Imagine letting strangers choose what to do with $20 billion...

Imagine letting strangers choose what to do with $20 billion...

By now, you've certainly heard about Tesla (TSLA) founder Elon Musk's recent shenanigans...

Instead of going to a financial advisor or lawyer, Musk turned to Twitter (TWTR) on November 6 to crowdsource the decision on whether or not to sell 10% of his Tesla holdings. That's more than $20 billion in equity.

The tweet came after Sen. Ron Wyden (D-OR) proposed a "Billionaires Income Tax" on unrealized investment gains every year for the country's wealthiest taxpayers. Musk was looking to create a dialogue around taxing these unrealized stock gains. By selling 10% of his holdings, he would have to pay the taxes on the sale.

He failed to mention in his poll and what few other financial publications have said... he has a large tax bill coming due...

Part of Musk's compensation package includes Tesla stock options which will be expiring in the next few quarters. To exercise them, he will be forced to pay taxes on the gain.

While the Twitter poll drummed up a lot of attention, it looks like Musk would have sold no matter the outcome.

Many financial advisors may also consider selling to be the smartest move. With Tesla's market capitalization crossing more than $1 trillion in the last two months, cashing out seemed like a good option for many investors.

Musk's Twitter stunt helped bring more attention to the proposed Billionaires Income Tax, and in the process, sent Tesla stock falling. Without taking a step back, it's hard to know if all this commotion is just market noise or something more serious.

While the tax question rages, we have been thinking of another here at Altimetry...

While the tax question rages, we have been thinking of another here at Altimetry...

Just ask any tax accountant, and they will tell you the difficulties in implementing a tax on unearned income. With many ways to even calculate the value of any held stocks in aggregate, it will be a long time coming before any legislation is seen from Washington.

However, there is another important question Tesla investors should be asking themselves after this poll. Now that Musk is looking to sell, should they also consider jumping ship?

To answer this question, we can turn to Uniform Accounting, the only way to get an accurate snapshot of the business and what the market is pricing into the stock.

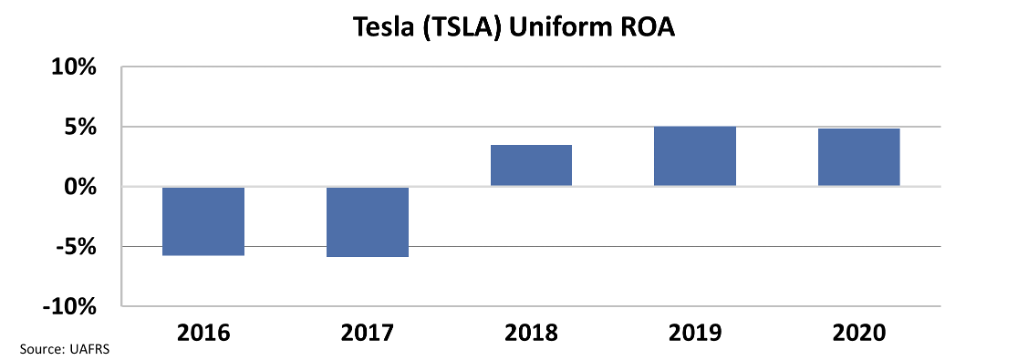

Looking at Tesla's Uniform return on assets ("ROA"), we can see that in the past three years, the electric car company has finally managed to generate a profit. Since 2018, Uniform ROA has been positive.

However, Tesla's historical performance doesn't tell us whether it's still an attractive stock purchase.

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect Tesla to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

But here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Framework to determine what returns the market expects.

