Gone are the days of fistfights over TVs and all-out brawls in the mall parking lot...

Gone are the days of fistfights over TVs and all-out brawls in the mall parking lot...

Many retailers have traditionally looked to Black Friday as an early gauge of sales for the holiday season. And this year, a concerning trend seems to have swept the nation...

Leading up to Black Friday, high-end shopping centers around the U.S. were losing customers. A sample of 25 locations around the country showed that foot traffic fell more than 3% year over year ("YOY") through October.

That same month, we explained that the wealthiest 20% of Americans were the only consumers with pandemic savings left. In other words, 80% of Americans had already burned through their extra cash.

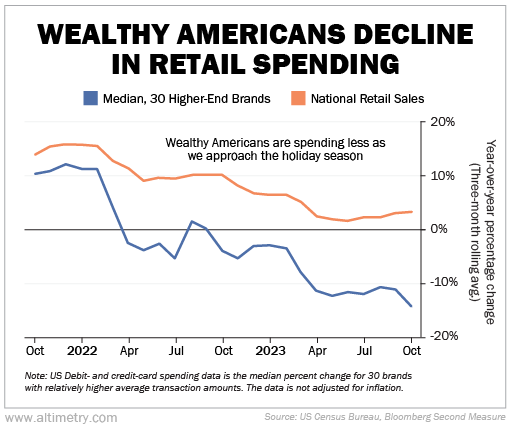

But as it turns out, we should have been worried about the wealthiest folks, too. If these consumers still have cash to spare, they aren't showing it.

Today, we'll explain why consumer spending habits are a troubling sign for this holiday season... and bad news for U.S. gross domestic product ("GDP") as a whole.

Retailers are hurting... and brands that cater to wealthier consumers are down big this year.

Retailers are hurting... and brands that cater to wealthier consumers are down big this year.

According to recent data from Bloomberg...

The median decline in Black Friday sales was 4% for a group of 40 companies that generate a higher percentage of year-to-date sales from the shopping holiday than their peers.

If Black Friday numbers are any indication – and they often are – companies should be worried about sales for the holiday season.

The National Retail Federation agrees. It predicts a 3% to 4% YOY rise in holiday spending... down from the 5.4% increase last year.

And as we said, the slowdown is hitting high-end retailers more than most. Three-month average sales for this group are down about 14% through October.

Take a look...

During this time frame, sales declined for almost three-quarters of high-end companies. Some well-known brands, like Big Tech giant Apple (AAPL), luxury fashion retailer Tapestry (TPR), and department store Nordstrom (JWN), are facing their biggest drops in two years.

Even high-earning households aren't building their savings anymore... Back in July, a survey from personal-finance website Quicken showed 32% of Americans earning at least $150,000 per year were living paycheck to paycheck.

Put simply, the wealthiest Americans may not be able to buoy consumer spending for much longer...

Put simply, the wealthiest Americans may not be able to buoy consumer spending for much longer...

No consumer group is immune from a spending slowdown these days. And since consumer spending makes up two-thirds of GDP, that's a big red flag for the economy.

Even the highest-earning households will struggle to keep spending at recent rates. Conditions are only going to get tighter from here. Less spending is bound to lead to more layoffs... which will shrink spending even further.

Investors need to watch out. As we enter a recession, stock valuations will fall across the board.

Regards,

Rob Spivey

December 8, 2023

P.S. Today's unsteady market is a big change from recent years. And my colleague Joel Litman is so worried about what we're seeing that he's officially "sounding the alarm"...

Joel says the current environment is a minefield for unprepared investors... and the decisions you make in the coming days could determine your wealth for the next decade.

He recently shared the exact steps you should take to prepare yourself (and see 5 times potential gains). Get the details here.

Gone are the days of fistfights over TVs and all-out brawls in the mall parking lot...

Gone are the days of fistfights over TVs and all-out brawls in the mall parking lot...