Goldman Sachs (GS) needed a pivot...

Goldman Sachs (GS) needed a pivot...

The investment bank is widely considered the best of the best on Wall Street. It has a long-standing sterling reputation for top-tier mergers and acquisitions (M&A), initial public offerings ("IPOs"), and headline-making deals.

But that doesn't mean it can afford to get complacent. During the Great Recession, Goldman's big deals slowed to basically nothing. And to get access to federal bailout money, it needed to start acting like a real bank.

(The government would only give bailout money to banks that proved they were working to de-risk their businesses.)

Goldman obliged, but its revenues didn't recover in the next several years. Interest income was above $35 billion pre-Great Recession. By 2015, it was just $8 billion.

If Goldman wanted to survive another downturn, it had to move down the food chain toward smaller customers. So in 2016, it began to build out Marcus by Goldman Sachs.

This was its first shot at consumer banking. The platform offered high-yield savings accounts and attractive certificates of deposit. It solved many of the headaches of traditional banks. It was online-first, meaning setting up an account only took a few clicks. And once you had an account, it was easier to operate than other banking platforms.

Plus, Goldman rolled out Marcus when interest rates were low elsewhere. Marcus aims to keep its interest rates at least four times higher than the national average, which is currently about 0.4%.

In the end, starting a traditional consumer bank allowed Goldman to find a niche in the ever-changing financial-services landscape. But in its efforts to grow its booming consumer offering, the bank may have cut some corners...

The Federal Reserve is currently reviewing Marcus' operations. Not many details have been revealed about the investigation. But the Federal Reserve doesn't conduct reviews for fun.

Of course, a Fed review doesn't guarantee any wrongdoing. But it does raise questions about why there's a review at all.

The unit was previously expected to break even by 2021. Now, it's forecast to lose $1.2 billion this year. It's possible the Fed is stepping in to make sure proper risk controls are in place in the wake of the mounting losses.

At first glance, Marcus looks like a money pit...

At first glance, Marcus looks like a money pit...

Since 2016, Goldman Sachs has lost $4 billion on its retail-banking platform. The company was targeting breakeven by this year, but that doesn't seem realistic based on as-reported numbers.

When looking at banks, we can't rely on our usual favorite metric – return on assets. Banks' assets are cash... So the appropriate measure is return on equity ("ROE").

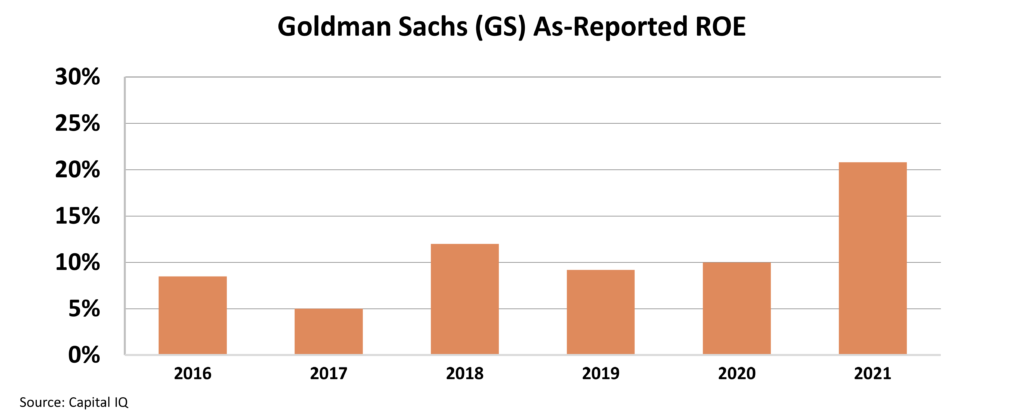

Goldman's as-reported ROE has been unimpressive since launching Marcus. Take a look...

The corporate average financial ROE is around 16%. Goldman's was well below that from 2016 through 2020.

Last year was a particularly good one for the legacy investment bank. IPO and M&A activity were booming. But Marcus is still burning cash, bringing Goldman's as-reported ROE down.

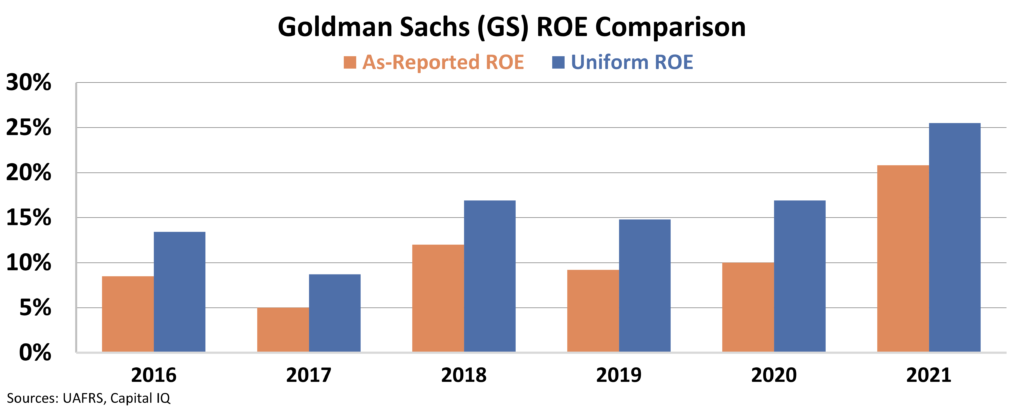

Of course, regular readers know it's rarely that simple. Once we clean up Goldman's financials using Uniform Accounting, Marcus doesn't look like a drag.

Goldman's Uniform ROE tells us the bank is still right in line with the competition. Check it out...

Goldman had a few rocky years as it spent a lot to get Marcus off its feet. But since then, Uniform ROE has been average or better. It improved from 9% in 2017 to 17% the next year. And it has been about 15% or higher since.

Marcus might not be adding much to the bottom line for now. It could be considered a "loss leader" – a business that attracts clients despite losing money. This opens the bank up for long-term growth potential. The fact remains that Goldman's neobank is growing at an astounding rate.

It'll be interesting to see what the Fed finds in its review. It could turn out that the central bank wants to make sure Goldman isn't being risky by growing Marcus so fast. But again, we won't know for sure until more details are released.

In the meantime, there's probably no reason to worry that Goldman has lost its edge.

Regards,

Rob Spivey

October 13, 2022

Goldman Sachs (GS) needed a pivot...

Goldman Sachs (GS) needed a pivot...