Apple changed the music industry but slipped behind in streaming...

Apple changed the music industry but slipped behind in streaming...

Apple (AAPL) revolutionized the way people listen to music when it launched iTunes more than 20 years ago. Between iTunes and the hundreds of millions of iPods sold, Apple has flourished.

That's why as video streaming first took off, thanks to Netflix (NFLX) in the late 2000s, many expected Apple to take the lead.

Considering its loyal user base and solid leadership in the music market, it made sense that the company would push into the streaming world.

But Apple never made a bold move until recently...

Despite the apparent similarity in business models, Apple's strategy that dominated the music industry didn't quite work for streaming.

When Netflix launched its streaming service, it spent billions of dollars acquiring the rights to stream third-party content, and today it spends billions more producing its own content.

When streaming started to take off, Apple raked in $40 billion in revenue. So, Apple decided against dedicating a significant part of its revenue to compete.

But today, Apple generates about $365 billion in revenue annually, with nearly $100 billion in profit. That might explain why Apple is finally comfortable jumping into the streaming market...

Growing the streaming services side of the business...

Growing the streaming services side of the business...

Apple TV+ is now the fourth-largest video streaming service outside China based on subscribers. But Apple still doesn't look at its streaming service as a growth vector for its business.

Rather, it's another way to preserve the company's valuable product ecosystem. By that, we mean that streaming helps keep Apple users loyal. Apple's bread and butter is its hardware. Solid streaming content only makes those products more "sticky."

When looking at as-reported numbers, you may be wondering why Apple isn't looking to change its strategy.

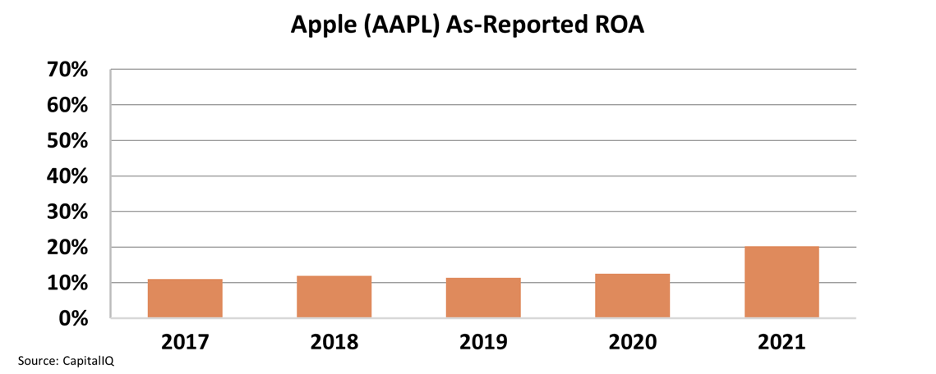

As-reported metrics suggest that Apple has performed like the average U.S. corporation in recent years, with return on assets ("ROA") hanging around 12% for most of the last five years.

ROA inflected in 2021, which might make investors think Apple's push into streaming is driving a shift to new return levels.

If that were truly the case, Apple might as well just buy Netflix. The $2.65 trillion company has $190 billion in cash sitting on its balance sheet. If it wanted, it could pay for most of Netflix's $160 billion business, making Apple the biggest streaming company overnight.

But Apple knows what it's doing, and it's sticking with its hardware-first strategy.

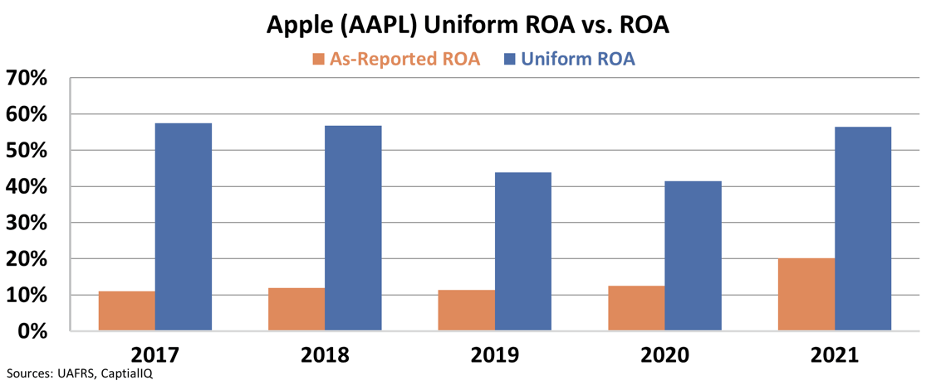

So, let's look at Uniform Accounting to understand the Big Tech company's strategy.

Instead of being the average company that as-reported metrics show, we see that Apple is well above average, with a Uniform ROA ranging between more than 40% and nearly 60% for the last five years.

That explains why Apple could enter the streaming services market at a slower pace. It does not need to offer a revolutionary service to be successful.

Apple's strategy is to protect and grow its hardware ecosystem to keep these massive returns.

Streaming is an opportunity for Apple to keep people in its ecosystem of iPhones, iPads, Apple TVs, and Macs... And it wants to keep people buying the hardware that has made the company so profitable.

Roughly less than a third of Apple TV+ customers pay for the service. The other Apple TV+ users come from free trials, included when purchasing a new Apple product.

While Apple TV+ has a few hits, its offerings don't quite match up to the catalog of Paramount+, Peacock, or the original content of Netflix and Hulu. But Apple has also spent significantly less on content than its competitors... and the company could easily buy out a small studio if it wanted.

But it has made it clear that it isn't trying to be the No. 1 leader in streaming.

Rather, it's just looking for ways to make customers stay on its devices a little longer and maintain its historically successful strategy in its main profit lines.

Under the surface, Apple is shifting to Software as a Service ('SaaS')...

Under the surface, Apple is shifting to Software as a Service ('SaaS')...

That doesn't mean to say Apple isn't evolving. Today more SaaS businesses are emerging with more reliable Internet, offering new solutions and tools.

In recent years, Apple has pivoted to various nonhardware products, such as Apple Pay and iCloud.

Here at Altimetry, we believe the future of SaaS will not slow down... as the reliance on SaaS will only continue. In fact, our recent backtest of 75 SaaS firms showed an incredible 96% success rate among these companies.

And we found the next upcoming SaaS winner.

We're so excited about our findings that we want to share them with you. That's why we put together this special presentation with everything that you need to know.

Click here to watch the presentation.

Regards,

Joel Litman

January 25, 2022

Apple changed the music industry but slipped behind in streaming...

Apple changed the music industry but slipped behind in streaming...