Watch us explain our views on companies... for free!

Watch us explain our views on companies... for free!

Altimetry Director of Research Rob Spivey periodically hosts webinars for our institutional clients.

He takes them through Uniform Accounting insights using our institutional web application – the Valens Research app. It's a significantly more complicated version of our Altimeter tool, with more bells and whistles. Each time Rob hosts these webinar, he generally talks about five companies.

Going forward, we'll be posting some mini-videos about each of the companies he highlights for the public to see. You can watch the first few we've already posted – on names like Microsoft (MSFT), Bookings Holdings (BKNG), United Healthcare (UNH), and Grubhub (GRUB) – by going to this page on the Valens Research site. We're also posting them on our YouTube channel, which you can find right here. Let us know what you think at [email protected].

A popular investing strategy has to do with merger and acquisition (M&A) arbitrage...

A popular investing strategy has to do with merger and acquisition (M&A) arbitrage...

While in prior articles we've talked about how companies often underperform after making large acquisitions because of the "winner's curse," this strategy looks at another side of M&A – divestitures.

Specifically, it focuses on spinoffs.

These are different than normal divestitures, so let's briefly explain both...

A standard divestiture involves one company selling itself or one of its business units to another company for some combination of cash or stock.

For example, 3M (MMM) – the massive conglomerate that makes everything from Scotch Tape to pet blankets – divested its Polycom business to Plantronics (PLT) back in 2018.

That's right... Until 2018, 3M also owned the company that makes the most well-known audio conferencing tools. When 3M divested the business, it received a mix of cash and stock... and that was basically the end of the transaction. Polycom was now part of Plantronics.

Spinoffs are a little different...

Rather than selling a part of the business for cash or stock considerations, spinoffs allow the smaller part of the business to become independent. Then the spun-off company usually becomes publicly listed.

There are many reasons to choose a spinoff over a traditional divestiture...

First, it doesn't require finding a buyer and working through the traditional M&A process. The valuation work tends to be more straightforward and efficient.

Second, typical divestures are subject to standard tax laws. When the company is sold, capital gains are realized. If the company pays out proceeds of the sale to investors as dividends, then these investors pay dividend taxes.

Spinoffs are a tax-free way to distribute value to shareholders.

Third, while firms that go through traditional M&A may underperform the market, spun-off businesses and their "parent" companies tend to outperform the market in the following years.

This is where the investment strategy comes in...

Studies have shown that spinoffs generally create more value for shareholders of the spun-off company and the parent company than staying as a conglomerate, and the spun-off business has a slight edge in that aggregate performance over the prior parent.

Some investors make an entire strategy out of investing in spinoffs to take advantage of this phenomenon.

However, as we'll show today, not all spinoffs outperform their parent companies... and Uniform Accounting can help us better understand these trends.

In recent years, we've seen a number of high-profile spinoffs. PayPal (PYPL) spun off from eBay (EBAY), Abbott Laboratories (ABT) spun off AbbVie (ABBV)... and in 2016, today's highlight Yum Brands (YUM) spun off its Chinese operations into Yum China (YUMC).

Yum Brands thought it could better serve stockholders by splitting its Chinese business into an independent unit.

China was a massively successful market for Yum Brands' restaurants, including KFC, Pizza Hut, and Taco Bell. All of these brands were showing incredibly strong growth in the country, and Yum Brands figured it could be more successful with a greater level of independence in China.

While this has proved to be the case operationally – with Yum China growing much faster and having a much more dominant market position – this hasn't led to a huge difference in stock performance since the spinoff.

Prior to recent market movements, Yum China had returned 73% since the spinoff.

Meanwhile, Yum Brands had returned 79% between the spinoff and the end of January. Take a look...

This directly contrasts the traditional wisdom that the spun-off company outperforms the parent after the spinoff. And in this case, Yum China has been growing significantly stronger than the parent business.

There's clearly something else going on with these businesses. Since they've roughly tracked each other since the spinoff, it may be important to look at each company's profitability to understand which will be the winner when the markets settle down.

