In the early days of the coronavirus pandemic, it appeared employers only had two options...

In the early days of the coronavirus pandemic, it appeared employers only had two options...

Across the U.S. – and the globe – quarantine orders forced many businesses to halt their normal operations, and employers had a choice. They could simply shut down completely... or they could send employees to work from home, where folks could do their jobs safely while socially distancing.

And for some industries, the disruption meant laying off employees – whether that meant automating their jobs or replacing them through improved efficiency. This certainly isn't the first time we've seen this happen... During most recessions, companies have historically sought to reduce costs through automation and removing superfluous jobs.

In many professions, automation is still a long way off. The bar and restaurant industry, currently battered by the pandemic, is unable to completely replace its workforce with robots. Furthermore, while public transit systems have seen a drop in demand, we don't have the full technology for a self-driving bus or commuter rail yet.

And yet, in other fields, automation has already begun to change the working landscape. For example, The Economist recently highlighted how hospitals are using chat bots to answer a deluge of questions about the coronavirus – it's a cheaper alternative to hiring a mass of call center employees.

Other fields have also seen increased efficiency, thus reducing the need for the current level of employees. Better telehealth solutions mean that doctors' offices need less employees to work with patients. Clerical and janitorial staff have seen declines as commercial buildings need to be cleaned less.

As employees save their companies money by working from home, some jobs will avoid automation as businesses adapt. However, the pandemic has not only unlocked new potential for employees to work from home... For some of them, it has accelerated their jobs vanishing permanently.

It's a reminder that we're seeing several different trends accelerated by the pandemic... and not all of them will be good for employees over the longer term.

Understandably, for many people, trends like this have created uncertainty and emotional trauma...

Understandably, for many people, trends like this have created uncertainty and emotional trauma...

Sadly, one of the side effects of the pandemic has been less interaction with others and a disruption of normal routines. Social circles have shrunk dramatically since the beginning of quarantine. Additionally, many hobbies have been temporarily put on hold.

These adjustments have caused a surge in demand for antidepressants and other psychological medications. Folks rely on these drugs to sustain their mental health and create a resemblance of normalcy in these trying times. However, many of these drugs have adverse side effects.

For example, consider tardive dyskinesia... This is a nervous system disorder that can cause various facial tics. It commonly occurs in patients who use long-term neuroleptic drugs.

Due to the rise in the use of these types of medications, it's no surprise that some manufacturers – such as Neurocrine Biosciences (NBIX) – are trading at elevated price-to-earnings (P/E) ratios. In Neurocrine's case, company has high valuations... It makes a drug approved by the U.S. Food and Drug Administration ("FDA") to treat tardive dyskinesia.

Investors seem to be betting that this disorder will be more widespread, as various degrees of quarantine restrictions continue and demand for antidepressants has increased.

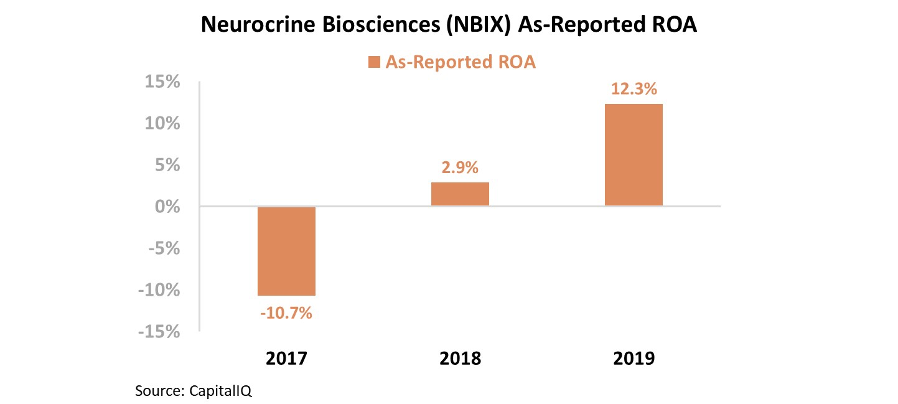

However, Neurocrine hasn't been able to justify its high valuations in recent years. Granted, the company's as-reported return on assets ("ROA") has grown in each of the past five years... but from significantly low levels. Neurocrine has only seen its ROA move above cost-of-capital levels once, in 2019. Take a look...

