The credit market is having a rough year...

The credit market is having a rough year...

In the first two months of 2023, U.S. corporate bankruptcies reached a 12-year high. And while they've calmed down somewhat since then, S&P Global Market Intelligence reports that there have been 459 bankruptcies through August 31.

That's more than the total for each of the past two years. Rising interest rates, a closed borrowing market, and weakening economic data are driving the surge.

Investors aren't just worried about soaring bankruptcies. They're also on edge due to the circumstances of those bankruptcies.

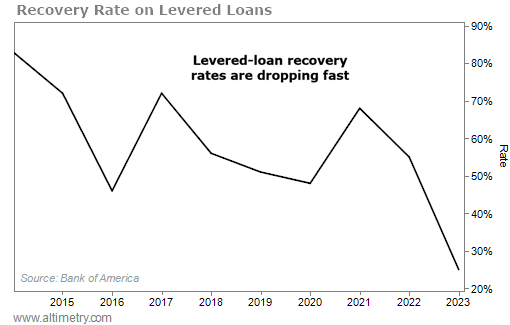

You see, unlike stockholders, bond investors can typically recoup some of their investment if the company goes bankrupt. This is called the "recovery rate"... and that number is dropping.

Said another way, creditors are recovering less money on average when companies go bankrupt. We expect it will only get worse over the next several months... So it's no wonder the credit market is getting jumpy.

Today, we'll cover exactly what's going on in the credit market... and why the wave of panic could be a blessing in disguise.

For bond investors, two questions matter more than anything else...

For bond investors, two questions matter more than anything else...

These folks don't book gains from price movement, the way stock investors do. Once they decide to buy, their return is locked in. They know exactly how much money they'll get at maturity, when the issuing company pays off the bond.

So before purchasing any bond, smart bondholders will ask themselves...

- Can this company stay afloat long enough to pay me when my bond matures?

- If this company does go bankrupt, how much of my investment will I get back?

Stock investors aren't focused on these issues. If a company goes bankrupt, shares fall to zero. They recover nothing on their investment.

Naturally, creditors care a lot about how much money they'll recover in a worst-case scenario. If a company's assets are worth more than the value of its bonds, it can sell those assets to pay back bondholders – in full – in the event of a bankruptcy.

Over the long run, the recovery rate across all types of loans has been around 40%. In good times, it can be much higher.

Creditors offering riskier loans tend to require higher recovery rates. For instance, levered loans are loans made to borrowers that already have a lot of debt or poor credit ratings.

These types of loans offered recovery rates above 50% for most of the 2010s. Often, they surpassed 60%.

But those higher recovery rates seem to be changing quickly...

But those higher recovery rates seem to be changing quickly...

Take cancer-treatment company GenesisCare. It was backed by private-equity giant KKR.

GenesisCare had a CCC- credit rating from S&P... meaning it was considered extremely speculative and on the verge of default.

Unfortunately, it filed for bankruptcy in June. And despite being financed with levered loans, it looks like investors will only get roughly 15% of their money back.

That's a pretty bad recovery for a debt investor. It's way lower than the 50% average of the past decade-plus. And it might be a sign of what's to come for more businesses...

According to Bank of America, the expected recovery rate from levered loans is only 20% today.

Take a look...

This year's recovery rate is by far the lowest we've seen in the past decade. It dramatically changes the calculus for potential bond investors.

Their investments aren't nearly as safe as they once were.

As panicked credit investors head for the exits, they'll punish all bonds...

As panicked credit investors head for the exits, they'll punish all bonds...

And that includes the bonds that don't deserve it.

Keep in mind that not every bond carries the same amount of risk. Some bond recovery rates are falling... but not all. There are still safe places to put your money in the bond market.

Investors don't tend to differentiate during times of uncertainty. This time will be no different.

We expect that as more companies go bankrupt, many perfectly safe bonds will start trading at discounts.

Patient investors will be rewarded with better opportunities.

Regards,

Rob Spivey

September 14, 2023

The credit market is having a rough year...

The credit market is having a rough year...