Strap in for a busy Thanksgiving at the airports...

Strap in for a busy Thanksgiving at the airports...

Before the pandemic, the Wednesday before Thanksgiving was typically the busiest travel day in November.

But the pandemic has brought about yet another interesting change in our behavior. Instead of waiting for the day before, people have chosen to fly in yesterday, making the Monday before Turkey Day the most popular travel day.

White collar professionals have been liberated from the physical confines of their office desks, and Zoom (ZM) has made any quiet room with Internet a fair candidate for a workspace. Hence, many are flying in earlier than they otherwise would.

So what is expected this year for Thanksgiving holiday travel?

The American Automobile Association ("AAA") estimates that the total travel volume for the Thanksgiving holiday is within 5% of the pre-pandemic levels in 2019. The nonprofit organization reports that air travel has nearly recovered – up 80% from the prior year. So, it is shaping up to be a "business as usual" Thanksgiving for the airline industry.

Comparing airline valuations with pre-pandemic days...

Comparing airline valuations with pre-pandemic days...

Airlines have faced a tough 18 months. When air travel dropped off a cliff, the commercial industry grounded thousands of flights to save on expensive fuel and labor costs. But the airlines were still on the hook for payments on existing aircraft, airport fees, and certain staff.

The flight routes that did remain operational were flown at a severe loss. Airlines typically strike a delicate, low-margin balance between travel demand and flight costs to turn a profit, and the pandemic took to this delicate balance with a sledgehammer.

Although more Americans are returning to the skies, airlines are still recovering from the lingering effects of the break in operations. They are also dealing with higher fuel costs, component shortages for planes, and a severe shortage of workers.

For over a year, some investors have been saying, 'buy the airline industry.' But the data says there is more due diligence to do...

For over a year, some investors have been saying, 'buy the airline industry.' But the data says there is more due diligence to do...

Using Uniform Accounting, we can look across the largest U.S. and Canadian airlines and directly compare them.

