This past summer, the once-forgotten legal drama Suits became one of the biggest hits on Netflix (NFLX)...

This past summer, the once-forgotten legal drama Suits became one of the biggest hits on Netflix (NFLX)...

The Universal Studios TV show, which premiered on the USA Network more than a decade ago in June 2011, didn't release a new season. In fact, its last episode aired more than four years ago in September 2019.

There was no big promotional push, either.

Still, it became a chart-topping phenomenon after it dropped on Netflix's platform in June... despite the fact that it was already available on streaming service Peacock. According to data-analytics firm Nielsen, Suits broke the record for most watched minutes on an "acquired" TV show... clocking 3.7 billion minutes in a single week in July across both Netflix and Peacock.

Now, again, this unexpected surge in popularity has nothing to do with a brand-new season... or a Netflix-led revival campaign... or even the fact that it stars a pre-royal Meghan Markle.

Instead, it's the result of several big entertainment studios backtracking on pulling their content off of Netflix.

You may recall that in the heyday of the streaming wars, these studios clutched their content close. They pulled their titles from Netflix to launch their own subscription services.

But it appears that going it alone in the streaming world may have proved too challenging... as studios are returning to the strategy of making money through licensing. Instead of streaming content exclusively on their own platforms, they're once again allowing Netflix to host their content for a fee.

And as it's the largest streaming service in the world – with 247 million paying subscribers – it makes sense why forgotten shows like Suits are suddenly making a comeback.

Today, we'll delve into why these studios are rekindling their relationship with Netflix. We'll also look at what this means for the broader streaming industry's ever-changing narrative...

Building your own streaming service isn't as easy as it seems...

Building your own streaming service isn't as easy as it seems...

Just take a look at how it has turned out for media and entertainment giant Warner Bros. Discovery (WBD).

The company was formed in 2022, after AT&T's WarnerMedia unit merged with Discovery.

Together, they boast a huge portfolio of content and brands... including Discovery Channel, CNN, Food Network, Animal Planet, and Cartoon Network. They even own the Batman and Harry Potter franchises.

The companies thought that by joining forces and becoming a content giant, they'd be able to compete with Netflix on their own streaming platform, HBO Max (now known as Max).

However, even Warner Bros. Discovery has started selling its content back into the Netflix ecosystem. It recently put the hit movie Dune and the sitcom Young Sheldon on the platform.

And the reason is simple...

Trying to compete with Netflix is just too costly...

Trying to compete with Netflix is just too costly...

Warner Bros. and Discovery took on a ton of debt when they merged.

Altogether, the combined company has about $45 billion in debt. A lot of that comes due in the next two years... and it will likely struggle to meet its obligations.

