One of the most hotly anticipated movies of the year is right around the corner...

One of the most hotly anticipated movies of the year is right around the corner...

Among the 10 highest-grossing movies of all time, three have been set in Disney's (DIS) flagship movie franchise, the Marvel Cinematic Universe.

Superheroes from The Avengers are now household names, and this strong intellectual property is a large draw for streaming service Disney+.

Disney's last Marvel movie Black Widow was released as an in-theater and streaming event. The film's leading actress Scarlett Johansson filed a lawsuit over its disappointing box office numbers.

Now, Disney has learned from its mistake and is moving back to the silver screen for its next highly anticipated flick.

Despite its upcoming theatrical release date of next Friday, the newest Spiderman film, No Way Home, broke websites on its pre-launch sales last month. We haven't seen this level of demand since before the pandemic when nothing was stopping anxious moviegoers from seeing the next Marvel hit.

It's a sign of the recovery in theater demand, as more confident and vaccinated consumers are willing to leave their homes to watch movies again.

But they also need to manage their e-commerce infrastructure to ensure customers can buy the tickets they want. Otherwise, the back-and-forth closures and reopenings may leave the theater business scrambling.

But it's not just the theaters that are struggling to fulfill online orders...

But it's not just the theaters that are struggling to fulfill online orders...

Amazon Web Services experienced a temporary outage on Tuesday, halting streaming services like Netflix and Disney+ and cryptocurrency exchange Coinbase.

Every day, millions of users rely on the web for all manner of services, from shopping to streaming. Even minutes of outages can spell hundreds of thousands of dollars in lost potential profits for the companies providing these services.

This is why the monitoring and security platform Datadog (DDOG) is becoming more important every day. Datadog offers monitoring and analytics services for websites to monitor their website traffic and e-commerce platforms 24/7.

And by providing its product under the Software as a Service ("SaaS") model, Datadog has been able to print money in helping to keep the Internet online.

To see how well Datadog has been doing, we'll turn to The Altimeter...

To see how well Datadog has been doing, we'll turn to The Altimeter...

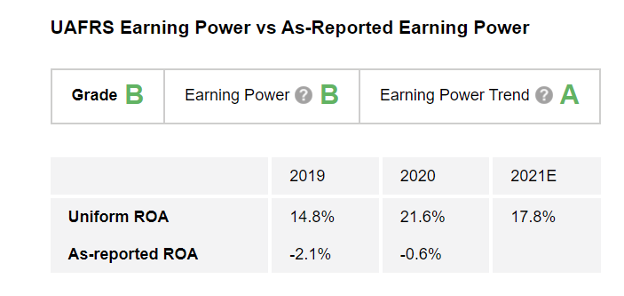

On an as-reported basis, Datadog's return on assets ("ROA") last year was less than zero, meaning it appears to be losing money.

But the lackluster productivity is only a symptom of antiquated GAAP rules that distort the usefulness of financial metrics like ROA. In the case of Datadog, GAAP rules cause things like excess cash and research and development ("R&D") expenses to drag ROA down.

The Altimeter makes more than 130 adjustments on nearly 5,000 publicly traded companies to show the "real" numbers, allowing investors to make apples-to-apples comparisons between companies.

The Altimeter shows that Datadog's Uniform ROA is actually 22%, significantly higher than the 0% most investors would see. This earns the company a "B" grade for Earnings Power.

As Datadog has continued to grow this strong return from 15% in 2019 to 22% last year, it has earned the company an "A" grade for Earnings Trend. Together, this comes together to a strong overall "B" grade.

Here's the secret to Datadog's success...

Here's the secret to Datadog's success...

Thanks to the SaaS model that Datadog is employing, the stock is up about 400% over the past two years. This is because – as we've covered with recent essays on fellow SaaS winners Shopify (SHOP), Adobe (ADBE), and HubSpot (HUBS) – this business strategy has repeatedly proven to turbocharge investor returns.

Many of these companies have trumped the returns from the S&P 500 Index. However, as we've explained in recent essays, these stocks have already generated multibagger returns... meaning their remaining upside is limited.

But we recently discovered a small tech company that's quietly making the transition to a SaaS business model... and we believe its shares have the potential to return as much as 2,000% from here as the rest of the market finally catches on to what our Uniform Accounting has found. Get the details on this incredible opportunity right here.

Regards,

Edward Edwards

December 9, 2021

One of the most hotly anticipated movies of the year is right around the corner...

One of the most hotly anticipated movies of the year is right around the corner...