We say it time and time again here at Altimetry Daily Authority...

We say it time and time again here at Altimetry Daily Authority...

It's critical to look at the correct data.

Every investor needs to have the correct information on a company – not just to understand prior performance, but to put the future into the proper context.

Here at Altimetry, we view businesses through the lens of Uniform Accounting. This framework gets at the heart of a company's real operations... unlike as-reported GAAP metrics, which are full of accounting distortions.

Once we apply Uniform Accounting and can compare any company "apples to apples," we can begin to price in market expectations.

Before buying any stock, investors should focus on how the market expects a name to perform. Without knowing what the market is pricing into a stock's performance, insight about the future outlook for the company doesn't necessarily have any effect on whether a stock will go up or down.

For example, if an investor knows for a fact that streaming giant Netflix (NFLX) will add 8 million subscribers in a particular quarter, but doesn't know how many the market expects, there's no way to make money. The market may only believe Netflix can add 6 million subscribers in that quarter, and the stock will go up. However, if the market expects 10 million subscriber adds, the stock will fall even if the company posts massive growth, as the management failed to live up to expectations.

This is the power of our Embedded Expectations analysis – it condenses market expectations into one chart.

If you're interested in learning about the embedded expectations of a plethora of companies, you can turn to our YouTube channel – powered by our institutional research arm Valens Research.

Here, you can find the recordings of the Uniform Accounting webinars we conduct for our institutional clients, along with breakdowns of the individual company analysis we provide. We highlight a few companies across multiple market sectors each week, so be on the lookout.

Earlier this year, we highlighted global pharmacy retailer Walgreens Boots Alliance (WBA) on our YouTube channel...

Earlier this year, we highlighted global pharmacy retailer Walgreens Boots Alliance (WBA) on our YouTube channel...

Operating in more limited markets to competitor CVS Health (CVS), Walgreens operates strictly as a pharmacy chain – with more than 21,000 retail stores across the globe.

After CVS purchased health insurance company Aetna in 2018, the newly combined company was primed to see huge cross-selling synergy between the health insurance and pharmacy businesses. On the other hand, Walgreens acquired U.K-based pharmacy company Boots in 2014... which took Walgreens from a largely U.S.-based operation to a more global presence.

And due to distortions in the data between Walgreens' as-reported and Uniform Accounting figures, investors are being misled about the company's performance since the acquisition...

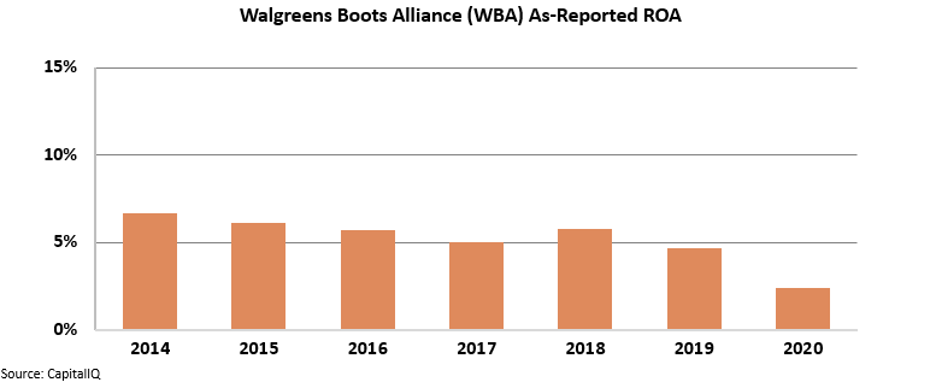

GAAP metrics indicate that Walgreens has seen steady declines in its return on assets ("ROA") since the tie-up in 2014. As you can see in the chart below, the company's as-reported profitability has faded from 7% in 2014 to 2% last year...

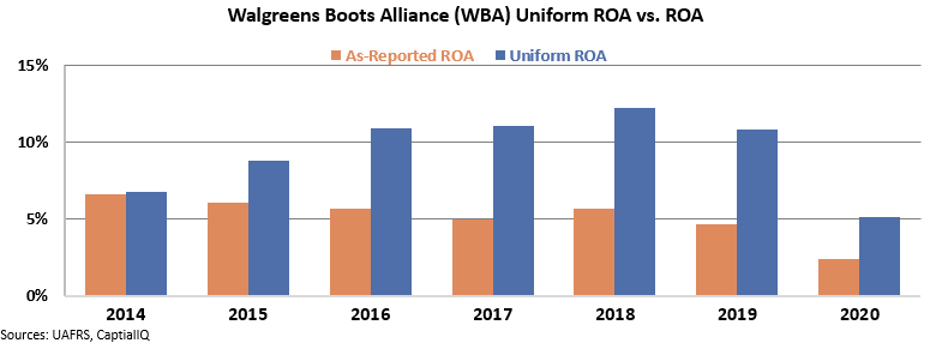

In reality, this apparent weak earnings power is just "noise" from bad accounting. After adjusting for items such as goodwill, interest expense, and other distortions, we can see Walgreens' real performance.

After the Boots acquisition, Walgreens efficiently integrated the two business and saw its profitability ramp up massively in the following years.

Walgreens' Uniform ROA expanded from 7% in 2014 to 11% in 2019. And then, instead of experiencing a continued downturn, Walgreens saw performance drop in 2020 due to coronavirus-related pressures affecting the retail and pharmacy business. Take a look...

Even though 2020 wasn't a great year for the company, its real profitability levels remained positive through the worst of the pandemic... and were more than double what as-reported metrics indicate. This confirms that Walgreens' Uniform ROA levels haven't been in a long-term secular decline.

Without Uniform Accounting, investors would think the coronavirus was just another nail in Walgreens' profitability coffin after a bad couple of years following the Boots acquisition. But after seeing the real data, we can understand that Walgreens should bounce back to stable profitability after the pandemic recedes.

Discrepancies between the as-reported metrics and the real, Uniform data can create opportunities for savvy investors...

Discrepancies between the as-reported metrics and the real, Uniform data can create opportunities for savvy investors...

Understanding these inconsistencies and seeing the real earnings of a company can help investors make big gains on stocks that Wall Street is incorrectly pricing.

In our Altimetry's Hidden Alpha newsletter, we leverage the power of Uniform Accounting to identify safe stocks that still have the opportunity for massive upside. On Monday, we identified a company that stands to benefit from three booming industries... but the market is missing the full story – and part of the reason why is because of misunderstandings about this company's acquisition strategy.

Learn more about Hidden Alpha – and how to gain access to this brand-new recommendation – right here.

Regards,

Joel Litman

March 3, 2021

We say it time and time again here at Altimetry Daily Authority...

We say it time and time again here at Altimetry Daily Authority...