The concern is about the rising cost of debt...

The concern is about the rising cost of debt...

Fear isn't always rational... The market tends to get spooked by rising interest rates since it dislikes rapid changes in the monetary landscape.

At the end of last month, Federal Reserve Chair Jerome Powell affirmed that the U.S. central bank could raise rates several times this year. The increase in rates would increase borrowing costs from effectively zero, where the rate has stood since the onset of the pandemic.

But some investors fear that the Fed's response could slam the brakes on economic growth.

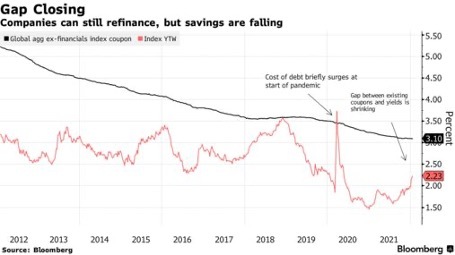

For instance, Bloomberg's "Era of Ultra-Cheap Money Begins to Fade in Corporate Bond Market" asserts that the last decade has been great for companies looking to refinance debt... and that this trend is coming to a close post-pandemic with the increase in borrowing costs.

For the past decade, the coupon rates companies paid out on their debt have been higher than the prevailing cost to borrow. This encouraged companies to refinance their debt to lower their aggregate cost of capital.

In other words, it became easier for companies to take on debt to fund operations or expansion efforts.

The chart below compares coupon cost (the black line) with the cost of debt (the red line).

In the chart, we can see the first time since the financial crisis when the cost to refinance flirted with the current coupon cost for companies was in late 2018 when the market was tumbling. The second was in March 2020, during the onset of the pandemic, when the cost of debt briefly surged and crossed the line before retreating to much lower levels.

Most recently, the cost of debt appears to be closing in on the coupon rate, which draws concerns for what that could mean for companies.

But will increased borrowing costs hurt growth...

The change in costs isn't the most important factor to consider...

The change in costs isn't the most important factor to consider...

The change in borrowing costs isn't as important to companies refinancing as the absolute value of the borrowing cost.

While the spread between the coupon and borrowing cost has tightened by about 0.15% to 0.2% since late 2021, when the Federal Reserve started discussing raising rates more aggressively, it is still about 0.9%.

Factoring in the move that's already happened, even if the Fed were to raise rates at the speed that they've discussed for 2022, there would probably still be a 0.2% to 0.3% spread between the cost to refinance and the coupon cost of debt.

It would still make sense for companies to actively borrow new money in the debt markets.

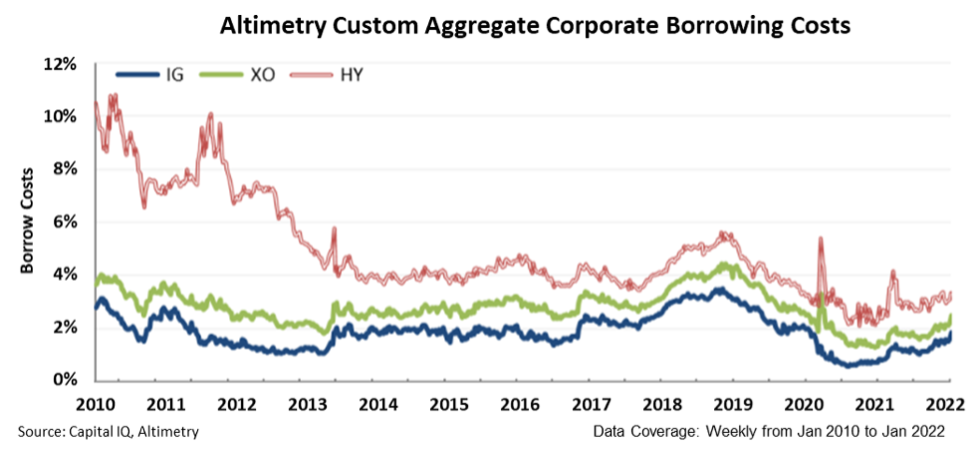

This aligns with our aggregate cost to borrow charts that we highlight regularly. Included below is an updated version of the chart we have been showing since 2019, with data up to 2022 included.

The chart highlights the total cost of U.S. corporations to borrow. We break it down into three buckets: investment grade ("IG"), crossover ("XO"), and high yield ("HY").

IG companies are among the largest, safest, and most stable public companies, while HY companies are the smallest and riskiest. So, it makes sense that HY cost to borrow is always more expensive than IG, and XO charts toward the middle.

After the brief spike in 2020 at the start of the pandemic, the cost to borrow returned to incredibly low levels thanks to wide-open credit markets.

Right now, we see that the cost to borrow remains at very low levels for HY, IG, and XO companies.

Because the rates are so low, even if the cost to refinance rose 1%, it would just be in line with normal levels from the past decade, where we experienced strong positive economic growth, a period when companies were still actively borrowing.

Companies still have room to continue to grow and refinance without overly rising debt burdens.

While there may be concerns about the closing gap of aggregate borrowing costs, there is still plenty of room for growth.

There's one group of companies whose growth won't be impacted by whether or not borrowing costs rise...

There's one group of companies whose growth won't be impacted by whether or not borrowing costs rise...

We've found a well-positioned business model regardless of the interest rate environment because it allows companies to print money.

This business strategy is so resilient that it has a 96% proven success rate when looking at the companies we've analyzed that use it... And we've seen stock returns of nearly 760% from it.

In a recent video presentation, I detail why it's such a successful formula and how it led us to uncover the next winner that has the potential to be a 20-bagger.

Learn all about it in my free presentation by clicking right here.

Regards,

Joel Litman

February 7, 2022

The concern is about the rising cost of debt...

The concern is about the rising cost of debt...