When Jamie Dimon talks, Wall Street tends to listen...

When Jamie Dimon talks, Wall Street tends to listen...

That's just what happens when you run the largest bank in the world.

JPMorgan Chase (JPM) has nearly $4 trillion in assets under management. It operates in more than 100 countries. And it has roughly 290,000 employees worldwide... As a result, the bank pretty much has its finger on the pulse of the economy.

Last week, Dimon released his annual shareholder letter. And as usual, it had some important takes that the financial markets made note of...

Dimon warned of economic risks like quantitative tightening and a surge in private credit due to limited regulation. And he discussed geopolitical risks like the ongoing war in the Middle East and rising tensions with China.

He highlighted the U.S. economy's resilience. And he praised the effectiveness of current industrial policies such as the Inflation Reduction Act and the CHIPS and Science Act. However, he also cautioned against ineffective government intervention that could damage the economy.

Above all, though, his most crucial point may have been about the state of inflation...

As Dimon put it in his shareholder letter, "There seems to be a large number of persistent inflationary pressures, which may likely continue."

We completely agree with Dimon. As we'll explain today, we're a long way from 2% inflation... and investors are starting to realize it.

Dimon cited several reasons for why he thinks inflation will remain high...

Dimon cited several reasons for why he thinks inflation will remain high...

For starters, rising geopolitical tensions have triggered the restructuring of global supply chains.

More and more U.S. companies are looking to bring manufacturing closer to home – what we call the "supply-chain supercycle." And the biggest companies are no exception...

Giants like Intel (INTC), Microsoft (MSFT), and Nike (NKE) have all talked about pulling manufacturing out of China. And while the U.S. will surely benefit from this wave of infrastructure spending, it also means higher input costs for companies... and, as a result, higher inflation.

Next, there's the recent proposed uptick in U.S. defense spending. Last month, President Joe Biden requested a new $895 billion defense budget for fiscal year 2025. That's about a 4% increase from 2023... and a new record for defense.

The government is also making significant investments into the new green economy. As Dimon said in his shareholder letter, the U.S. will spend trillions of dollars each year just to fulfill its ambitious climate goals.

Of course, increased government spending translates into higher inflation.

Lastly, there's also rising health care costs, largely driven by the aging Baby Boomer population and increased prices for medical technology and pharmaceuticals.

All of this is reshaping the inflationary framework. Dimon suggests that it may prevent inflation from returning to the cozy 1.5% to 2% range we've enjoyed for much of the past decade.

Now, this doesn't mean we'll return to 5%, 7%, or 9% inflation...

But it does indicate a potential new "normal" where inflation sits much higher than the Federal Reserve or investors would care to admit.

That means the Fed may not have much room to cut interest rates...

That means the Fed may not have much room to cut interest rates...

And investors are finally beginning to notice.

Currently, the market is anticipating just one quarter-point rate cut in 2024, with a roughly 33% chance of a second cut.

This outlook marks a significant shift from January, when investors were expecting six to seven rate cuts.

While still overzealous, the change in sentiment underscores a growing realization that there will be fewer rate cuts than the market initially anticipated.

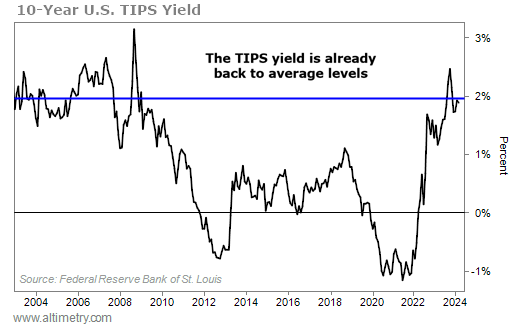

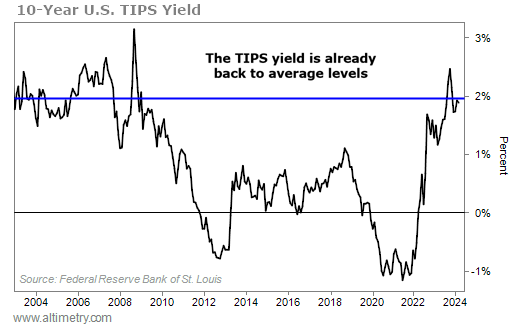

We can see this by looking at Treasury Inflation-Protected Securities ("TIPS"), too...

TIPS measure the "real cost of capital" for the U.S. government. That means they reflect the interest rate after accounting for inflation.

Over the past 30 years, the average TIPS yield has been about 2% (as shown by the blue line in the chart below). If you exclude certain abnormal periods where real interest rates were negative, the average real interest rate is closer to 2.5%.

Take a look...

Interest rates should, in theory, be around the same as the government's cost of capital (as measured by TIPS) plus the expected inflation rate.

If the Fed sets rates much higher, it's at risk of sending the economy straight into recession. If it's much lower, inflation will never subside.

Right now, the TIPS yield is about 2%. And as of last month, inflation is still at 3.5%.

That means interest rates should be around 5.5%... which is exactly where the Fed has rates set today.

So it makes sense why Dimon doesn't see interest rates coming down any time soon. The Fed knows we're still in the middle of a long battle, and it's not going to budge until it's winning.

Regards,

Joel Litman

April 17, 2024

When Jamie Dimon talks, Wall Street tends to listen...

When Jamie Dimon talks, Wall Street tends to listen...