In the midst of the 'Corona Crash,' let's not forget the 'Flash Crash'...

In the midst of the 'Corona Crash,' let's not forget the 'Flash Crash'...

March was a historic month for the markets as stocks collapsed in the wake of the escalating coronavirus pandemic.

It's appropriate timing for the release of a new book on nearly the 10-year mark of another event that shook the markets... the Flash Crash of 2010, when the S&P 500 Index plunged by 5% in four minutes. The book covers the crash and one of the people blamed for it: day trader Navinder Singh Sarao.

Last week, Bloomberg featured an excerpt from the book: Flash Crash: A Trading Savant, a Global Manhunt, and the Most Mysterious Market Crash in History. It covered Sarao's background, and how he found himself in the center of the blowback from the Flash Crash.

Sarao doesn't sound like the classic archetype of a trader at all. In fact, as his description highlights, he was more of a gamer than a trader in how he dealt with the markets, treating them like the FIFA computer games he played.

Sarao was almost detached in terms of how his trading connected to the realities of the market and his life... including when applying strategies like "spoofing," or faking demand and orders, which caused him to become a high-profile target in the midst of the search for a scapegoat for the Flash Crash.

The short bio is a reminder that the traders of today aren't always the swashbuckling types that we often think of, from the era of Gordon Gecko and the 90s Wolf of Wall Street brokers of Long Island.

Follow the 'megatrends' when coming out of a recession...

Follow the 'megatrends' when coming out of a recession...

During the midst (and the aftermath) of the Great Recession, one of the best places to invest for a savvy investor was in for-profit college companies.

From an investment standpoint, the logic was sound. A lot of people who were displaced from the recession decided to go back to school for new training, but they obviously needed school to be flexible and fairly inexpensive.

Enter the boom in the for-profit trio of online universities: University of Phoenix, Bridgepoint Education – now known as Zovio (ZVO) – and DeVry University.

All three – and several other companies – had massive online presences, making it easy for professionals to get reeducated on their own schedule from home.

That's not the only reason the trio was such a great set of investments... the Great Recession also lined up with the millennial megatrend.

In addition to a wave of unemployed professionals, a massive number of millennials were just reaching college age around 2008. This led to a surge in demand for higher education that traditional universities wouldn't be able to support alone.

The numbers speak for themselves...

Enrollment at University of Phoenix peaked at an all-time high of more than 470,000 in 2010, while Bridgepoint was named the fastest-growing private education company in America in 2008.

What you may not know – partially because each of these companies has either gone private or changed its name since the recession – is that each of these schools was either public or owned by a savvy private-equity firm.

At the time, University of Phoenix was publicly listed as Apollo Education, and eventually acquired by private-equity firm Apollo. Likewise, Bridgepoint was formerly owned by Warburg Pincus.

They eventually ran into trouble because of how they ran their businesses... but these companies had the right idea in focusing on the millennial "age wave."

And they're not the only ones who can take advantage of megatrends. By following large shifts like this, investors can get a jump on profits.

A great example was when investors bought raw material suppliers as China started to open trade to the world, causing demand to skyrocket.

Another recent demographic shift in the U.S. has been the rising Hispanic population – both through immigration (particularly from Mexico) and higher birth rates for current U.S. residents of Hispanic origin.

Some companies are aware of these trends and have been able to cater towards this shift. As Hispanic culture is more widely recognized, and as the actual demographics in the U.S. shift, companies like Hormel Foods (HRL) have successfully followed this megatrend.

While some of the company's oldest and largest brands include SPAM and Skippy peanut butter, it has turbocharged its returns by expanding into a number of Mexican offerings.

In 2009, Hormel created a joint venture called MegaMex Foods to bring a variety of Mexican foods to the U.S. market. MegaMex includes products like guacamole, taco sauce, and several Mexican food chains like Chi Chi's and El Torito.

