Wall Street wasn't hooked on Adobe's 'digital heroin'... but customers were...

Wall Street wasn't hooked on Adobe's 'digital heroin'... but customers were...

Adobe (ADBE) dominated the creative software world for decades. Its flagship products like Photoshop, Illustrator, and Premiere Pro became the industry standard for designers, photographers, and anyone else in a creative field.

The design industry was addicted to Adobe. Folks would pay as much as $2,600 for the entire "Creative Suite," as it was called. That price tag included a license to use Adobe's software forever.

Every year or two, the company would release a new version... and users could pay to upgrade or choose to keep using their current model.

It seemed like business couldn't have been better. With the launch of its fifth generation of the Creative Suite, the company grew its revenue roughly 50% from 2009 to 2012.

But in 2013, Adobe upended the entire business model... and baffled Wall Street.

Adobe got rid of its whole sales strategy overnight...

Adobe got rid of its whole sales strategy overnight...

The company announced that it was abandoning the "perpetual license model," wherein customers paid once for lifetime access to its software.

Going forward, they'd have to subscribe to the "Creative Cloud" – and pay regular installments to keep their access.

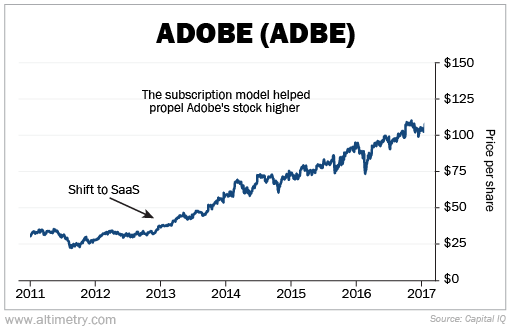

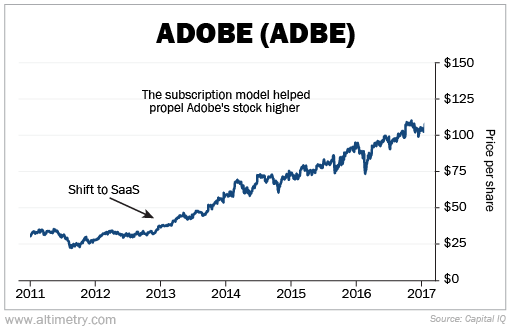

Adobe's move toward Software as a Service ("SaaS") garnered few fans and plenty of criticism. Instead of paying hundreds or thousands of dollars up front, folks were now saddled with monthly or annual fees.

It was a lot more expensive to "own" the Creative Suite in the long term. And users weren't actually owning anything. If they stopped paying for the subscription, they'd lose access to the software.

A photographer named Brad Trent argued the move would stifle innovation. If Adobe didn't have to convince users to buy the new version with each release, there was less pressure to add new features and improve the software.

Trent, along with nearly 50,000 other Adobe users, signed an online petition to stop the company from enforcing the subscription model.

Wall Street was equally unimpressed with Adobe's decision...

Wall Street was equally unimpressed with Adobe's decision...

A slew of research analysts downgraded Adobe in the early 2010s. As Brendan Barnicle of Pacific Crest Securities said...

In the dozen years I've been an analyst, I've never seen a company go through this kind of transition from on-premises to subscriptions pricing without some speed bumps.

Barnicle was right. Net income fell roughly 35% in the following year... in large part because the initial cost of the software fell.

It was all going exactly as Adobe planned.

While users weren't happy with the change, they couldn't fight the design industry's addiction. There simply wasn't a better alternative to Adobe's products. Folks were pretty much forced to sign up for Creative Cloud.

Within a year of the change, Adobe was making more revenue from subscriptions than from perpetual license sales.

And by the end of 2016, with the subscription service firmly dominating, Adobe's stock had nearly tripled...

Adobe users are now hooked for life. Its revenue has risen every year since 2013... and has more than quintupled.

The company is the flagship example of how powerful a transition to a subscription model can be.

The market should have learned an important lesson from Adobe's success...

The market should have learned an important lesson from Adobe's success...

And yet, investors continue to doubt other companies going through the same transition.

That includes one of our favorite software companies in today's market.

My team and I have been following this company's progress for some time. It's a key player in helping other businesses clean and organize their data.

And a few years back, it decided to go the way of Adobe – switching from perpetual software licenses to a subscription-based model.

Just like with Adobe, investors punished shares for the short-term cost of this transformation. But the doubters are missing out on this company's biggest opportunity yet.

The stock already jumped almost 30% overnight earlier this week. We think that's just the start. It's all thanks to a critical government AI deadline that's fast approaching... learn more here.

Investors may be wary... but if Adobe's journey teaches us anything, it's that short-term struggles can lead to long-term dominance. Don't be fooled by the current volatility.

There are plenty of opportunities out there... if you know where to look.

Regards,

Joel Litman

April 25, 2025

Wall Street wasn't hooked on Adobe's 'digital heroin'... but customers were...

Wall Street wasn't hooked on Adobe's 'digital heroin'... but customers were...