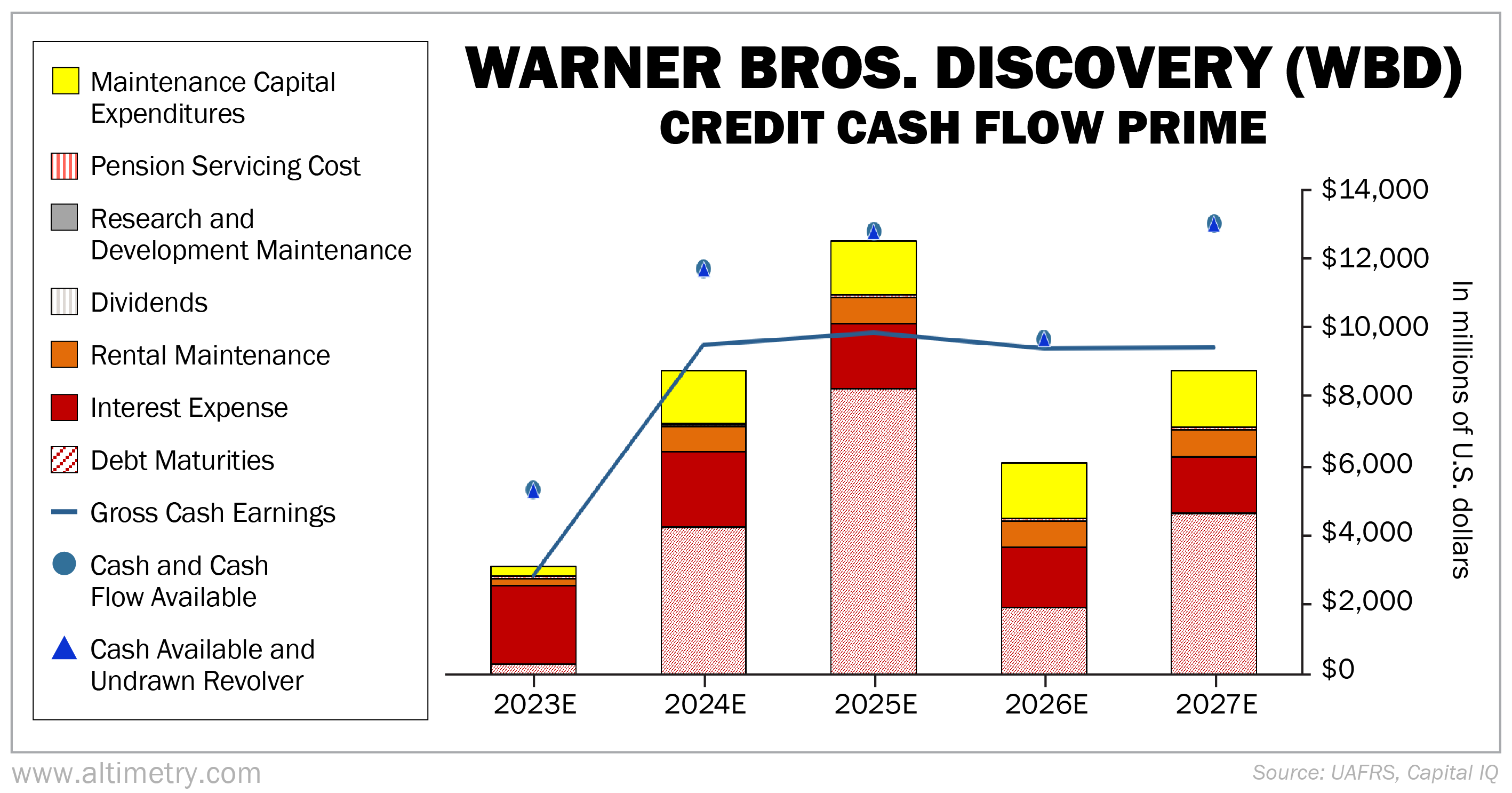

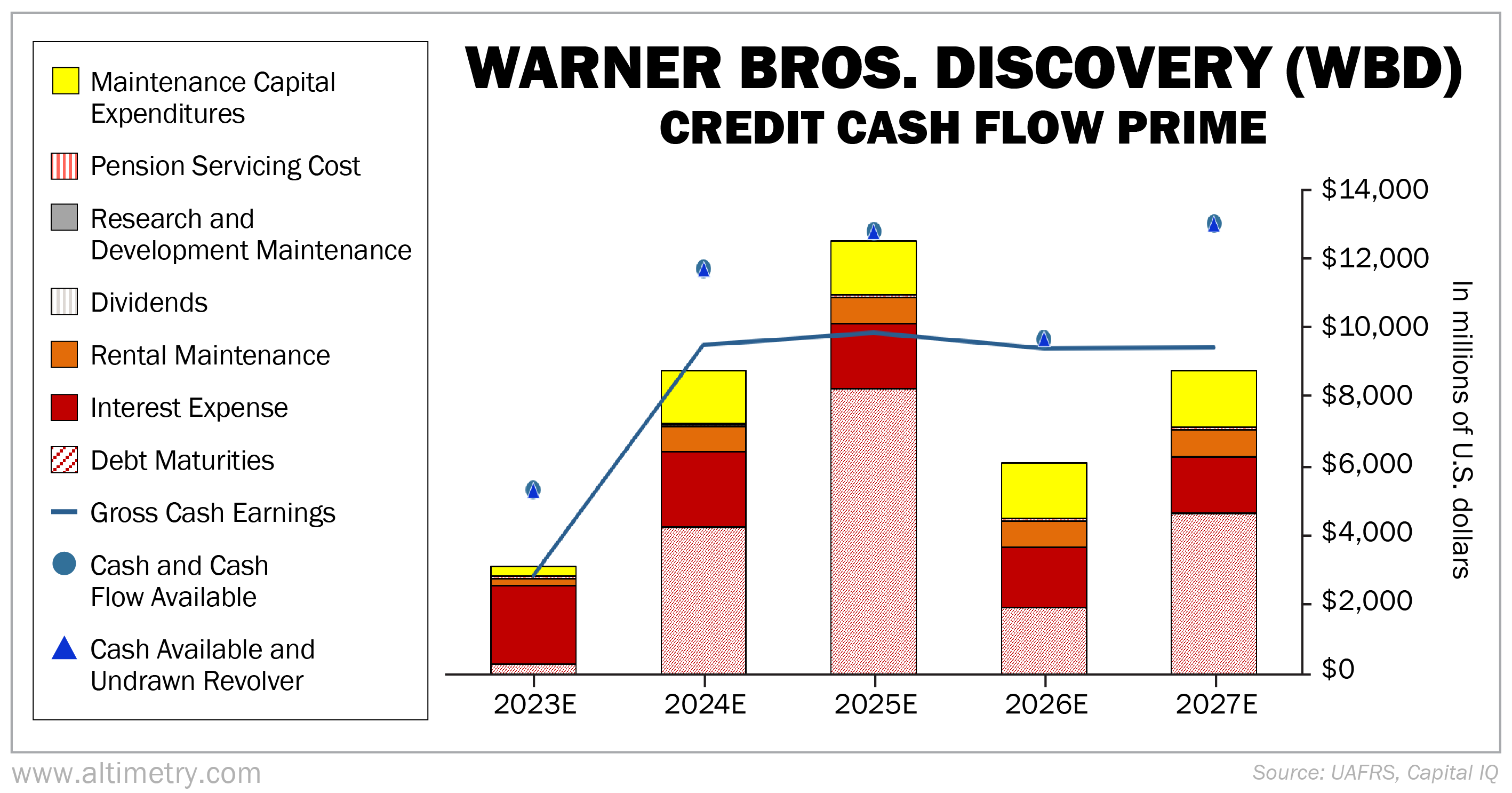

We can see this through our Credit Cash Flow Prime ("CCFP") analysis.

The CCFP gives us a more accurate sense of a company's overall health. It compares financial obligations against cash position and expected cash earnings.

In the following chart, the stacked bars represent Warner Bros. Discovery's obligations through 2027. This is what it needs to pay in order to keep the lights on... to prevent the company from collapsing.

We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

Starting next year, Warner Bros. Discovery won't have enough cash flow to cover all its obligations.

Take a look...

Licensing content to Netflix means that the company can enjoy immediate cash flow... That gives it a bit of a buffer over the next few years while it works through its massive debt maturities.

This is a lot easier than spending on marketing or investing heavily in new content to draw in paying subscribers.

While the streaming industry has long seen exclusivity as a means to attract and retain subscribers... it's just not a financial reality for companies like Warner Bros. Discovery – especially given the economic pressures of post-merger integration.

After all, exclusive content is expensive – not just in terms of production, but also when it comes to the infrastructure required to distribute it effectively.

Licensing content to platforms like Netflix offers a pathway to revenue without more spending.

And that's becoming increasingly attractive as the streaming market matures and the battle for exclusive content leads to diminishing returns.

Warner Bros. Discovery's pivot highlights the importance of financial health over the allure of exclusivity...

Warner Bros. Discovery's pivot highlights the importance of financial health over the allure of exclusivity...

And it's not the only one that's backtracking on its licensing strategy.

Pretty much all other content-houses-turned-streaming-platforms are doing the same.

Paramount (PARA) and Disney (DIS), for instance, have both started adding some of their content back into Netflix's library.

And keep in mind that this type of decision isn't made lightly. Not only does it give Netflix a better catalog, these licensing deals typically last for at least a few years.

It's likely a sign that the streaming industry is already past its peak fragmentation... and that some of Netflix's competitors are struggling under the surface.

On that note, there's reason to believe that this could be a big year for Netflix, especially as it continues to strengthen its content portfolio.

Regards,

Rob Spivey

January 11, 2024

This past summer, the once-forgotten legal drama Suits became one of the biggest hits on Netflix (NFLX)...

This past summer, the once-forgotten legal drama Suits became one of the biggest hits on Netflix (NFLX)...