The hybrid-work model will change office space for years to come...

The hybrid-work model will change office space for years to come...

Many have been calling for the death of office real estate investment trusts ("REIT") since the global pandemic struck.

Global lockdowns forced the world to work from home, and many workers haven't stepped foot in the office in more than a year. As a result, companies saw the merits of a remote- or a hybrid-work model.

Employers will continue to embrace a hybrid-work model long after the pandemic, thanks to its advantages. As a result, the demand for office space could potentially never recover to its pre-pandemic levels. That makes office REITs a risky investment.

However, one subsector has stood out like a diamond in the rough.

Laboratory commercial real estate ("CRE") spaces, used for developing vaccines and other drugs, have performed well since 2020. Instead of demand being crushed by the pandemic like the rest of the CRE industry, laboratory CRE demand spiked.

In 2020, sales and refinancing of life science buildings totaled $25 billion, up more than 270% from 2019.

Biotech companies spent billions researching and developing COVID-19 vaccines and needed laboratories for research, leading to a laboratory CRE boom.

Investors have taken notice, pouring big money into the space. KKR (KKR) recently paid $1.1 billion for office space in San Francisco with plans to repurpose it into laboratory space.

IQHQ, a real estate startup, recently raised $2.6 billion to develop laboratory buildings. The life sciences real estate development company sees such strong demand in the space that it is breaking ground on a $1 billion project in Boston without pre-signing leases for the building.

A possible winner in the CRE space...

A possible winner in the CRE space...

A big winner in laboratory CRE demand is Alexandria Real Estate Equities (ARE). Alexandria is the largest life sciences REIT listed on the U.S. market, investing aggressively in the booming space.

The company recently paid $1.5 billion for a space close to Altimetry's Boston office in the Fenway neighborhood.

Considering the massive tailwind in the space, investors might be thinking that Alexandria is a no-brainer investment. However, as regular Altimetry Daily Authority readers know, buying a stock is not about how good the company is... It's about what the market expects the company to do.

Most investors determine stock valuations using a discounted cash flow ("DCF") model. This model uses investors' assumptions about the future and produces the "intrinsic value" of the stock.

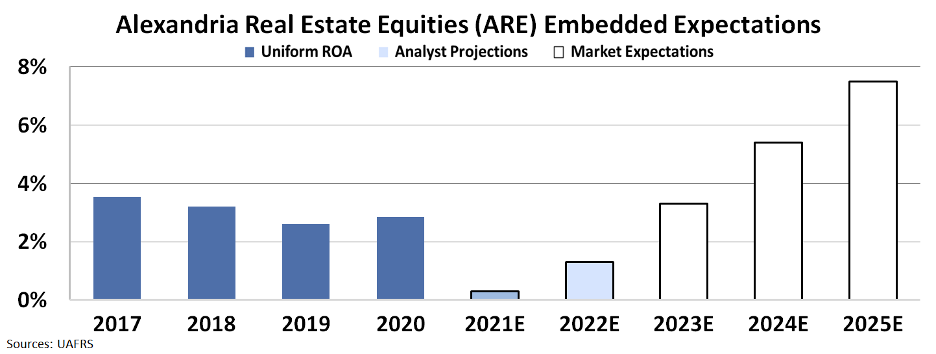

However, here at Altimetry, we know models with garbage-in assumptions only come out as garbage. Therefore, we turn the DCF model on its head in the below chart. Here, we use the current stock price to solve what returns the market expects.

The dark blue bars represent the historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how ROA will shift in the next five years.

The issue for Alexandria Real Estate is that the dramatic increase in laboratory demand has already been priced into the stock. Though the company's ROA is forecasted to be lower than normal in 2021 and 2022, the market is pricing its ROA to rocket to 7.5% in 2025.

The 7.5% long-term ROA priced in by the market is double the company's historical ROA of 3% to 4%. As a result, it's unlikely for Alexandria to reach these lofty expectations.

The boom in laboratory commercial real estate is a great story for private real estate developers. And these massive investments will likely turn out to be very successful.

But for public investors, it's a different story. While Alexandria Real Estate will benefit from the strong tailwinds in life sciences CRE, any boost to profitability is already priced into the stock.

We just found a company that's primed to be a huge winner in the hybrid-work world...

We just found a company that's primed to be a huge winner in the hybrid-work world...

It's a thought leader for the future of office space, and it's a titan in the industry. However, the market doesn't realize that this property company is set up for a double.

We just recommended it to our Altimetry's Hidden Alpha subscribers yesterday. To learn more about Hidden Alpha and find out how to gain instant access to this brand-new recommendation, click here.

Regards,

Joel Litman

August 3, 2021

The hybrid-work model will change office space for years to come...

The hybrid-work model will change office space for years to come...