Based on this, it would appear the market is paying up for hope... but Neurocrine isn't fully delivering on that optimism.

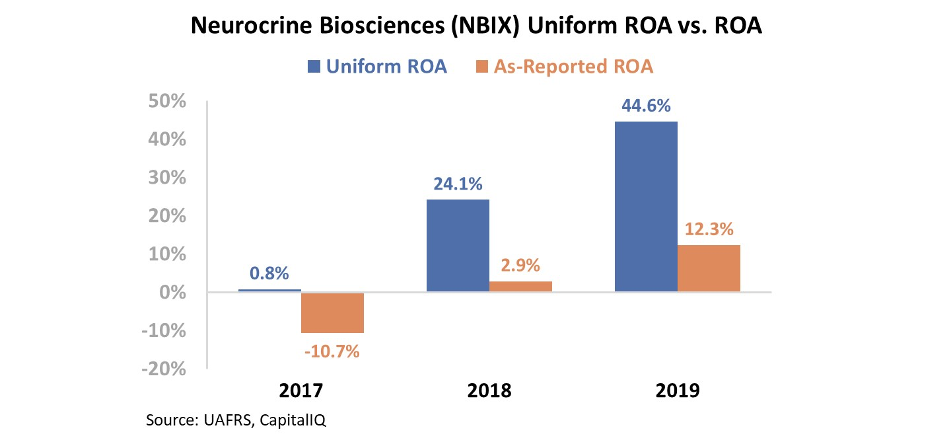

However, this isn't an accurate representation of the company... GAAP's mistreatment of research and development (R&D) expenses – among other distortions – are artificially reducing Neurocrine's valuation and profitability levels.

In reality, Neurocrine is actually a much less expensive stock than the market thinks. The company's Uniform P/E ratio stands at 13 times – significantly lower than its as-reported P/E ratio of 21.

And looking back at recent years, Neurocrine has been able to increase its returns far faster than as-reported metrics reflect. In 2017, Neurocrine only had a 1% Uniform ROA. This metric jumped to 45% last year – nearly 4 times greater than the as-reported ROA of 12%...

Uniform Accounting shows that Neurocrine is actually a high-return business... and the company's valuations are cheaper than investors think. So let's take a closer look at what this means in the years ahead...

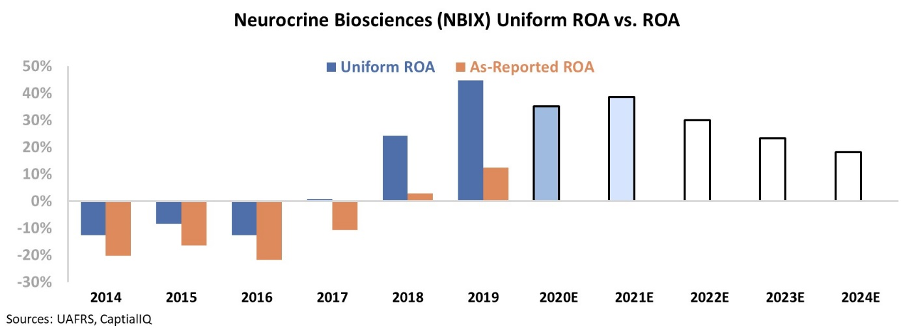

To understand what the market is expecting, we can use the Embedded Expectations Framework to easily understand market valuations.

The chart below explains Neurocrine's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Analysts are assuming Neurocrine's Uniform ROA will continue at its elevated levels. However, the market is pricing in returns to drop sharply. This appears to be overly bearish – Neurocrine's drugs have just been released to market, and the company also has a significant pipeline for future drugs and is seeing positive tailwinds ahead.

As-reported metrics show an expensive company with growing, yet significantly low returns... and this is scaring investors away.

However, Uniform Accounting proves that this perception is completely incorrect. Not only is Neurocrine highly profitable, it will be relatively easy for the company to beat market expectations.

Without the proper tools, investors might miss out on this impressive company.

Regards,

Rob Spivey

August 28, 2020

In the early days of the coronavirus pandemic, it appeared employers only had two options...

In the early days of the coronavirus pandemic, it appeared employers only had two options...