Bankers had no interest in helping Walt Disney build Disneyland...

Bankers had no interest in helping Walt Disney build Disneyland...

It didn't matter that Disney (DIS) was a household name. It didn't matter that it was one of the biggest media companies in the world. Its string of huge commercial successes – including Cinderella, Treasure Island, and The Story of Robin Hood – didn't matter, either.

Walt spent most of 1953 planning the park and trying to get funding. But the U.S. was in the middle of its third recession in a decade. Banks just weren't willing to take on the risk of such a big unknown during an economic slump... even for a company as established as Disney.

Walt was forced to raise cash in any way he could. He sold his home in Palm Springs and took out a $50,000 loan from his life insurance policy to fund construction.

Keep in mind, Walt was the founder and chief executive of a massive media company. If banks weren't willing to work with him, it was bad news for the rest of corporate America.

And if Walt Disney were planning his brand-new theme park in 2024... he'd probably run into similar problems.

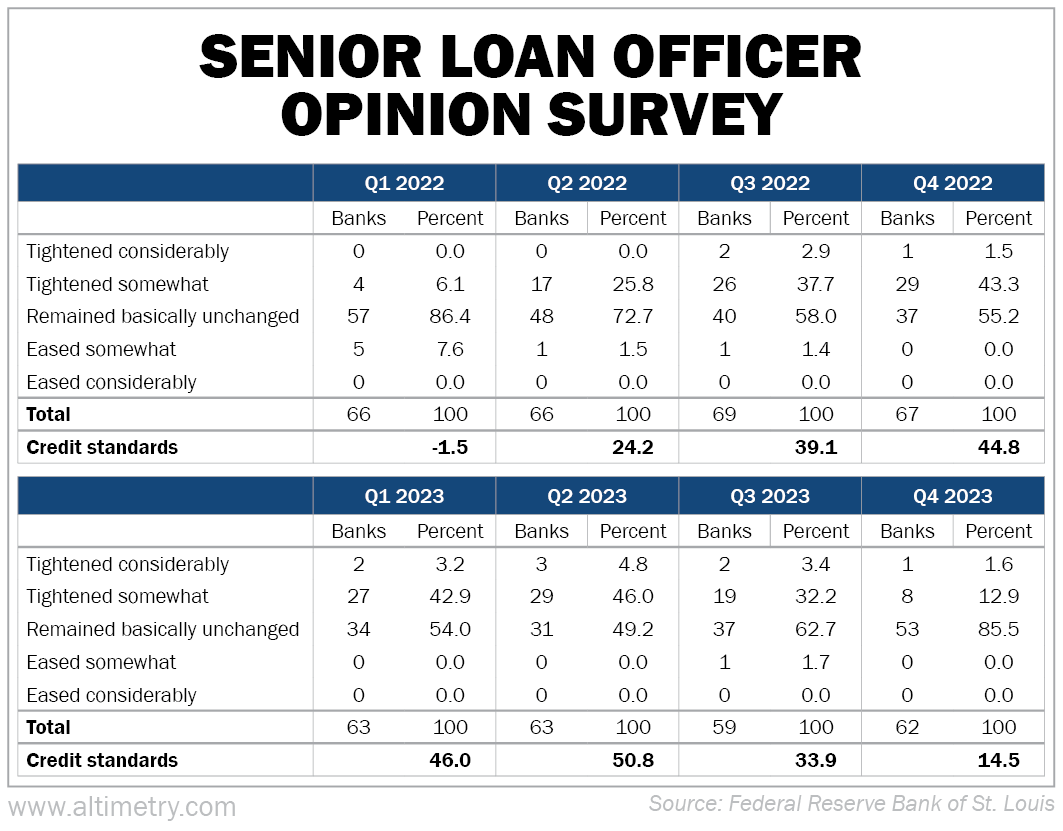

Regular readers are familiar with the Senior Loan Officer Opinion Survey ('SLOOS')...

