The gene sequencing industry has come a long way...

The gene sequencing industry has come a long way...

It took roughly 150 years of scientific work and $2.7 billion to map the first human DNA sequence.

In the 1860s, a scientist named Friedrich Miescher discovered nucleoid acids. But more importantly, he also found a way to isolate nucleoids.

Miescher's pioneering works went beyond just contributing to high school biology books. The preliminary work he had conducted helped future scientists advance genome sequencing.

Continued breakthroughs have enabled us to further scientific research into advanced sequencing technologies. After the first human genome was fully sequenced in 2003, another genome was sequenced in 2006 in just six months for $20 million.

This other genome allowed us to clone the DNA sequence of a live sheep to procreate a new life. The sheep became such an icon that her name, Dolly the cloned sheep, may ring a bell.

Since the early 2000s, DNA sequencing has only gotten cheaper and faster.

By 2018, most gene sequencing projects could be done in days, and the cost even broke the important $1,000 barrier.

At that level, gene sequencing reached consumer pricing levels.

From learning more about our ancestors to our pets' breed...

From learning more about our ancestors to our pets' breed...

In recent years, broad applications of this technology have become even cheaper for consumers, thanks to the rapid scale of DNA sequencing services. Some are like 23andMe, providing a broad overview of ancestry and health, while other services such as MyGenome give a more targeted look.

These services allow you to understand more about your genes. With gene information available commercially, consumers could potentially unlock insights about health risks or the origin of their family tree.

DNA sequencing is now at a point where many companies can do it cheaply, so they must come up with a new differentiator to sell to customers.

As a result, the industry is coming full circle back to lovable animals. The logical next step for those in the industry is to learn more about our pets, the furry family members that can't tell us more about themselves.

Embark Veterinary and Wisdom Panel used what we know about the human genome sequence and has applied it to dogs.

Now, you can send in a sample and, within a few weeks, obtain a genetic output that tells you your dog's real makeup, which has led some families to find out their "purebred" is anything but...

Has profitability accompanied the rapid rise in the industry?

Has profitability accompanied the rapid rise in the industry?

While the industry has already grown rapidly, we have only just scratched the surface of what gene sequencing can do and continue its rapid ascension into a big future industry.

Even though it is difficult to tell which companies will eventually dominate the market, some tangential players are surefire bets. Companies like Embark or Wisdom Panel, suppliers to the gene sequencing industry, benefit no matter who wins.

Life science solutions company Agilent Technologies (A) has a comprehensive segment of its diagnostics and genomics business that sells the tools necessary to sequence DNA.

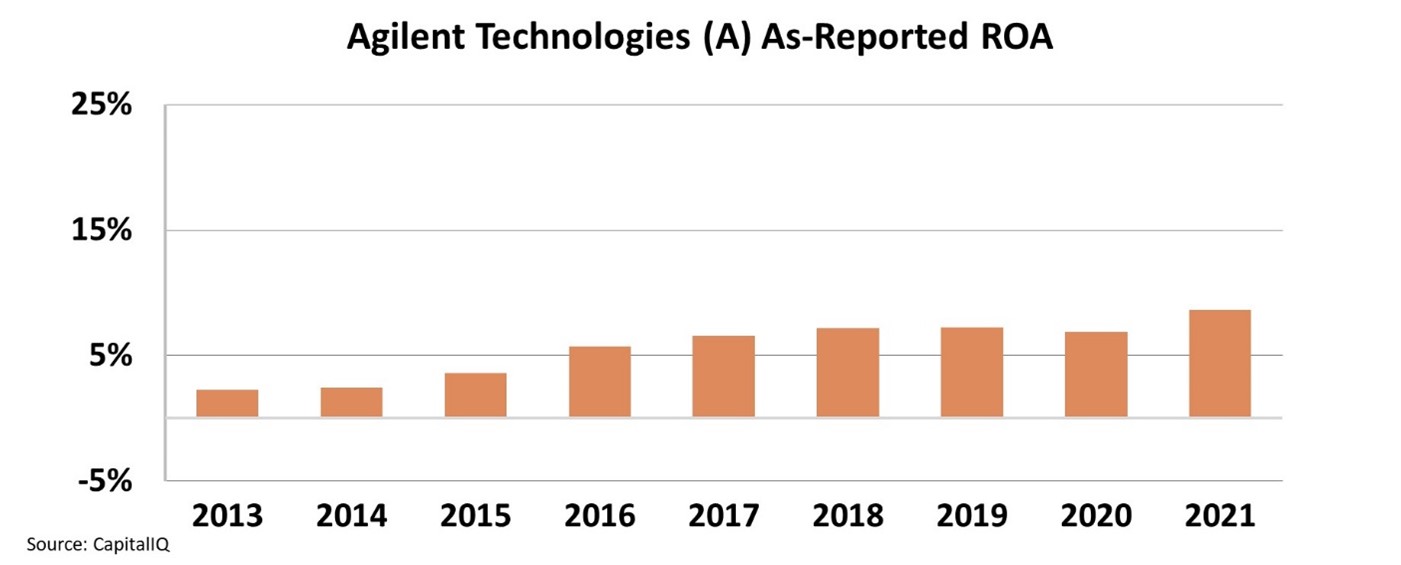

Shockingly, even while the gene sequencing market has exploded in the last few years, it doesn't look like Agilent is any better for it.

