For years, private-equity ('PE') firms thrived on a simple formula...

For years, private-equity ('PE') firms thrived on a simple formula...

- Buy using debt,

- Cut costs,

- Boost earnings,

- Sell at a profit.

Low interest rates and easy credit made this model wildly successful. But that era is fading. Borrowing costs are rising.

Exit opportunities – like taking companies public, selling them to large competitors, or selling to another PE firm – are drying up.

In short, PE's smooth ride is coming to an end.

While fund managers insist their portfolios are performing well, public-market valuations paint a much less flattering picture.

Since inflation ran rampant in 2022, the Invesco Global Listed Private Equity Fund (PSP), which tracks publicly traded PE firms, is down 12%.

And PE companies are resorting to some tricky shortcuts to look more profitable than they actually are...

The case of Schur Flexibles perfectly illustrates the problems in PE...

The case of Schur Flexibles perfectly illustrates the problems in PE...

PE firm Lindsay Goldberg sold the Austrian packaging company to a buyout group in 2021.

But Schur quickly fell apart... and the resulting scandal has rocked the PE world.

A criminal probe is investigating whether the company boosted its EBITDA by hiding costs to inflate performance. (EBITDA stands for "earnings before interest, taxes, depreciation, and amortization.")

And of course, it's raising questions about how much responsibility Lindsay Goldberg bears for Schur's alleged misdeeds.

Regardless of the outcome, when Schur collapsed, it exposed just how fragile PE has gotten.

Investors are starting to question the numbers – and the outlook of the industry in general.

This degrading trust extends far beyond Schur and Lindsay Goldberg...

This degrading trust extends far beyond Schur and Lindsay Goldberg...

Take Apollo Global Management (APO), which owns big brands like Chuck E. Cheese, Yahoo, and Claire's Stores.

Put simply, Apollo is a household name in PE. And when it comes to the firm's books, everything looks shiny.

Assets under management reached $751 billion at the end of 2024. They're up 15% year over year and 37% in the past two years.

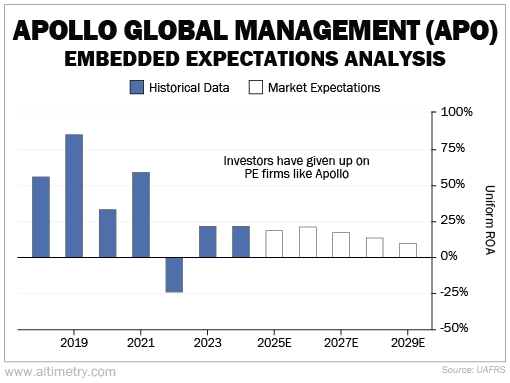

But investors don't believe the underlying business is set to thrive. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Apollo's Uniform return on assets ("ROA") stayed largely above 50% through 2021, during the era of cheap debt and healthy PE.

Then the post-pandemic economy hit. As interest rates soared, returns flipped negative. They've only "recovered" to around 24%.

Investors don't expect even this mild bounce back to last. They think Uniform ROA will slide to 10% by 2029.

Take a look...

The market is well aware that PE is struggling. Investors don't seem to want to stick around and watch.

And between rising rates, tighter credit conditions, and fewer ways to sell, we don't blame them.

Regards,

Joel Litman

March 31, 2025

For years, private-equity ('PE') firms thrived on a simple formula...

For years, private-equity ('PE') firms thrived on a simple formula...