It's time to look away from the heavyweights for alpha...

It's time to look away from the heavyweights for alpha...

The past few weeks have been choppy for large-cap stocks. Investors have been set up for disappointment this earnings season, leading to short-term volatility.

This has already meant the S&P 500 Index is down around 1% over the past month, with the Nasdaq down 2%, too. Investors are beginning to clue into what we have been saying: the slowing of earnings growth for the near future, fears over inflation, and concerns with Washington's threatening deadlock.

While this doesn't mean a crash is imminent, it does mean for the moment that large-cap names like Apple (AAPL) and Facebook (FB) may not be the best place to park your money. Instead, there is another group of stocks that have weathered this recent rollover better than most.

The Russell 2000, the index of small and microcap names, is actually up more than 4% since Sept. 20.

Part of the reason for this is that the Russell 2000 has been relatively stagnant since March, while the other indexes have continued to rally. The S&P 500 was up more than 15% from March 1 to Sept. 1. The Nasdaq was up more than 13% in the same period, while the Russell didn't budge 1%.

As the pendulum swings back, the return of the microcap is coming...

As the pendulum swings back, the return of the microcap is coming...

The reason for this slowdown was a shift in investor focus. With folks again concerned about the global pandemic and the emergence of the delta variant, the world of "At-Home Revolution" names once again saw a huge boon.

These names, bringing essential services into the home, are predominantly the large tech companies. These companies also sit on top of the Nasdaq and the S&P 500, driving these indexes and inflating valuations.

Meanwhile, small-cap and microcap names didn't benefit in the same way from at-home tailwinds. These smaller companies have been off people's radars. With the second wave of the pandemic, folks were more focused on Amazon (AMZN), Alphabet (GOOGL), and Zoom Video Communications (ZM) – names that clearly benefited.

As the world starts to reopen again and these larger names come under pressure to deliver stellar results, the Russell 2000 can get the market's attention once again as investors recognize the value of these "off the beaten track" names.

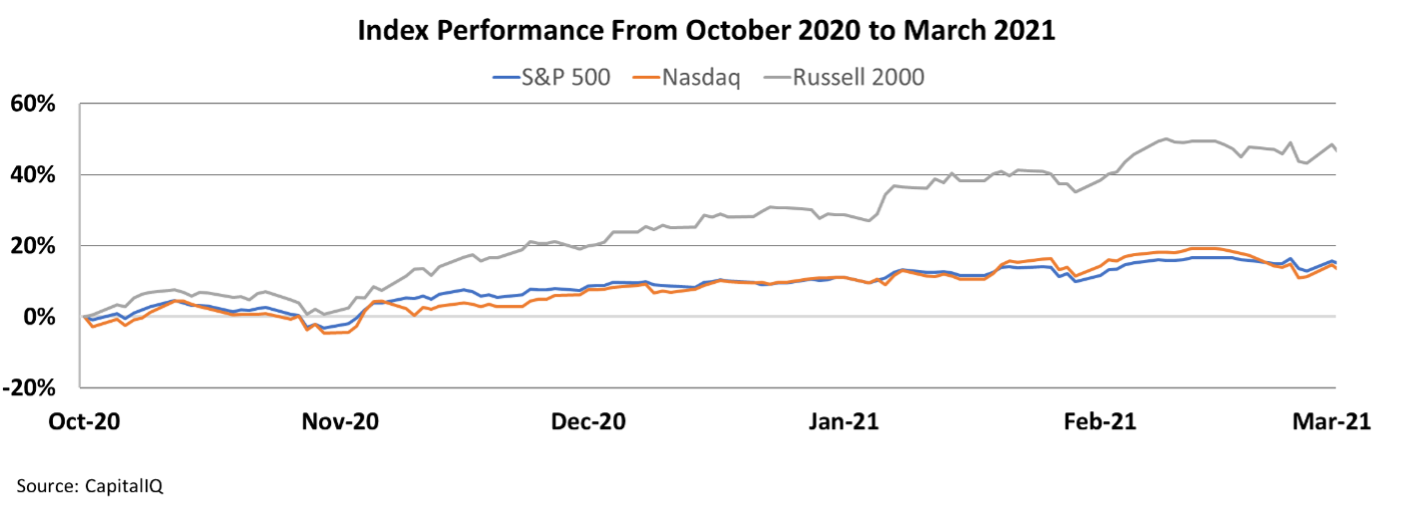

For context, these are the companies that took off between October 2020 and March 2021.

As investors realized these smaller names weren't, in fact, about to go under and had great tailwinds from cheap lending and raised economic spending, they were trading at bargain prices.

From October 2020 to March 2021, the S&P 500 and the Nasdaq were only up 12% and 15%, respectively. However, the Russell 2000 was up almost 50% during the same period.

As some technical analysts at Real Money and other outlets have highlighted, the Russell 2000 shows that the market is beginning to recognize the potential for another small-cap and microcap run. And it's not based just on hype, but fundamentals.

This means people who can get in front of this next rally in the Russell 2000, just like the one a year ago that lasted until March, are uniquely positioned to benefit in an otherwise tumultuous time for stocks.

And the best part for active investors is that when the Russell 2000 runs, the cream of the crop in that index run even higher than the average.

Regards,

Joel Litman,

October 18, 2021

It's time to look away from the heavyweights for alpha...

It's time to look away from the heavyweights for alpha...