The Bureau of Labor Statistics just reported the highest Consumer Price Index ('CPI') reading since August 2023...

The Bureau of Labor Statistics just reported the highest Consumer Price Index ('CPI') reading since August 2023...

The CPI surged 0.5% in January, exceeding both December's 0.4% rise and the market's expectation of 0.3%.

Gas, food, and housing prices all climbed sharply, bringing year-over-year inflation back to 3%.

The market reacted immediately – and harshly – to this news... The S&P 500 Index tumbled 0.3% and U.S. Treasury yields jumped back above 4.6%. Fewer experts now expect the Federal Reserve to cut interest rates.

Folks had hoped inflation would cool off, but these numbers signal the opposite. And they could force the Fed to keep rates higher for longer.

However, we believe this inflation spike is more of a blip than a trend. The Fed's cautious approach should reassure investors... because sticky inflation isn't as big a threat as they think.

Simply put, hotter-than-expected inflation won't last...

Simply put, hotter-than-expected inflation won't last...

For starters, policymakers knew inflation could have one-off spikes. That's exactly why the Fed hasn't rushed to cut rates.

Second, many of these price jumps are seasonal. January inflation data, for example, often comes in higher due to annual price adjustments.

A significant part of the January 2025 inflation spike came from unique factors, like the avian flu outbreak... This caused a 15.2% jump in egg prices. And it accounted for two-thirds of the total spike in grocery prices that month.

Similarly, prescription drug prices surged 2.5% in January. This was, again, largely due to annual price resets.

And third, supply chains – a major driver of inflation in 2021 and 2022 – have recovered from COVID-19 disruptions.

On top of that, long-term inflation expectations remain stable...

On top of that, long-term inflation expectations remain stable...

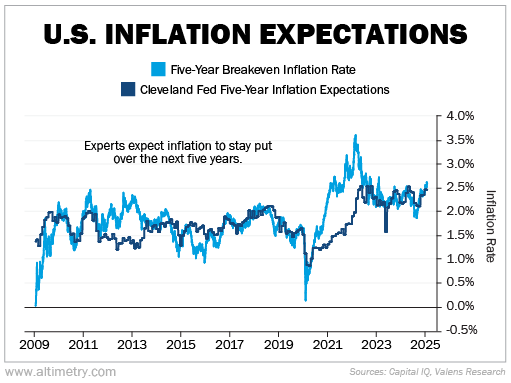

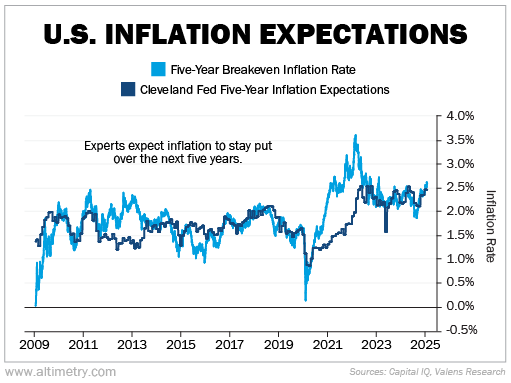

We can see this in the Cleveland Federal Reserve's five-year inflation data...

Its in-depth economic analysis and long-term inflation forecasts help gauge future price stability.

And according to the latest forecast, inflation is expected to remain between 2.3% and 2.5% over the next five years. That's well within historical norms.

Take a look...

This forecast also shows that, while seasonality and one-off jumps factor into inflation, they don't skew the long-term picture.

And the Fed understands this point.

That's why the central bank hasn't overreacted to short-term inflation prints...

That's why the central bank hasn't overreacted to short-term inflation prints...

The Fed realizes the latest data is just a temporary blip. It expects occasional price jumps and has kept interest rates high as a result.

Unless inflation keeps rising for multiple months, there's no reason to fear a return to post-COVID levels.

Investors who panic over inflation headlines risk missing the bigger picture... All the data shows that inflation is likely to remain steady for the next few years.

So rather than obsess over one bad CPI reading, investors should focus on the long term. Otherwise, they'll miss out on a good buying opportunity.

Regards,

Joel Litman

March 6, 2025

The Bureau of Labor Statistics just reported the highest Consumer Price Index ('CPI') reading since August 2023...

The Bureau of Labor Statistics just reported the highest Consumer Price Index ('CPI') reading since August 2023...