I hope grades aren't your main focus when hiring people...

I hope grades aren't your main focus when hiring people...

When I was entering public accounting in the early 1990s, most of the "Big Eight" accounting firms had minimum grade level requirements for new applicants.

I remember Coopers & Lybrand specifically excluding any applicant with a grade point average ("GPA") of less than 3.85 out of 4.0. Out of five classes, if you got four "As" and one "B," you'd have missed the opportunity to work there.

Recently, several of our new hires at Altimetry told us that global consulting firm McKinsey maintains that same 3.85 GPA requirement, at least in the region we recruit from.

The persistence of this GPA requirement is puzzling to me. There's a plethora of information on the topic... But the journal American Psychologist accumulated extensive research on the subject.

To wit, people who get the top grades don't go on to become the most successful in life – it's a weak correlation.

The research summary I'm referring to appeared in 1973.

That's almost 50 years ago. Five decades later, it would be difficult to find research that says otherwise. Forcing all personnel to have only the highest possible grades simply isn't a good strategy for a firm. To justify 3.85 as a minimum GPA seems more like a marketing stunt than a good strategy for hiring the right people.

Legendary investor Warren Buffett laid out three qualities when looking for employees...

Legendary investor Warren Buffett laid out three qualities when looking for employees...

And I can't find any reason to disagree. Buffett says to look for integrity, intelligence, and motivation.

The perfect candidate ought to have all three of these traits. However, of those three, the screen for inclusion is intelligence and certainly can't be grades.

The exclusion filter is integrity. The worst-case scenario for an employer would be hiring someone who's highly intelligent and motivated, but has no integrity.

That person would be able to steal from you aggressively, and you'd never catch him.

Buffett goes so far as to say that if a person lacks integrity, it would be better for all of society if he were lazy. A low-integrity coach potato is far less harmful to society.

Here at Altimetry, we don't employ a GPA cut-off. We look for folks who embody the three traits Buffett mentioned. And it's vital to do everything to ensure that integrity is paramount.

And yet, it's difficult to determine if a person possesses these traits – and is a good fit for your firm – without working alongside them for some time...

And yet, it's difficult to determine if a person possesses these traits – and is a good fit for your firm – without working alongside them for some time...

This is just one great benefit of internships and school/work programs like Northeastern University's co-op program, which we partner with here at Altimetry.

We work with our interns for six months before making the decision to bring them into the company full-time.

This hiring practice has been leveraged by small companies for some time now. When a small business is trying to fill an important role such as controller, CFO, or someone to manage cash accounts, it often hires a temporary employee.

This way, managers have time to evaluate the individual's performance in case they make a catastrophic mistake. Additionally, they look to hire someone from a place they can trust.

For larger companies, this process becomes harder...

For larger companies, this process becomes harder...

This is why big accounting firms rely on the expertise of a company like Robert Half (RHI).

The company has built a competitive advantage helping firms locate their most important resource: people. And one service Robert Half offers to this end is temporary positions.

This allows employers flexibility and gives them the ability to work with various candidates before bringing someone on full-time. Companies get the people they need in an important role, without the stress of long-term commitment before they're certain these folks are a fit.

Considering that Robert Half is able to solve such universal needs, investors would assume that the company also generates robust returns.

