Few sentiments seem to generate as much controversy as the title of this essay...

Few sentiments seem to generate as much controversy as the title of this essay...

When I was a kid, I heard from my father – a doctor, not an expert on investing – about the necessity of having some of your assets in gold. I still have the gold and silver coins he bought me for a few birthdays growing up.

I'm willing to bet this is a common experience for a lot of readers. Smart, hardworking friends and relatives often tell me how important gold and other precious metals are in any portfolio.

Like my dad, most of these folks aren't investing experts, either. They work in medicine... technology... nutrition and fitness... you name it. It's as if they're looking for validation about their savvy investing techniques.

One relative keeps her gold stashed behind her television. A colleague has a small safe buried in his backyard filled with the stuff. One great high school friend told me he sleeps better at night – literally – with gold coins and bars stored between his box spring and his mattress.

It doesn't sound comfortable to me. It is to him, though.

And so goes all this fascination with shiny metals. It's not without some foundation, of course. Yet as I'll explain today, there's a time and a place to put your money in gold... and for most U.S. investors, this isn't it.

Long before I was writing newsletters of my own, I was reading them...

Long before I was writing newsletters of my own, I was reading them...

And back in the 1980s, one of the best-regarded offerings was Howard Ruff's The Ruff Times. Even today, it remains one of the most successful financial newsletters ever written.

Ruff was a giant in the investing world. He was also a market pessimist. I still recall his mandate for keeping lots of "hard money" – gold and silver – in a prudent portfolio.

I have come to realize that I share many of his beliefs about economics and politics. However, the data and signals we rely on today create a very different forecast of the future than Ruff's expectations.

Gold is a hedge against a dramatically failing economy. And the gold bugs love to quote this particular line from Ruff...

Throughout history, each time a paper currency finally caved in to inflation, gold and silver (especially silver) became the only universally acceptable coin of the realm.

The people of Argentina, Lebanon, Venezuela, and Zimbabwe should take heed. Russia, too, as the ruble collapses... and China as it enters a Great Depression that could outshine the U.S. in the 1930s.

Every prudent individual in those countries – Main Street or Wall Street or anyone in between – should be moving their assets out of those currencies as fast as they can. Physical gold and silver are far better options.

They ought to be shouting Howard Ruff's words through the streets.

The U.S. isn't China, though...

The U.S. isn't China, though...

It's not Russia, Venezuela, or Argentina, either. Despite a Congress full of economically uneducated, ill-advised, irresponsible drunken spenders... the U.S. economic machine continues to grow faster and stronger than the rest of the world.

Our companies are more profitable. Our corporate tax rates are among the lowest. And our tax revenues far, far exceed our debt-service requirements (even at these high levels that incompetent American bureaucrats have brought us to).

Gold and silver are great safe havens when fiat currencies collapse. That's not where the U.S. economy is headed these days.

It's true that gold has outperformed the dollar since the 1930s. It would beat any fiat currency given enough time... No doubt about that.

Yet almost all of gold's gains can be traced to two periods... the dot-com bubble bursting and the Great Recession. You can probably add the height of the pandemic to that list now.

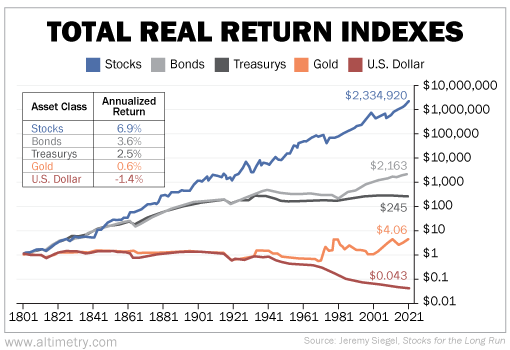

Take a look at this chart from the book Stocks for the Long Run by Wharton business school professor Jeremy Siegel...

Drag your eyes away from the dollar for a moment, and you'll notice something else...

Even if you include its best-performing years, gold isn't on the same planet of returns as the stock market.

In the past 220-plus years, U.S. equities have outperformed gold by about 575,000 to 1.

Longtime subscribers know I'm extremely bullish on the market's long-term prospects...

Longtime subscribers know I'm extremely bullish on the market's long-term prospects...

U.S. equities are poised to outperform the world – and even their own illustrious history – for decades to come.

Now, I still expect a recession in 2024... and possibly beyond. Knowing that, would I bet gold against the dollar?

Yes. Without a second thought.

However, would I take even one share of my retirement equity portfolio and move it into so-called hard money?

In other words, would I give up even a fraction of my share in the greatest economic machine ever... across the rest of my lifetime... and my children's lifetimes?

Not a chance.

Wishing you love, joy, and peace,

Joel

February 9, 2024

Few sentiments seem to generate as much controversy as the title of this essay...

Few sentiments seem to generate as much controversy as the title of this essay...