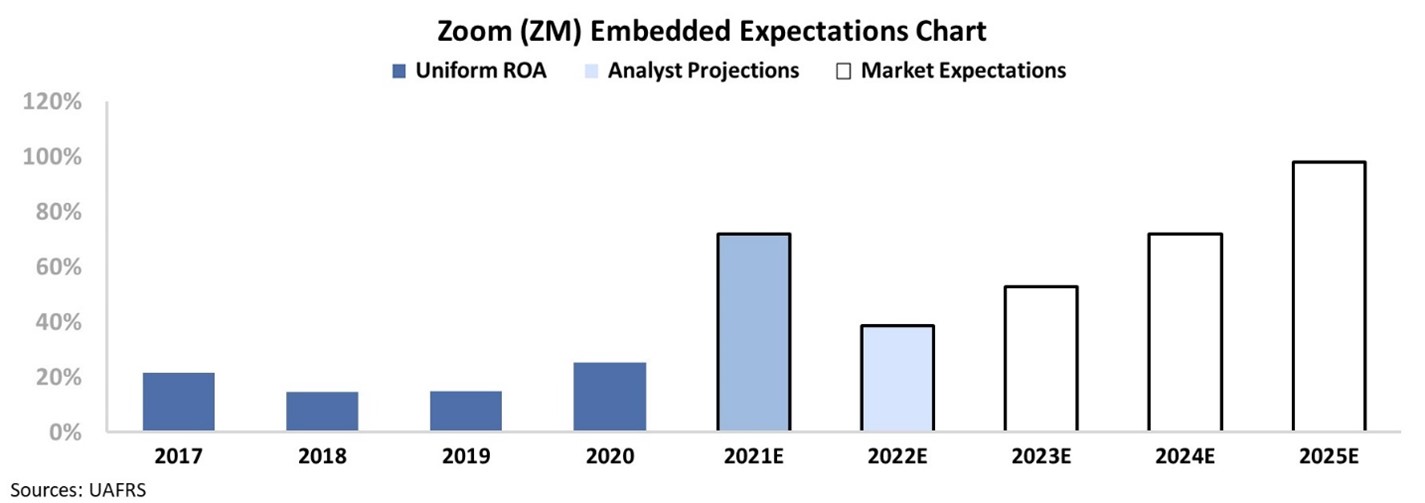

In the chart below, the dark blue bars represent Zoom's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how ROA will shift in the next five years.

While Wall Street forecasts returns to fall to 36% in 2022 after 2021 highs, the market expects returns to rise all of the way to 98% by 2025. Take a look...

These expectations are nearly 4 times as high as Zoom's current returns. The company would need to continue to see the astronomical growth of the past year move even higher to hit these expectations.

Zoom has been a shining star in this market and the new at-home world. But considering how high market expectations are, it will be hard for Zoom to exceed those levels... which is what a company needs to do to be worth more than its current stock price.

So while this may have been the year of Zoom, its stock is primed to disappoint investors next year.

Regards and Happy Holidays,

Rob Spivey

December 22, 2020

During the holiday season, offices tend to team-build alongside the festivities...

During the holiday season, offices tend to team-build alongside the festivities...