James Carville never expected an insult to be the most memorable part of his campaign strategy...

James Carville never expected an insult to be the most memorable part of his campaign strategy...

Carville was presidential candidate Bill Clinton's political adviser in his 1992 campaign against George H.W. Bush. Part of his strategy involved creating a unified message for everyone working on the campaign.

He hung a sign in Clinton's campaign headquarters in Little Rock, Arkansas, with three key agenda points...

- Change vs. more of the same

- The economy, stupid

- Don't forget health care

These three points paved the way for Clinton's eventual win. But it was the second that became a rallying cry...

You see, the U.S. had entered a recession just a few years earlier. Following the end of the Cold War, U.S. defense spending slowed way down. The savings and loan crisis was still causing bank failures.

The Federal Reserve was once again fighting inflation. It brought interest rates as high as 9.9% to cool down the economy.

All those challenges were a sore subject under Bush's term (whether or not it was his fault). Clinton's campaign kept voters focused on the economy by hammering it home at every chance.

The rest, as they say, is history.

Similar to the campaign trail, in the world of Wall Street, investors focus on one thing above all else...

Similar to the campaign trail, in the world of Wall Street, investors focus on one thing above all else...

Earnings growth, stupid.

For as many other trends as these folks pretend to care about, it all boils down to this one factor.

If the credit market freezes up, companies go bankrupt... which hurts earnings growth.

The rise of AI is so powerful because it's helping companies become more efficient... which boosts earnings growth.

The stock market cannot sustainably rally without earnings growth. That's why last year was such an anomaly. U.S. earnings fell 9% thanks to higher inflation and interest rates cutting into earnings. And yet, the S&P 500 rallied 24%.

If the market keeps rising at its current pace, this year could be even better. The S&P 500 is already up 15%. We're only about halfway through the year.

And unlike in 2023, this year's rally seems to be backed up by – you guessed it – earnings growth...

And unlike in 2023, this year's rally seems to be backed up by – you guessed it – earnings growth...

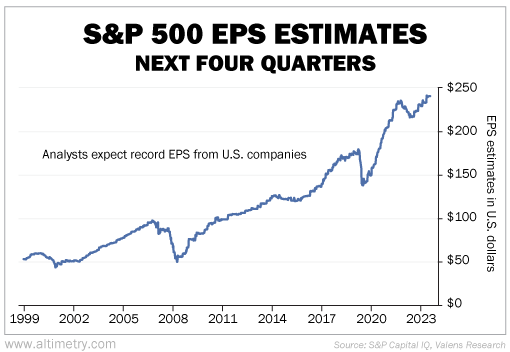

We can see this through Wall Street analyst forecasts for quarterly earnings per share ("EPS").

Analysts provide estimates for just about every public stock. The biggest stocks, like those trading on the S&P 500, tend to have the most coverage.

If you've followed our work for a while, you know we don't look to Wall Street for buy and sell recommendations.

But we recognize that these analysts are paid to be experts on the companies they cover. Their one- to two-year earnings forecasts tend to be pretty accurate.

So when it comes to forecasting the next several quarters of as-reported EPS... Wall Street can be a useful indicator.

The following chart shows Wall Street's EPS expectations for the entire S&P 500 over the next four quarters. As you can see, analysts expect EPS to reach an all-time high over the next year...

Estimates previously peaked in September 2022. Now, Wall Street expects the biggest companies to beat their old record.

Those lofty expectations could be reason enough to keep the market rallying.

While the credit market remains tight, it doesn't seem tight enough to stop refinancing activity. And if companies can still boost earnings, the market should keep rising in kind.

After all... it's all about earnings growth, stupid.

Regards,

Rob Spivey

July 8, 2024

James Carville never expected an insult to be the most memorable part of his campaign strategy...

James Carville never expected an insult to be the most memorable part of his campaign strategy...