Dear reader,

My first job when I got my CPA license was as an auditor in Chicago. I'd travel across the Midwest as part of my role, and I kept track of the best steaks in every small city within 500 miles of Chicago.

One of my fondest memories of the companies I audited was a scrap yard. It was fascinating to learn about how truckers attempted to "game" the system.

Some would try to angle their trucks in a specific way after they unloaded and had to drive over the scales to get paid, to make it appear they'd deposited more than they actually had. Others would attempt to add weight in other ways to maximize their payout.

I have had a keen interest in how people could game accountants – and an eye to watch out for it – for a long time.

Most people assume that asset-intensive businesses, like scrap yards or trash companies, are boring businesses to audit. But those heavy-asset companies sometimes offer the most interesting opportunities to dig in to.

Most people think it's more fun investing in tech companies. They make products for the future. Most of them are consumer-oriented. You get to look at fun metrics like daily active users ("DAU") and subscription growth. You can use buzzwords, talk about the blockchain, and think about Moore's law.

Tech companies might be exciting, but that doesn't mean they are the best investments. The big names like Amazon (AMZN) and Facebook (FB) may generate strong returns... but these companies are also the most followed by analysts and investors – making it tough to beat the market.

Often, the best stocks come from more boring industries. It's worth researching these often-overlooked industries to find a diamond in the rough.

The waste-collection and recycling-facilities markets are much less followed. But it's not for a lack of quality...

Companies like Waste Management (WM), Republic Services (RSG), Waste Connections (WCN), Advanced Disposal Services (ADSW), and Casella Waste Systems (CWST) are a few of the players in this market. They all offer mostly the same suite of waste collection and disposal services.

And these companies' stock returns are soaring. Since the market bottom in 2009, including dividends, Waste Management and Republic Services are both up more than 500%... Waste Connections is up 800%-plus... And Casella is up more than 3,200%.

This alone is reason enough to see if there are still any gems to be uncovered in the space. Are any of these businesses set up to continue producing strong stock returns?

Considering their offerings, it would stand to reason that these companies offer a commoditized service. Businesses that compete in markets like these compete on price. Even if they try to compete on quality, competitive pressures can eat away at returns.

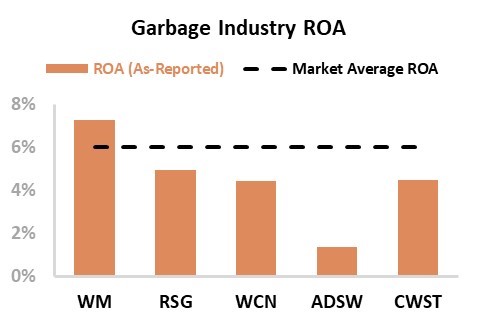

Sure enough, if we look at the big names in the industry, we see a market-average return on assets ("ROA")...

Waste Management looks like the best of this bunch, with a 7% ROA. It's the only company with above-average returns.

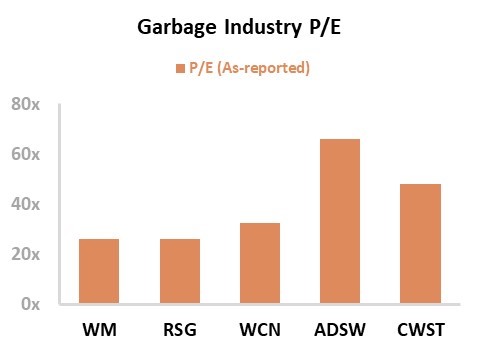

A strong ROA is a good starting point, but it is important to look at valuations. Take a look at the same set of companies based on their price-to-earnings ("P/E") ratios...

Waste Management still looks promising by this metric. With the corporate average P/E ratio in the 20 range, none of these companies look "cheap." But Waste Management, Republic Services, and Waste Connections – the three biggest names – all look the most reasonably priced.

Using a traditional research process, Waste Management looks like the best opportunity.

However, there's a big problem here. These garbage companies are using bad numbers.

As always, the answer lies in the accounting. The as-reported numbers are so wrong, they give investors the wrong picture of an entire industry.

As you know, we specialize in Uniform Accounting – a more reliable way of looking at companies than the GAAP and IFRS accounting policies.

As-reported accounting policies distort the way we think about the impact of something as important as industry fundamentals. How can we invest accurately if we can't understand the economics of the markets we invest in?

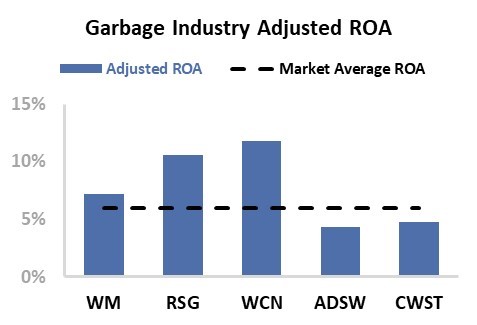

Instead of looking at bad data, we look at the real numbers... And this paints a totally different picture.

The chart below highlights the Uniform ROA of each of the five companies, after all of the adjustments under Uniform Accounting are made. The industry is turned on its head... Advanced Disposal and Casella still underperform long-run corporate average returns, but Waste Management is only in the middle of the pack – not best-in-class. Take a look...

Republic Services and Waste Connections are best-in-class operators by our Uniform ROA metric.

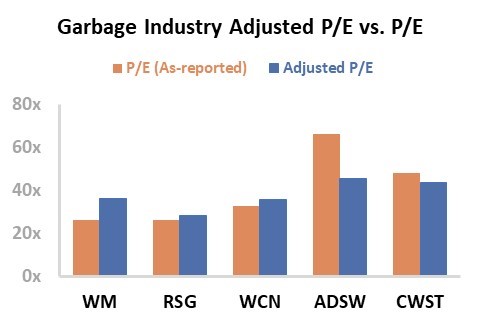

The same inconsistency applies to valuations. After adjusting the financials, P/E ratios for the industry reveal a different story...

Republic Services, Waste Connections, and Casella look mostly the same. That said, Advanced Disposal is not nearly as expensive as traditional metrics would indicate, and Waste Management is much more expensive.

On a Uniform basis, Waste Management is as expensive as Waste Connections with half the ROA.

When looking at the industry with unadjusted numbers, Waste Management is the clear winner. However, when you clean up the numbers, you can see it's a middle-of-the-pack company.

There's no sense in paying best-in-class prices for an average business.

This is just another reason why as-reported numbers hurt the investment process.

Regards,

Joel Litman

October 4, 2019

P.S. I recently partnered with Stansberry Research founder Porter Stansberry to share my "Truth Detector" investment system. It's a new way to see which stocks could soon double or triple your money, using forensic analysis. Learn more about it – and a subscription to my brand-new Altimetry's High Alpha newsletter – right here.