For decades, gold has been revered as the go-to stable asset during economic turbulence...

For decades, gold has been revered as the go-to stable asset during economic turbulence...

Today's environment is a great example. Almost everyone seems to agree the Fed will start cutting rates in September... and the U.S. dollar is starting to weaken.

At the exact same time, gold has never been stronger. The metal surpassed $2,550 per ounce for the first time earlier this week.

This has reignited the old gold-versus-stocks debate. Gold is generally considered a safer investment, especially when the economy is getting weaker.

However, the truth is... gold's appeal may not be as strong as it appears – especially when you dig into the numbers.

Many people think the S&P 500 lags behind gold...

Many people think the S&P 500 lags behind gold...

That's because they're looking at simple price charts. They're missing a critical piece of the puzzle, though...

I'm talking about dividends.

Anyone with money in the stock market should be taking their dividends and reinvesting them. The S&P 500 doesn't reflect this approach... which offers a totally different return profile.

And gold doesn't pay dividends, of course. It's not like you can shave off a piece of your gold bar and watch it grow right back.

Equities have a massive advantage here because they can grow over time. Companies can expand, issue dividends, and even spin off parts of the business.

They have multiple ways to pay investors, all of which can help equity returns compound.

To see the difference in action, consider one of our favorite 'vice' stocks...

To see the difference in action, consider one of our favorite 'vice' stocks...

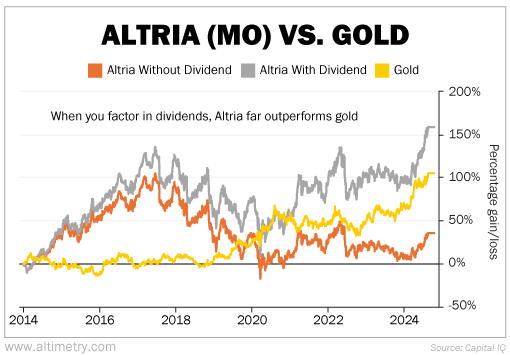

Altria (MO) is one of the world's leading makers of tobacco products. And by stock price appreciation alone, it has been a modest performer... up around 50% since 2014.

However, when you factor in dividends... Altria's total return surges to more than 150%.

Take a look...

As you can see, Altria's return including dividends was 1.5 times higher than the return on gold... which was approximately 100% over the same period.

It's the same across much of the S&P 500. You can't stack simple price appreciation against gold. These businesses are paying dividends, and investors are – or should be – reinvesting those dividends.

Gold is just a shiny rock... It doesn't grow.

Gold is just a shiny rock... It doesn't grow.

In contrast, dividend-paying stocks not only appreciate in capital... they offer dividends that you can reinvest, compounding growth over the years.

If you're looking to protect your portfolio during uncertain times, seek out companies with stable dividends. They can offer you some of the "defensive" properties of gold.

Plus, they can actually pay you cash.

And when the economy stabilizes, those stocks will keep growing. An ounce of gold will remain nothing more than an ounce of gold.

Wishing you love, joy, and peace,

Joel

August 23, 2024

P.S. A few weeks ago, I tackled the gold-versus-stocks debate on the Palisades Gold Radio podcast... and stirred up some fierce pushback from gold enthusiasts. You can listen to the episode for free by clicking here.

For decades, gold has been revered as the go-to stable asset during economic turbulence...

For decades, gold has been revered as the go-to stable asset during economic turbulence...