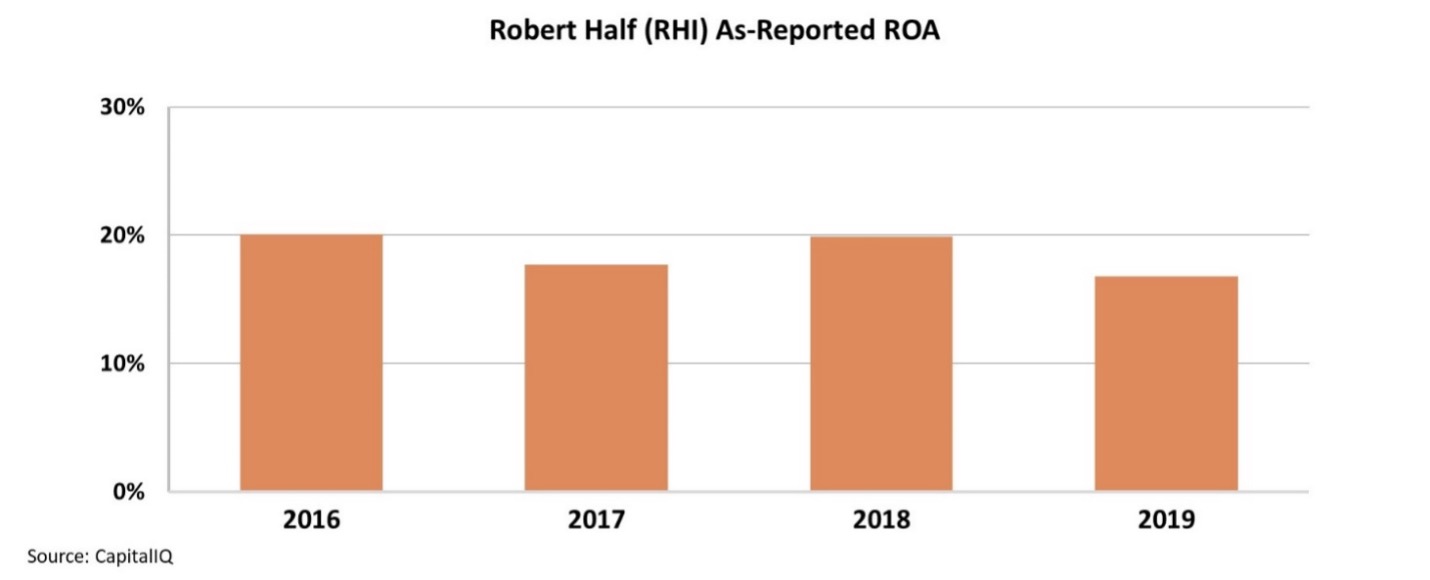

GAAP metrics tell a story of slight overperformance. Robert Half's as-reported return on assets ("ROA") have consistently maintained levels above 18% over the past four years. This is well above corporate averages of 12%.

These above-average ROAs would point to customers valuing Robert Half's services... but they only hint at the firm's actual profitability level.

These above-average ROAs would point to customers valuing Robert Half's services... but they only hint at the firm's actual profitability level.

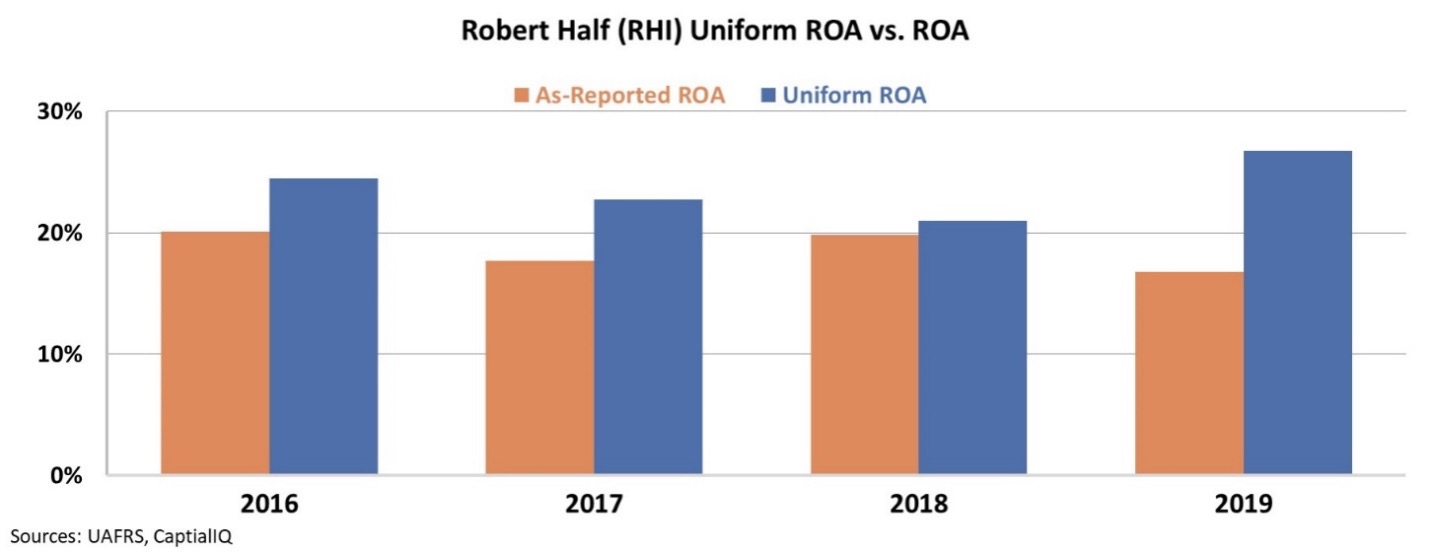

In reality, Robert Half's returns have been suppressed due to bad accounting.

Using Uniform Accounting, we adjust for items such as goodwill, interest expense, and other distortions present in GAAP metrics.

After we make these adjustments, we can see Robert Half's real performance. The company's Uniform ROA has been consistently greater than 21% for the past four years. Furthermore, this metric has been moving higher. Take a look...

When looking at the Uniform data, it's clear that Robert Half is earning big returns for sourcing high-quality employees.

And looking ahead, the company is positioned to see performance continue to improve, especially as corporations will have a harder time screening for employees in the work-from-home world.

Clients are willing to pay a premium for additional time to figure out whether employees are the right fit. That means Robert Half is benefiting... and far more so than as-reported metrics would have you believe.

Regards,

Joel Litman

February 19, 2021

I hope grades aren't your main focus when hiring people...

I hope grades aren't your main focus when hiring people...