Regular readers are familiar with the Senior Loan Officer Opinion Survey ('SLOOS')...

It's a poll conducted every quarter by Federal Reserve regulators... asking loan officers if their lending standards have tightened, loosened, or stayed the same over the past three months.

Said another way, it tells us how willing banks are to make loans – and how easy or hard it is for corporations and consumers to access credit.

A negative number means that banks are making it easier to get credit overall. A positive number means they're making it harder for customers to borrow.

The ratio has been extraordinarily high for much of the past few quarters. You almost never see a SLOOS reading above 40% without a recession... But it happened in both 2022 and 2023.

Take a look...

And we can use the SLOOS to zoom in even more... Since the fourth quarter of 2022, the survey has collected a total of 314 responses.

Only once did a bank respond that it eased lending standards. Every other time, banks either tightened standards or kept them the same.

In the fourth quarter of 2023, "only" 15% of banks tightened standards. That sounds promising on the surface... particularly next to 34% in the third quarter.

But remember, the other 85% of banks kept lending standards the same. They didn't ease standards. That's after multiple quarters of severe, recession-level tightening.

Banks are still treading cautiously...

Banks are still treading cautiously...

And in the meantime, individuals and businesses will find it tough to borrow. Without access to credit, growth will struggle. Those who can't refinance are running out of options.

There's still plenty of pressure on this economy... no matter what the recent S&P 500 rally seems to say.

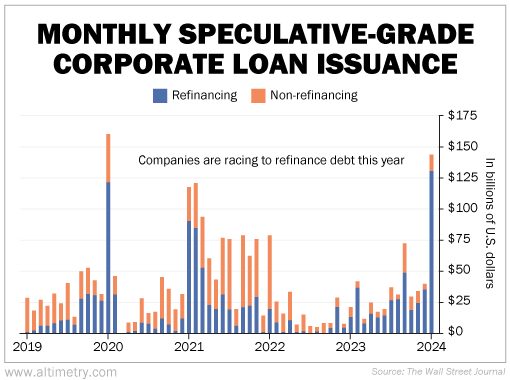

That's why we saw a refinancing scramble in January.

Speculative-grade debt issuances began to pick up toward the end of 2023, as some businesses had to pay back maturing debt... even at unfavorable rates.

The five-year Treasury rate rose for much of last year... before falling somewhat to 3.8% in late December. The 10-year Treasury sat at similar levels. And companies finally embraced that this might be the best they could get in terms of interest rates.

The result was a $125 billion spike in speculative-grade loan refinancing to start the year.

Take a look...

As you can see, in January, total speculative loan issuances hit levels we haven't seen since early 2020.

Other corners of the market are singing the same tune. Companies issued more investment-grade bonds in January than almost any time... besides one month in 2016 and one in 2020.

This flurry of lending activity doesn't mean the credit markets are reopening...

This flurry of lending activity doesn't mean the credit markets are reopening...

And in fairness, they were never totally closed to begin with. It's just that companies have been fighting the idea of refinancing into significantly higher interest rates... until now.

In the past few months, we've seen a small drop in these rates. The 10-year Treasury now sits at 4.24%. That's a material change from its 4.98% peak in October.

Rates are by no means low. But this small change has made companies think about refinancing. They've been waiting for a better time to do so... and they're running out of patience.

Investors keep an eye on credit because it shows how strong the economy is (or isn't). This new refinancing activity has made them hopeful. They think it can help the U.S. economy avoid the coming recession.

But the SLOOS shows banks aren't making it easier to get loans. Even though more companies are refinancing, it's still going to be tough to get credit in 2024.

Businesses and investors alike are navigating a tricky financial environment. That's not likely to change in the next few months. Strategic decision-making and careful planning are more crucial than ever.

Regards,

Rob Spivey

February 26, 2024

Bankers had no interest in helping Walt Disney build Disneyland...

Bankers had no interest in helping Walt Disney build Disneyland...