There's more to the U.S.-China trade standoff than semiconductors and TikTok...

There's more to the U.S.-China trade standoff than semiconductors and TikTok...

Most of the mainstream media is focused on the "exciting" sides of our ongoing economic spat with China... like whether the U.S. will abandon Chinese chipmakers or ban one of 2022's most popular social media apps.

But the trade war involves plenty of battles that don't get much attention, too. In fact, one of the most important developments has to do with a far more mundane part of the market.

Last month, the U.S. and Europe made progress toward taxing carbon-intensive steelmaking and aluminum production. About 90% of steelmaking in China relies on these "dirtier" methods.

Proposed tariffs from the so-called "Green Steel Club" would be a way to reward cleaner steel providers... push China to turn to greener methods... and help the U.S. get a leg up, tradewise.

As I'll explain today, this policy would be beneficial to many U.S. steelmakers. One company in particular is already making massive strides in the green-steel space – and the market isn't paying attention yet.

The U.S. steel industry is ready for a greener future...

The U.S. steel industry is ready for a greener future...

Among all the major steel-producing nations, no other country is as focused on what's called electric arc furnace ("EAF") steelmaking. This process uses electrical currents to melt scrap and recycled steel instead of raw materials.

In addition to being a greener option, the EAF method lets steelmakers produce higher-end steel for less. That means higher margins, improved efficiency... and with the Green Steel Club's proposed legislation, tax benefits as well.

Major steelmaker Nucor (NUE) has been utilizing EAF technology for more than 50 years. It's the largest steelmaker in the U.S. and the biggest scrap recycler in North America.

The company is well-positioned to benefit from a Green Steel Club bounce. It created the "Econiq" net-zero carbon steel certification, which guarantees certain steel products don't release carbon emissions.

With the U.S. pushing for more green steel, Nucor has a huge leg up...

With the U.S. pushing for more green steel, Nucor has a huge leg up...

The company should see increased sales as demand shifts toward greener steel. It might even be able to raise prices. Its focus on green steel could actually help the bottom line.

But the market thinks it's business as usual for Nucor.

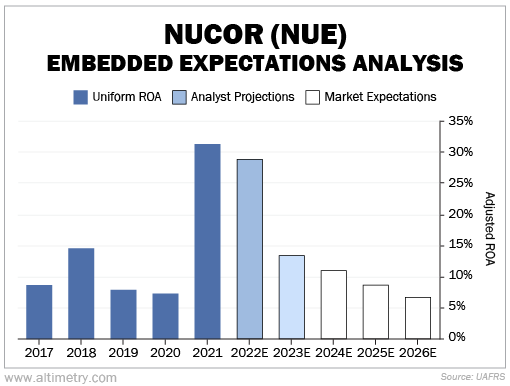

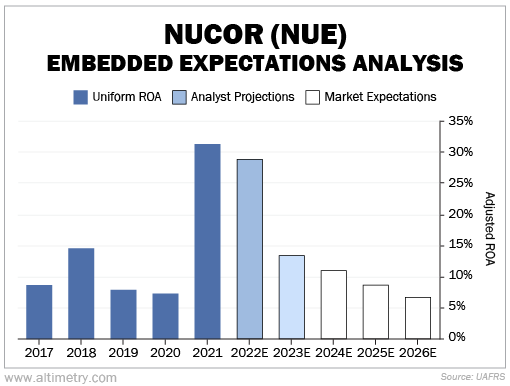

We can see this through our Embedded Expectations Analysis ("EEA") framework. It uses Uniform Accounting to determine what the market expects from a company based on the current stock price.

Investors believe Nucor's Uniform return on assets ("ROA") will decrease to 7% in the next five fiscal years. That's about where it was in bad years, like those between 2017 and 2020.

Take a look...

As you can see, 2021 was an exceptional year for Nucor's business. Steel demand was ramping up, and steelmakers were slow to respond. That meant more demand... less supply... and higher prices.

But investors don't think it will last. They expect the steelmaker to get back to historical average levels.

Normally, that wouldn't be a bad guess...

Normally, that wouldn't be a bad guess...

The steel industry is like any commodity business. It employs a lot of people... and in the long run, most companies are about breakeven.

EAF technology is widespread in the U.S. But Nucor is a cut above the rest, thanks to its Econiq certification. That means better pricing, higher volumes, and less volatility when steel demand slows.

The market's expectations seem too pessimistic. The Green Steel Club's potential tax benefits could help Nucor sustain record-high profitability for a while yet.

If you're looking for a way to play the trade war, Nucor looks like a strong bet on greener steel.

Regards,

Rob Spivey

January 11, 2023

There's more to the U.S.-China trade standoff than semiconductors and TikTok...

There's more to the U.S.-China trade standoff than semiconductors and TikTok...