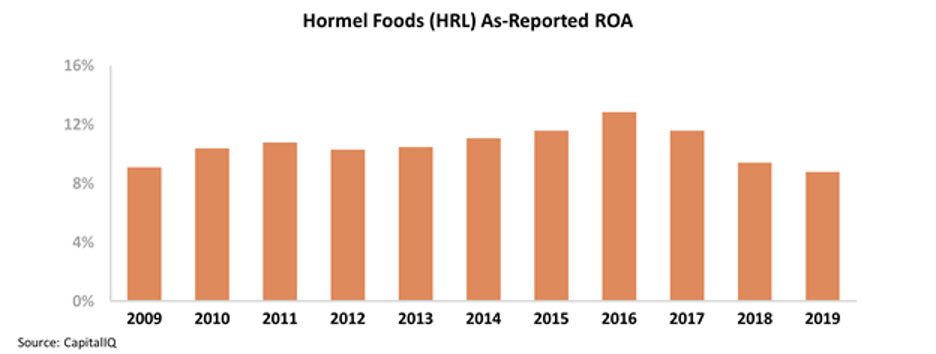

This investment proved to be massively profitable for Hormel. From 2009 until 2016, the company's return on assets ("ROA") expanded steadily from 9% to 13%.

That said, beginning in 2016 when the current presidential administration took office and took a strong stance on immigration, the gains realized from the MegaMex investment appear to be reversing, with Hormel's ROA falling back to 9% in 2019.

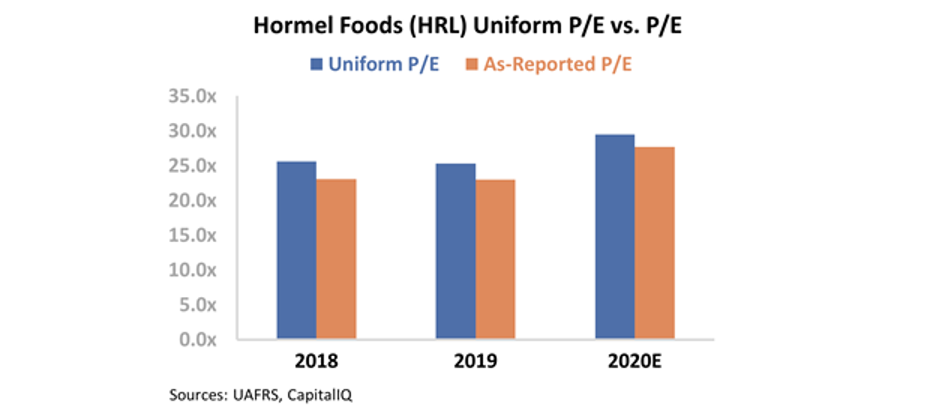

That said, investors still appear bullish on the company despite the slipping returns. Hormel's price-to-earnings (P/E) ratio has continued to rise and remains above market averages. The company's Uniform P/E ratio is currently at 30, which is above market averages around 20.

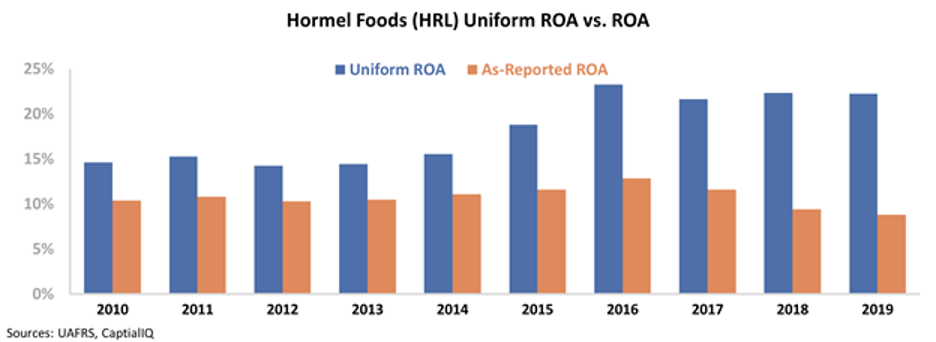

While it may seem like investors are missing Hormel's recent profitability declines, the reality is the as-reported metrics are just wrong.

Hormel's profitability hasn't fallen back to 2009 levels in the last four years – it's as strong as ever. But that's only visible under Uniform Accounting...

After adjusting for misleading line items like the treatment of goodwill and non-cash stock option expenses on as-reported financials, we can see that Hormel's Uniform ROA has expanded from 15% in 2009 to peak levels around 22% – which it has maintained since 2016. Take a look...

Regardless of the effect the current administration has had in terms of immigration figures, the value of Hormel's investments into Mexican food has remained. This isn't a company that investors are too bullish on... It's one that the market knows has recognized the larger-scale demographic shifts.

Regards,

Joel Litman

May 21, 2020

In the midst of the 'Corona Crash,' let's not forget the 'Flash Crash'...

In the midst of the 'Corona Crash,' let's not forget the 'Flash Crash'...