Right now might be one of the best times to start a business in a decade...

Right now might be one of the best times to start a business in a decade...

We started Valens Research – the institutional investment research firm that powers Altimetry – back in 2009, right in the teeth of the Great Recession. Wall Street was a wasteland, and we could see that there was an impressive opportunity because of how traditional investment research's weaknesses had been laid bare.

Wall Street's research hadn't properly identified credit risk for companies, and its equity analysis was incomplete due to looking at the wrong data. With the market in such an upheaval, we saw an opportunity. Eleven years later, knowing all we know now, I can confidently say that we're happy with our decision.

Recessions are times of significant distress and uncertainty. But because of the disruption they create, they're amazing times to start a business. They expose old business models and create new market opportunities.

Billionaire entrepreneur Mark Cuban said as much in a recent interview. He thinks one of the major things that will help get people back into work after the pandemic is going to be new businesses. As he said, the U.S. is likely to find "25 or 50 world-class companies that were created specifically because the pandemic of 2020 happened."

So while this may be a stressful period, remember that it is out of this destruction that new innovation can occur. This is the time to pay attention for new opportunities for disruptive business models that will win in a new market environment.

'Blue Horseshoe loves Anacott Steel'...

'Blue Horseshoe loves Anacott Steel'...

This is one of the most easily recognizable lines from the 1987 classic film Wall Street. It's code for saying Gordon Gekko (played by Michael Douglas) is targeting the fictitious company, thus causing its stock to rise rapidly.

Gekko is trying to raise the price to make it difficult for a rival investor to buy the company. At the same time, he's also placing personal bets on Anacott Steel to make a quick gain.

The code "Blue Horseshoe" makes it so Gekko can't be found out and busted for any sort of insider trading, pump-and-dump scheme.

But that's not the only instance of underhanded activity in the movie... Another memorable scene shows the extent that amoral investors might go through to get early insights into mergers and acquisitions (M&A) and corporate plans.

Charlie Sheen's character, Bud Fox, is sent to find out what rival investor Sir Laurence Wildman is planning on buying next. In order to accomplish the feat, Bud pulls a classic spy stunt – he dresses up as a janitor in order to break into Wildman's office and figure out his next move.

The scene feels a bit comical and ludicrous, but it highlights an interesting point...

Maintenance staff truly have access to more sensitive documents than you may realize.

Most offices have a cleaning crew come through every night to clear out trash, sweep floors, and prepare the space for the following day. Even in the most secure banks and brokerages, the janitorial staff has access to just about every office, leaving information potentially up for grabs.

The likelihood of somebody successfully posing as a janitor is low... and with most information being stored on password-protected computer these days, it would be tough to get as much information as they could in 1987.

That said, it goes to prove just how "covert" janitors are in their non-descript uniforms.

And today, let's look at the company that has supplied these uniforms for decades...

Cintas (CTAS) is one of the largest corporate uniform providers in the country. It's been a leading uniform and facility supplier for more than 50 years.

In addition to providing facility staff with the very same types of uniforms Bud Fox wore during his mission, Cintas also sells cleaning products like mops, chemicals, and restroom supplies.

Most of its customers are corporate, so Cintas' performance has historically been tied closely to the economy.

We call companies like this "cyclical," meaning their returns follow business cycles.

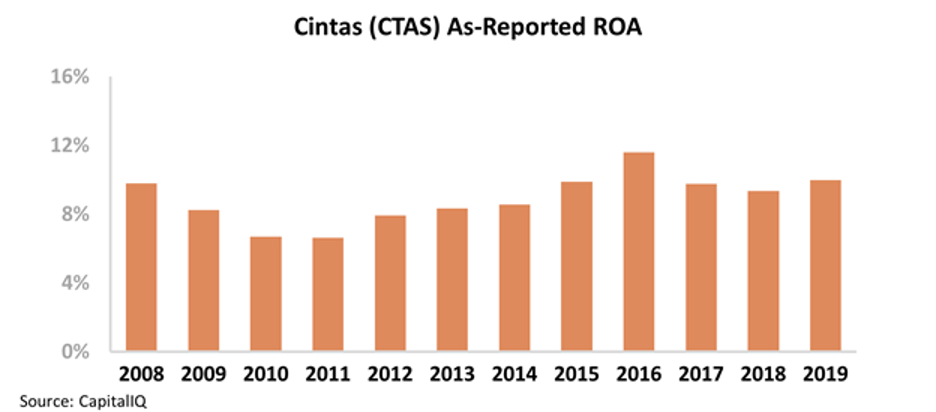

This pattern is clear for Cintas over the last decade or so, with its return on assets ("ROA") falling after the Great Recession before rebounding to a new peak in 2016.

That said, after 2016, the company's ROA reversed course and started falling again. This appears to be in contrast with the economy, which was strong over the past three years and only began faltering within the last few months. Take a look...

Despite the company's lackluster performance since 2016, its stock has performed much better.

Even after the fall from recent highs, CTAS shares are still up roughly 80% since the beginning of 2017.

On the surface, it looks like the market is paying for a business with declining returns, but that may not be the case...

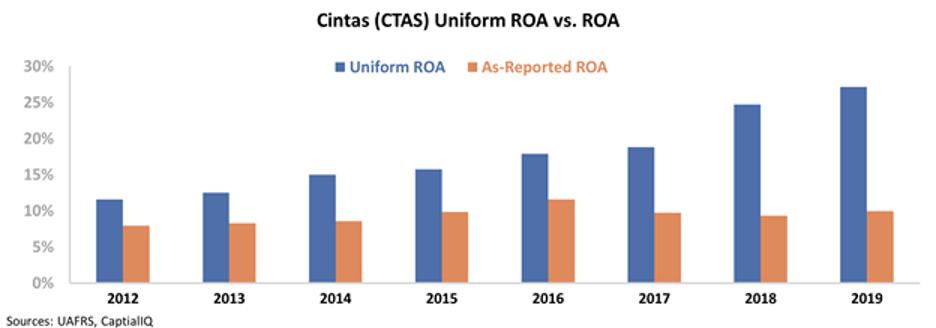

Once we apply our Uniform Accounting metrics to Cintas's as-reported financial statements, we can see a significantly different trend.

You see, in 2017, Cintas decided to further consolidate the uniform industry by acquiring competitor G&K Services for over $2 billion.

As-reported financial statements require companies to carry large amounts of goodwill on their balance sheets after completing material acquisitions. This misleading practice tends to punish acquisitive companies like Cintas, making them look like worse performers than they actually are.

After adjusting for goodwill distortions and other accounting issues – including the impact of non-cash stock option expenses and operating leases – we can see that Cintas has actually continued improving its ROA to new highs.

In 2019, the company's Uniform ROA reached 27%, significantly higher than the 10% ROA suggested by as-reported metrics.

Distortions like this make it nearly impossible to accurately assess companies using as-reported metrics. It looks like the market understands just how profitable Cintas – and the company's stock – still is, considering that shares are already rebounding after the recent sell-off.

Regards,

Joel Litman

May 5, 2020

Right now might be one of the best times to start a business in a decade...

Right now might be one of the best times to start a business in a decade...