The company's return on assets ("ROA") has remained weak for the past 10 years, with returns between 2% and 9%. In 2013, Agilent's ROA was at 2%, and the company has barely provided cost-of-capital returns at its best.

Given that the industry is becoming commercially viable, these results are quite disappointing. Furthermore, poor returns might suggest the management cannot efficiently use their assets.

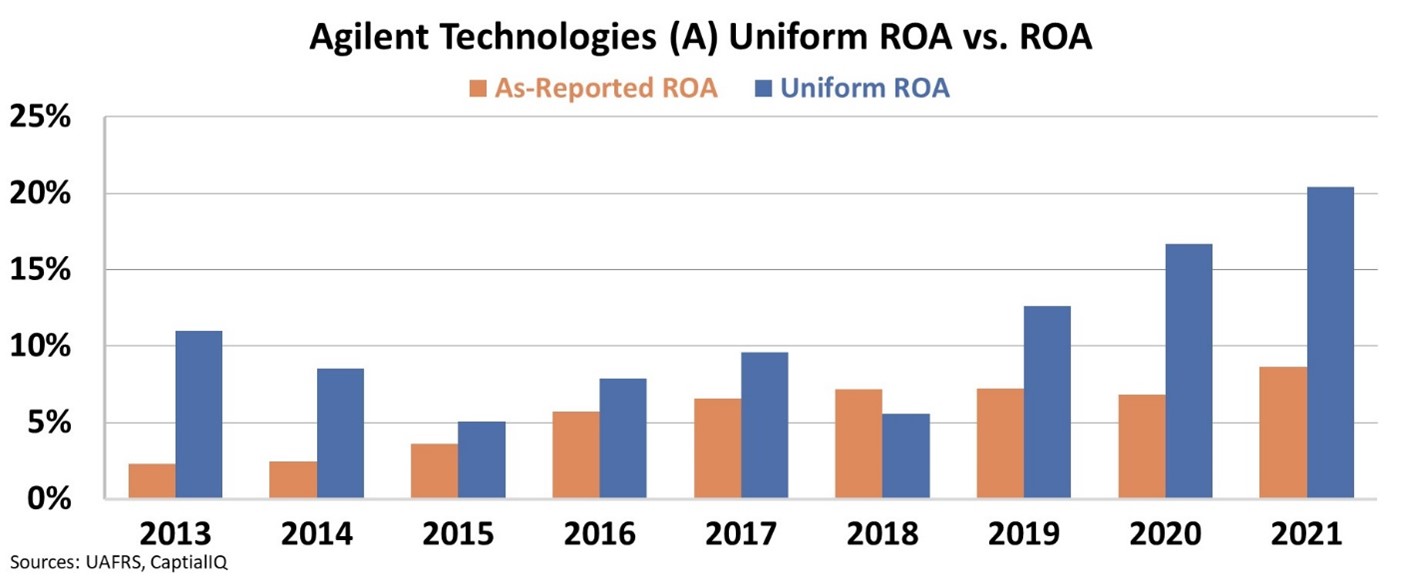

But once we make the adjustments necessary for Uniform ROA, we can easily see that returns started spiking around the time gene sequencing became commercially viable, rising from 6% in 2018 to 20% last year.

Considering the growing demand for gene sequencing and the enormous potential that remains uncovered with different applications, it seems like Agilent is ready to take off.

While the as-reported metrics continue to cloud investors' decisions, our Uniform data uncovers the truth and allows us to see the inflection it has seen in returns.

Regards,

Joel Litman

April 13, 2022

P.S. Are you interested in knowing which niche will be the source of the next big wave of billion-dollar companies? Through forensic accounting, my team at Altimetry has identified a hidden subsector of the market that will create tremendous wealth. Even Larry Fink of BlackRock said it's a space that will generate the next 1,000 unicorns...

And I put everything that you need to know in my brand-new presentation. You can access my team's analysis free of charge right here.

The gene sequencing industry has come a long way...

The gene sequencing industry has come a long way...