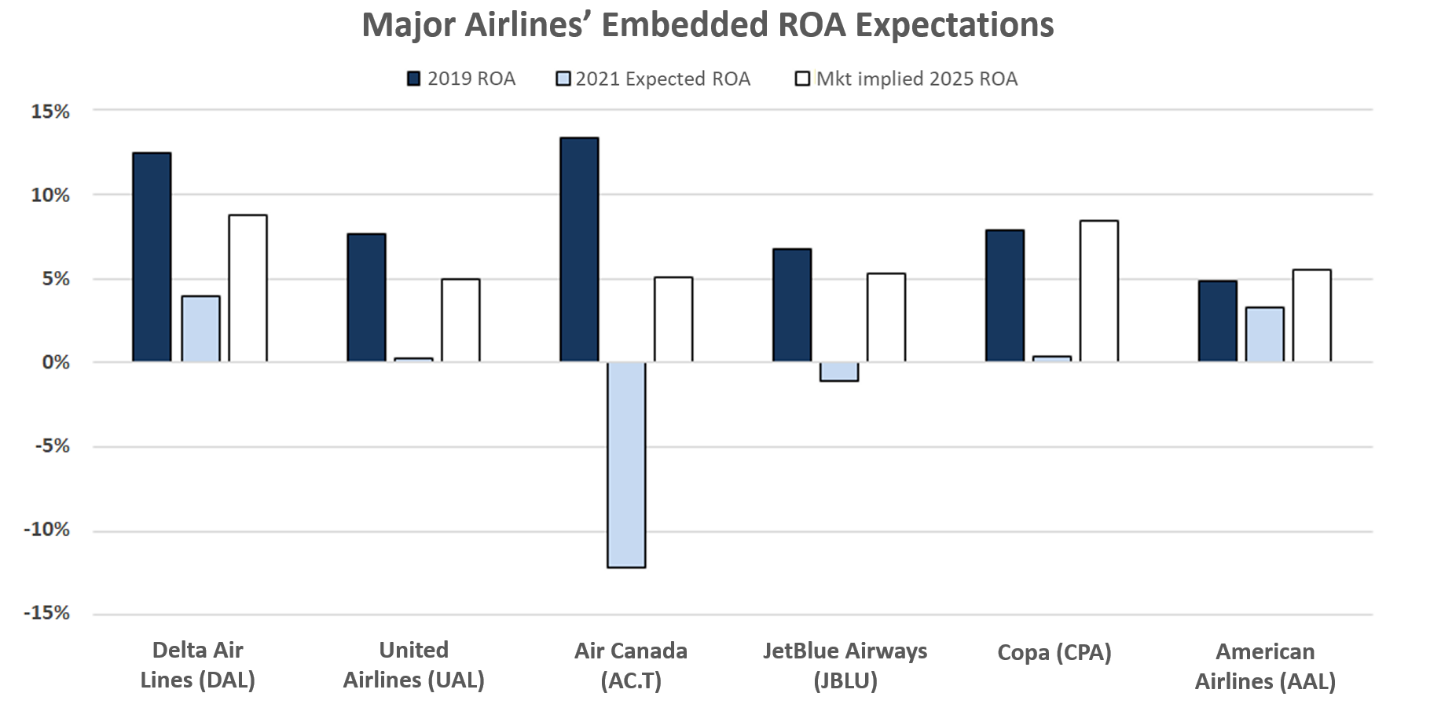

Let's look at the performance of Delta Air Lines (DAL), United Airlines (UAL), Air Canada (AC.T), JetBlue Airways (JBLU), American Airlines (AAL), and Copa (CPA). There are a few key metrics we need to see how the market feels about the air travel business:

- How profitable were these airlines before the pandemic in 2019?

- How are they forecasted to do in 2021?

- What investors are betting they'll be able to do over the next five years as the industry recovers...

Usually, when aggregating companies by industry, the market's take tends to be fairly similar. Oil companies tend to trade like oil companies. Semiconductor companies tend to trade like semiconductor companies. But not so for the airlines...

For American Airlines and Copa, the market expects profitability, measured by return on assets ("ROA"), to be higher than their performance in 2019. That's despite the numerous challenges coming out of the pandemic. Even more optimistic, 2019 was a strong benchmark year for travel.

Like Delta and Air Canada, some look particularly cheap. For other airlines, the market is pricing returns to suffer relative to 2019. Take a look...

This is a reminder that sometimes just "buying an industry" on optimism alone isn't wise.

While companies are subject to the various headwinds and tailwinds in their industry, different management teams have varying levels of competency and creativity. Some companies are better run than others.

Similarly, some companies are better priced than others. American Airlines being priced to perform as if the pandemic never happened could be a concerning signal to investors.

On the flipside, Air Canada being priced to stagnate at a third of its pre-pandemic ROA may seem unfairly bearish.

That is why we at Altimetry don't pick industries... We pick companies and strong themes such as the At-Home Revolution and Blue-Chip Turnarounds.

We work hard to recognize the broader currents at play. But remember, whether or not a firm is a good investment is more a result of company-specific factors such as competitive advantages and valuations, not just the industry it's in.

Even though we should all be thankful that the world is overall returning to normal this Thanksgiving, let's remain vigilant about how we choose our investments...

Even though we should all be thankful that the world is overall returning to normal this Thanksgiving, let's remain vigilant about how we choose our investments...

Our Hidden Alpha service curates a list of companies that are experiencing macro tailwinds directed by fantastic management.

The latest recommendation in our Hidden Alpha service stands to nearly double its stock price from where it stands today. In fact, the average return among its more than 25 open recommendations in the Hidden Alpha portfolio is 41%... and four of these stock picks have triple-digit gains.

With your Hidden Alpha subscription, you'll also get complimentary access to Timetable Investor. Our Timetable Investor informs readers about market ideas and insights you won't find anywhere else...

Learn how you can get a year of Hidden Alpha for 75% off the normal price – by clicking right here.

Regards,

Joel Litman

November 23, 2021

Strap in for a busy Thanksgiving at the airports...

Strap in for a busy Thanksgiving at the airports...