Let Altimetry Director of Research Rob Spivey walk you through how to read our Uniform Accounting charts in greater detail...

Let Altimetry Director of Research Rob Spivey walk you through how to read our Uniform Accounting charts in greater detail...

As we've mentioned previously, Rob occasionally hosts webinars for our institutional clients.

Using the Valens Research app – a significantly more complicated version of our Altimeter tool – we take these folks through a handful of companies where we're seeing significant dislocations between what Uniform Accounting and the as-reported GAAP-based data show.

After each of the webinars, we package these up as individual videos, so people who want to use Uniform Accounting can understand the power of seeing the real financial and valuation numbers.

We just posted a piece on Illumina (ILMN) earlier this morning. We've also uploaded one on S&P Global (SPGI)... Similar to Tuesday's Altimetry Daily Authority, Rob showed how wrong as-reported metrics are when looking at S&P Global's profitability.

Other recent companies include Mastercard (MA) and Abbott Laboratories (ABT).

We add two to three videos each week, and the format is similar to what we highlight here in the Daily Authority. We give a bit of background about the fundamentals of the company and what Uniform Accounting says.

So if you'd like to watch and listen to us explain our Uniform analysis, check out the Valens Research YouTube channel. You'll see more insights each week.

The utilities sector is changing where you should put your money in this evolving market...

The utilities sector is changing where you should put your money in this evolving market...

Over the past 30 years, the world has been grappling with how to reduce its carbon footprint. Through accords such as the Kyoto Protocol in 2005 and the Paris Agreement in 2016, countries across the globe have agreed to reduce their carbon emissions.

One major focus of these initiatives has been the utilities sector, as these companies contribute significantly to global emissions.

Some investors have moved their money away from power utilities focused on coal to holdings that instead focus on natural gas, which has a smaller emissions footprint. Others have looked to alternatives to take advantage of this trend.

With growing commitment from countries around the world to reduce their carbon footprint, we've seen a plethora of investment opportunities in the renewable-energy space. Thanks to tax breaks and favorable regulatory conditions, wind turbine and solar companies have started to flourish across the S&P 500 Index.

For investors looking to invest in the future, firms such First Solar (FSLR) and SunPower (SPWR) have drawn interest due to their flashy nature. However, another path to reduced utilities emissions has slipped under the radar for most investors...

A different method for reducing emissions is making the existing electrical grid more efficient. Through replacing older equipment, using computers to more efficiently allocate energy, and directing surplus renewable energy to high-demand areas, emissions can be lowered without changing the power source.

The market for this smarter grid is split into the hardware and software producers... And a key manufacturer for the hardware in this initiative is Hubbell (HUBB). By providing the equipment and devices required to efficiently allocate power, the company has positioned itself ahead of the shift in the utilities market.

However, it looks like Hubbell's new initiatives have been lackluster for returns. Traditionally, hardware production isn't as profitable as creating software. And in 2017, the U.S. announced it would pull out of the Paris Agreement – meaning the regulatory landscape appears to have shifted from under Hubbell's feet.

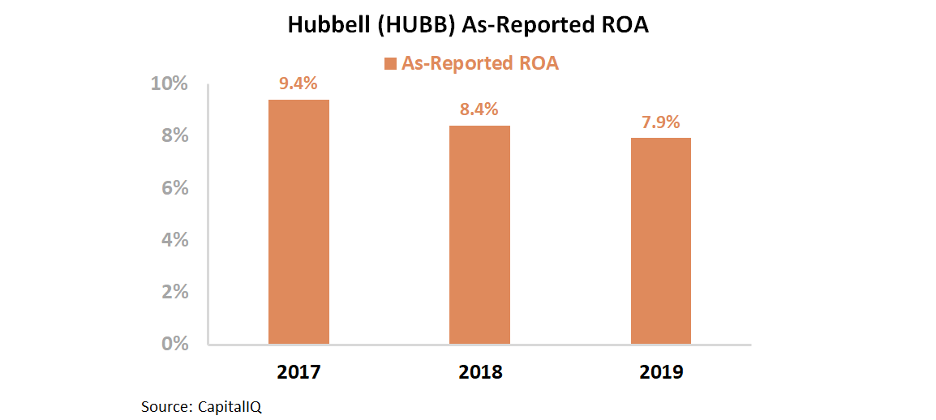

By looking at Hubbell's as-reported return on assets ("ROA"), it appears the numbers back up this narrative. The company's returns have slid from 9% in 2017 to 8% last year. Take a look...

For investors, Hubbell appears to be stuck in the unprofitable segment of a disappearing market. As the favorable regulatory atmosphere disappears, it's no wonder investors would seek to jump ship from a company with sinking profitability.

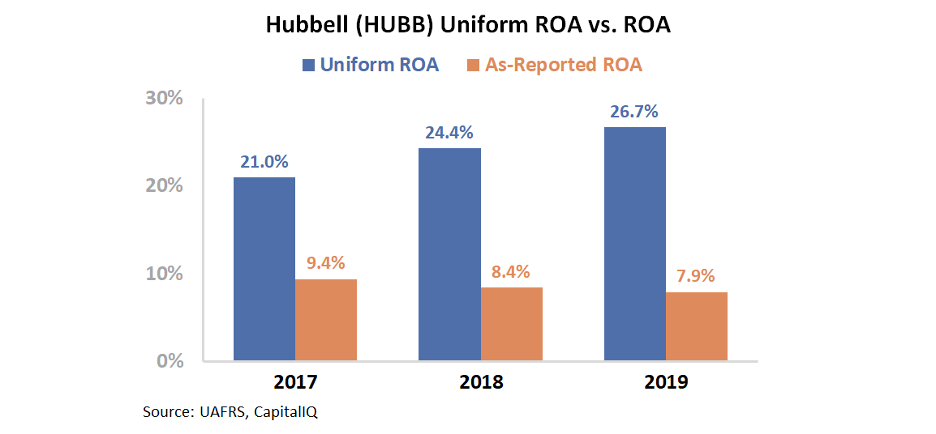

But if these investors based their decision to sell Hubbell on as-reported metrics, they'd be making a big mistake...

Due to GAAP treatment around goodwill, interest, and other expenses, Hubbell's as-reported ROA has been artificially depressed. As these distortions have grown, removing them yields a completely different profitably trend.

Hubbell's return on assets hasn't only been greater than the as-reported numbers indicate... but it's been increasing. The company's ROA has improved from 21% in 2017 to 27% last year. Instead of a paltry, diminishing return, Hubbell has realized significant operational improvement.

Rather than investing in a dead end, Hubbell has been focusing on a growth area for the future. Utilities companies are always looking to invest in efficiency improvements to save money in a low-return, regulated industry.

It's powerful for investors to use macroeconomic trends, such as renewable energy investment, to shape a portfolio strategy. However, when those decisions are informed by incorrect data, it's all too easy to draw the wrong conclusions... and miss a company on the path to greater profitability.

Regards,

Joel Litman

June 12, 2020

Let Altimetry Director of Research Rob Spivey walk you through how to read our Uniform Accounting charts in greater detail...

Let Altimetry Director of Research Rob Spivey walk you through how to read our Uniform Accounting charts in greater detail...