The coronavirus pandemic is altering the grocery industry...

The coronavirus pandemic is altering the grocery industry...

In a recent Wall Street Journal interview, Whole Foods CEO John Mackey explained that since the crisis began, consumers have been ordering more groceries online. Customers have also been making more bulk purchases, and Mackey noted that folks haven't spent as much time lingering in Whole Foods' stores.

The company has met the demand by closing some of its locations to in-person shopping and converting them to fulfill online orders only. The business was better prepared than its competitors thanks to the strength of its parent company, e-commerce giant Amazon (AMZN), which bought Whole Foods in 2017. This has allowed Whole Foods to improve its technology as well as delivery methods.

Mackey believes this surge in online shopping will remain even after the pandemic subsides.

I can attest to the effect of the surge in online grocery shopping since the pandemic started... I've been ordering groceries through delivery services Peapod and FreshDirect for more than 15 years in both New York and Boston. And I've had issues with getting a quick delivery in a day or two.

But when the lockdowns began, the wait shot up to more than a week and a half... and even longer at some points. Consumers who had never shopped online before embraced the ease of ordering, and grocers had to quickly adapt.

Previously, concerns over not being able to inspect the quality of fresh produce and meat before purchasing kept many consumers away from online grocery shopping. People were always worried they'd end up with spoiled meat and bruised vegetables.

Nevertheless, I had still been telling people I knew how easy online grocery shopping was... And now, these same folks are surprised by the quality of these products when ordering online. Having seen how convenient it is, they don't want to turn away – one of the many things that have changed in response to the "At-Home Revolution."

Mackey is right... These consumer habits are unlikely to subside as the pandemic fades. The greater challenge for these online grocers was attracting people to the platforms in the first place... but with 45.6 million people in June using an online grocery service, much of this problem has gone away.

Now that consumers have seen the ease and quality of online grocery shopping, we'll likely see sustained growth even after things get back to normal.

No matter how we get what we eat, many people have started to make their own food...

No matter how we get what we eat, many people have started to make their own food...

During the peak of lockdowns, many restaurants were closed to in-person dining. Earlier this month, New York City announced it would allow indoor dining at 25% capacity by late September. However, the shutdowns have already permanently affected restaurants. It's estimated that as of early August, 16,000 of New York City closures were permanent.

One of the results of people not being able to go out to eat (or being afraid to do so) has been an increased focus on making food at home. This has led to sustainable growth in the demand for grocery store offerings, regardless of the delivery method.

This has been beneficial for grocery wholesalers like United Natural Foods (UNFI). It's a name that Altimetry Daily Authority reader David asked us to look at from a Uniform Accounting perspective.

United distributes food to grocery stores in bulk – supplying the companies that supply food to Americans. It's essentially a background operator in one of the world's biggest markets, as the grocery market is estimated to be worth $682 billion.

United entered this business in 2018 with its acquisition of SuperValu. Previously, United was primarily a natural and organic food provider, but the company acquired the SuperValu grocery distribution business in part to expand the reach of its offerings.

The acquisition transformed United from a niche supplier beholden to Whole Foods – which made up 37% of all its sales before the SuperValu acquisition – to a relevant supplier for the entire industry.

This helped diversify United's customer base to include names like Kroger (KR), as well as a host of other smaller grocery stores. That meant more buyers for its legacy natural and organic food business. And if it could operate better than SuperValu, that would also mean significant profits from a big, low-margin business. United thus sold off most of SuperValu's grocery store business and focused solely on the distribution side.

The acquisition also bolstered United's online presence, which has seen huge benefits as a result of the pandemic. United serves as a virtual warehouse for retailers selling groceries online.

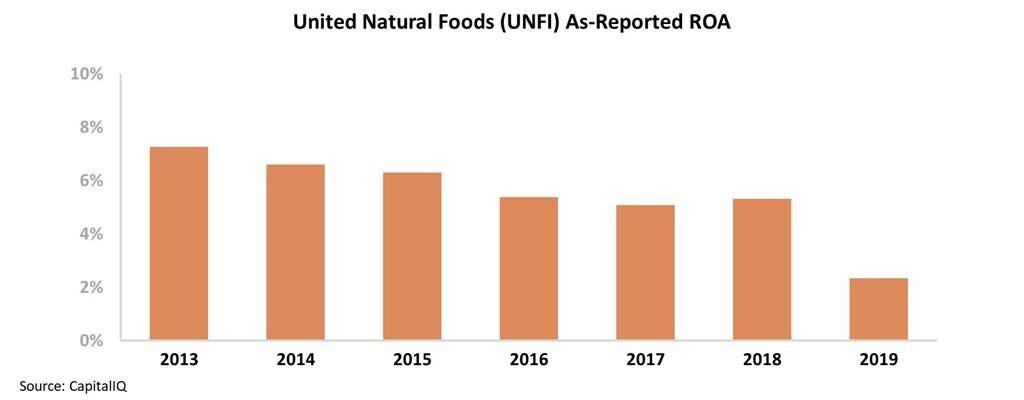

But looking at United's returns, it appears that the company's profitability been under pressure since 2013. United's as-reported return on assets ("ROA") fell from 7% in 2013 to 5% in 2018, prior to the SuperValu acquisition.

That said, it looks like United's attempt to diversify hasn't offered the solution the company was looking for. Last year, United's returns cratered even further to 2%. It appears the acquisition of the low-return distribution business caused returns to continue their downtrend...

The transaction seemed to be destroying value... which is how most acquisitions end up for large businesses.

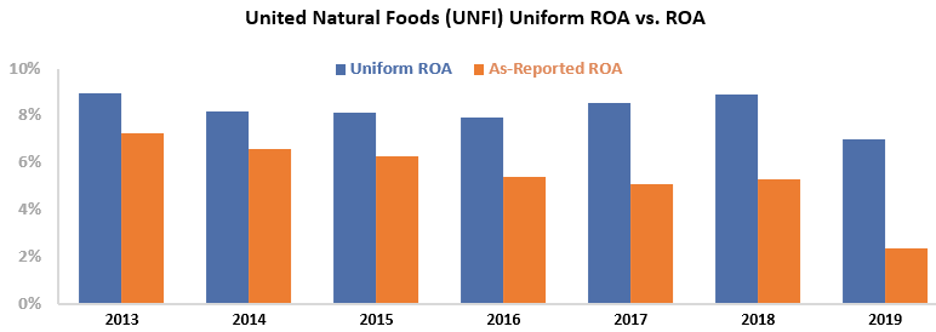

However, this picture of United's performance isn't accurate.

This is due to distortions in as-reported accounting, including the GAAP treatment of goodwill. The market has missed the mark on the stability of United's returns and the effect of the SuperValu acquisition.

In reality, United's returns sustained 8% and 9% levels between 2013 to 2018. While the as-reported metrics show collapsing profitability, Uniform Accounting shows that United's ROA was stable over this time frame.

Additionally, while the company's Uniform ROA fell from 9% to 7% after the acquisition, this was a much smaller decline than the as-reported figures suggest. This shows that while the integration has caused some slight declines in returns, it hasn't been value-destroying.

United's strategy – which looks reactive from an as-reported perspective – looks significantly different when we look at the real numbers.

And if the company can benefit from the recent surge in grocery demand, perhaps this acquisition will appear exceptionally savvy when investors look back in a few years...

Regards,

Rob Spivey

September 25, 2020

The coronavirus pandemic is altering the grocery industry...

The coronavirus pandemic is altering the grocery industry...