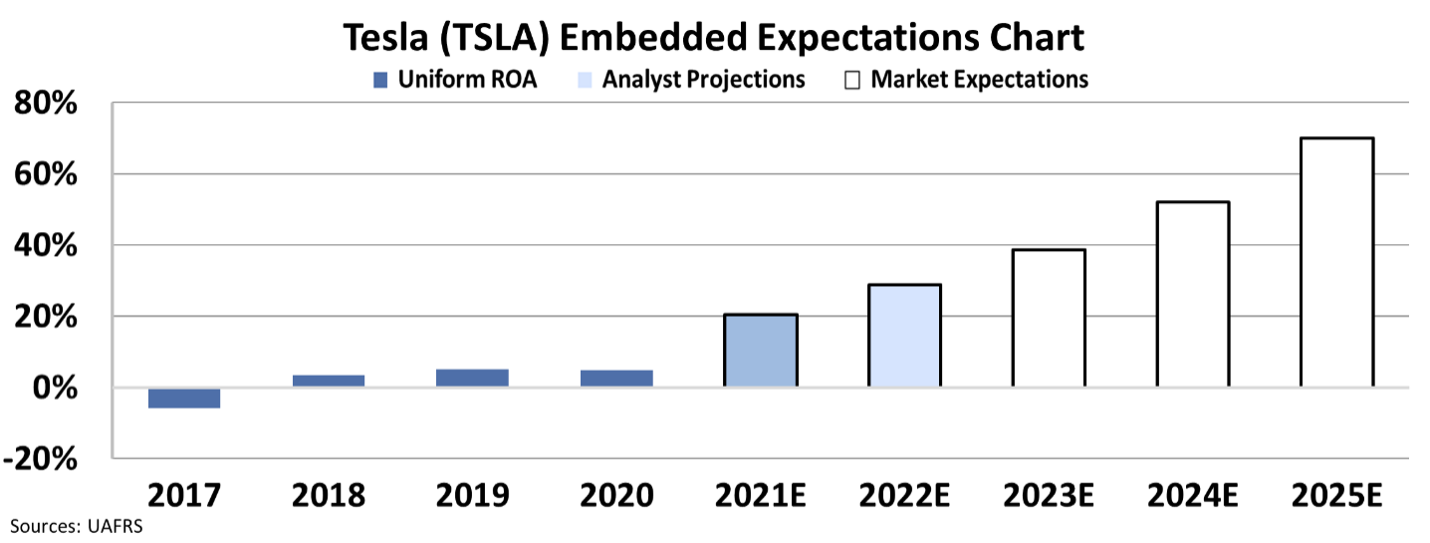

Breaking down the EEA chart, we can see that Tesla is forecast to see returns jump to between 20% and 30% in 2021 and 2022, respectively.

Right now, Wall Street analysts are forecasting for Tesla to see revenue rise from $31 billion in 2020 to $128 billion by 2025. For context, this would bring the company's revenue where Ford Motor's (F) is today, or a little less than half as big as Toyota Motor (TM) and Volkswagen (VOW3.DE), the two largest car makers globally.

To justify the current stock price, Tesla would need to grow at 33% a year, which it hasn't done since 2017, all while seeing Uniform ROA reach 70%. This is more than 15 times the average ROA of any other car company, which hovers around 5% at the best of times.

Even looking at Tesla as a battery company paints the picture of a market that has gotten ahead of itself, as no battery company has returns even half as strong as 70%.

This means to justify its current stock price. Tesla needs to return to its pre-profitability growth rates, all while growing returns by 15 times.

With his open-ended tweet, Musk might be looking for more than just creating a conversation around taxes. He may be giving himself an excuse to sell because this current stock price is unsustainable... especially if he knows what we know.

There are other large-cap stocks with better upside...

There are other large-cap stocks with better upside...

If you want to learn more about what really drives both the economy and stock market over the long run, subscribe to our Hidden Alpha newsletter.

With our Hidden Alpha service, you'll get access to not only our favorite large-cap stock ideas, but also The Timetable Investor, which helps users understand how to navigate macroeconomic topics such as inflation dynamics and tax rate regimes.

For a special offer on a year of Hidden Alpha, click here.

Regards,

Edward Edwards

November 16, 2021

Imagine letting strangers choose what to do with $20 billion...

Imagine letting strangers choose what to do with $20 billion...