Germany has flipped the switch on the largest ammunition plant in Europe...

Germany has flipped the switch on the largest ammunition plant in Europe...

The facility, which officially opened at the end of August, spans more than 320,000 square feet and is located in the German town of Unterluess. Built by defense contractor Rheinmetall (RHM.DE), it's capable of producing 350,000 artillery shells per year by 2027.

This is a monumental upgrade to Europe's firepower. And the symbolism wasn't lost on NATO Secretary General Mark Rutte, who called the plant "absolutely crucial" for the alliance's security.

German Defense Minister Boris Pistorius made the message even clearer... He noted that the facility isn't just a showpiece, but the first physical proof that Europe is finally putting real industrial muscle behind its defense promises.

Germany is Europe's largest economy. And after decades of restrained military policy, it's now at the forefront of the continent's defense revival...

The country placed a record-setting 8.5-billion-euro order with Rheinmetall last year and plans to triple its defense budget by the end of the decade.

Today, we'll show why this move represents a lasting turning point for European defense policy... and how Rheinmetall is leading the way for this structural shift.

Germany isn't waiting for the U.S. to defend Europe anymore...

Germany isn't waiting for the U.S. to defend Europe anymore...

Ever since Russia's full-scale invasion of Ukraine, Germany has been shedding decades of pacifist posture.

As we covered back in March, NATO members in Europe have come to the realization that they can no longer depend solely on the U.S. for defense.

They plan to ramp up military spending to 3.5% of their respective GDPs – a big step, considering only 23 of the 32 NATO members hit 2% of their GDP last year.

Right now, it seems Rheinmetall has emerged as the face of this transformation.

Its new facility is designed for rapid expansion. The company completed construction in just 14 months... less than half the time these kinds of factories typically take.

And it's already scaling production of munitions for the Leopard 2 tank – used by the Ukrainian army – and striking major partnerships across Eastern Europe...

In July, Rheinmetall announced a 550-million-euro joint venture with the Romanian government. The move will bring artillery and armored-vehicle production inside NATO's eastern flank, directly supporting Ukraine and strengthening supply lines for the alliance.

It's clear that Europe is pushing to meet its 3.5% defense-spending target. And if even a fraction of that number is met, the implications are enormous...

Governments are shifting from reactive aid to long-term strategic posturing. That means demand for tanks, shells, and advanced military platforms is likely to persist well beyond the ongoing war in Ukraine.

Investors are waking up to the bullish outlook on European defense...

Investors are waking up to the bullish outlook on European defense...

Rheinmetall has led the pack so far. The stock is up a massive 308% over the past year... far above European peers like BAE Systems (BAESY), Leonardo (LDO.MI), and Thales (HO.PA).

It's undeniably spearheading Europe's defense resurgence... but investors' expectations for the contractor are way too high right now.

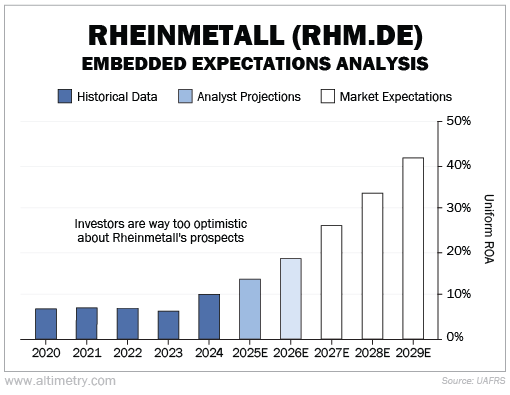

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At current prices, investors see that Rheinmetall is becoming a key player in Europe's defense industry. The company's Uniform return on assets ("ROA") has been around 7% over the past five years... and the market expects it to surge above 30% as soon as 2028.

Take a look...

We've said it before, and we'll say it again... even if Rheinmetall becomes the leading defense contractor for all of Europe, these expectations are extremely high.

We're talking about an enormous shift in Europe's defense strategy. Billions of euros are waiting to be poured into all of Europe's defense leaders – not just Rheinmetall.

Rheinmetall and its peers are building infrastructure that will define European defense for decades...

Rheinmetall and its peers are building infrastructure that will define European defense for decades...

Until recently, countries like Germany, France, and Italy had lagged in defense spending. After years of peace and budget cuts, European factories couldn't even replenish donated weapons, let alone meet wartime demand.

That's now changing in real time. Governments are mandating domestic supply and increasing budgets in a hurry. Rheinmetall is rushing to fulfill demand, and investors are rewarding it for that... But it can't support all of Europe alone.

As we mentioned, it has several European peers that are hard at work rearming the continent. And none of them have risen more than 170% in the past year... about half as much as Rheinmetall.

Investors should understand that European defense is surging in a way that it hasn't for decades... And it likely has a lot more room to run.

Rheinmetall got most of the early attention, but its peers shouldn't lag for long.

Regards,

Joel Litman

October 1, 2025

Germany has flipped the switch on the largest ammunition plant in Europe...

Germany has flipped the switch on the largest ammunition plant in Europe...