Whether working remote or in-person, employees have more flexibility...

Whether working remote or in-person, employees have more flexibility...

It seemed like the new work-from-home culture would last forever during the coronavirus pandemic. Many employers offered stipends for people to buy their own work setups, and some folks even moved hours away from their offices.

And yet, with the world seemingly returning to normal as vaccination rates rise, folks are starting to return to the office.

Most companies aren't forcing their employees to come back into the office five days a week. Many are adopting "hybrid" models, with a few days working at home and a few in the office.

And it's not just the workweek changing... It's also the office spaces.

As Bloomberg recently highlighted, companies and office buildings have put significant thought and capital into transforming office spaces.

Employers have focused on offering safer, more comfortable working conditions that encourage people to return to the office.

For example, some office spaces are moving to a "reservation only" system – requiring employees to book desks, conference rooms, and other areas before arriving.

This gives these companies more flexibility for their employees. Folks that want to work in a "cube" can do so, while those that want to work in open meeting spaces have that option as well.

The workspaces are changing... but a lot of changes are also happening behind the scenes.

The workspaces are changing... but a lot of changes are also happening behind the scenes.

For example, many companies have been investing in better ventilation to circulate airflow and reduce the risk of viruses spreading.

Additionally, we're seeing major pushes to fix office bottlenecks like elevators, which are critical parts of every high-rise building in every financial center worldwide.

The days of cramped elevators with analog buttons may have ended with the pandemic.

Businesses have started investing in innovative elevators that can accommodate fewer touches, higher throughput, and cleaner air for passengers.

This evolution looks to be no problem for the legacy metal processors...

This evolution looks to be no problem for the legacy metal processors...

The need for all this investment is likely a major factor in the strong performance of companies such as Otis Worldwide (OTIS), even during the toughest of times of the pandemic.

Otis manufactures and installs escalators and elevators. As we mentioned, this is an area of new investment as the pandemic recedes.

And yet, with less construction happening last year, investors might have expected to see demand for Otis weaken.

To see why this wasn't the case, let's see what our Altimeter tool has to say...

To see why this wasn't the case, let's see what our Altimeter tool has to say...

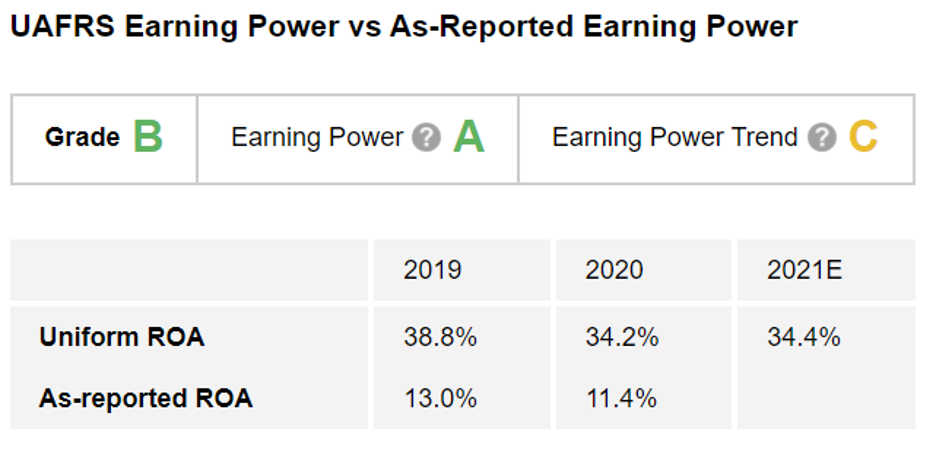

Using the power of Uniform Accounting – which removes more than 130 distortions in as-reported financial metrics – the Altimeter grades stocks based on their real financials.

Based on GAAP metrics, Otis has weak profitability. Its return on assets ("ROA") was a paltry 13% in 2019, which slid to 11% last year.

But after we clean up the GAAP numbers, we can see that Otis is currently minting money. Its real ROA stands at robust levels.

On a Uniform basis, the company has consistently generated ROAs of greater than 30% – reaching 39% in 2019. Even during the pandemic, Otis' profitability only slid to 34% last year.

Due to this strong profitability and slight slip in ROA, Otis earns an "A" grade in The Altimeter for Earning Power and a "C" grade for Earning Power Trend. Overall, the company earns a "B" grade for performance. Take a look...

And yet, strong performance alone doesn't make a company a good stock to buy...

And yet, strong performance alone doesn't make a company a good stock to buy...

Investors also need to look at valuations.

And once again, The Altimeter cuts through the accounting "noise" to show the real story of whether OTIS shares are cheap or expensive.

Altimeter subscribers can click here to see how Otis Worldwide is valued – and graded – based on Uniform Accounting. The Uniform valuations show if the market already understands the strength of the company's returns... and therefore, if future upside may already be priced in.

If you aren't an Altimeter subscriber yet, click here to learn how to gain immediate access to the rest of the Uniform data for Otis. Don't let the distorted, as-reported numbers lead you into making the wrong stock picks.

Regards,

Rob Spivey

July 8, 2021

Whether working remote or in-person, employees have more flexibility...

Whether working remote or in-person, employees have more flexibility...