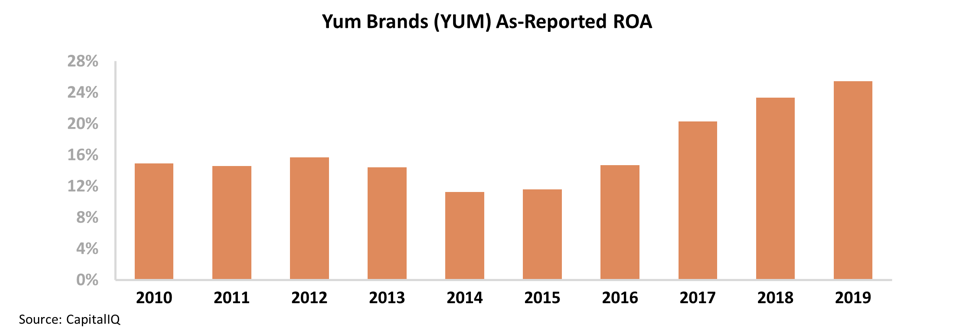

By this metric, Yum Brands' slight outperformance appears to make sense. The company has improved its return on assets ("ROA") in each year since the spinoff, improving from 15% in 2016 to 25% last year.

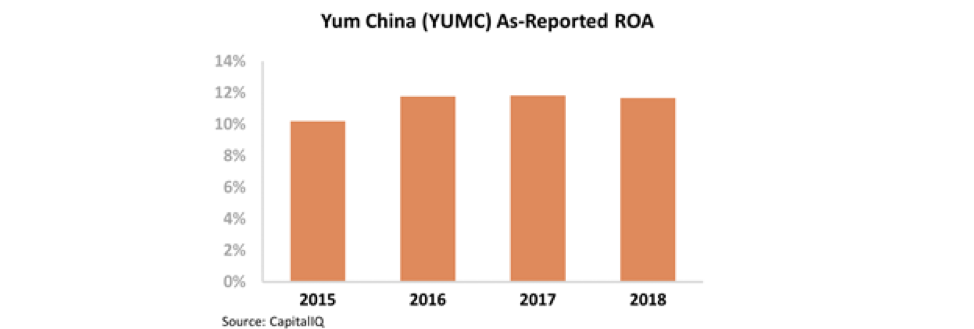

Meanwhile, Yum China's ROA has been much weaker – ranging around 10% to 12%, and it hasn't grown in the past three years.

At these levels, we can see why Yum Brands has slightly outperformed Yum China.

However, in order to understand which business is likely to win in the future, we need to turn to Uniform Accounting...

Once we restate each company's financial statements under Uniform Accounting, we can look at the future returns each company needs to justify current share prices.

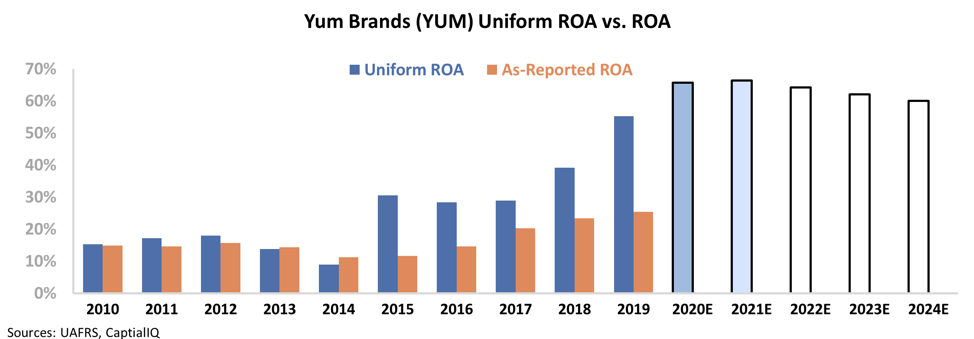

The charts below highlight Yum Brands' and Yum China's historical corporate performances in terms of Uniform ROA (dark blue bars) versus what sell-side analysts think the companies are going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, Yum Brands has seen its ROA improve even more than as-reported metrics would show, expanding from 28% in 2016 to 55% last year.

Even with that level of expansion, investors are only expecting the company's ROA to reach 60% by 2024 – Well below what Wall Street analysts forecast returns to rise to for 2020 and 2021.

On the other hand, Yum China has much steeper market expectations. Its Uniform ROA has remained stable around 11% to 13%, but investors expect to see the company's ROA nearly double over the next five years.

Considering Yum China has failed to grow its ROA over the past five years, it seems overly bullish to expect the company's profitability to double... especially when Wall Street projects its ROA to remain flat.

Many investors are willing to blindly follow investment strategies without understanding what they're investing in. This is a great warning sign to do proper due diligence before buying any high-profile spinoff you see in the news.

Regards,

Joel Litman

March 25, 2020

Watch us explain our views on companies... for free!

Watch us explain our views on companies... for free!