Valens Research is on the radio...

Valens Research is on the radio...

Last week, the institutional investment research firm that powers Altimetry was featured on MoneyLife with Chuck Jaffe. The interview starts at 38:07.

Altimetry Director of Research Rob Spivey was on the show to talk about our Uniform Accounting methodology and some interesting trends we're seeing... including around the "At-Home Revolution" – the societal shift in the wake of the coronavirus pandemic as people spend more time at home. Rob highlighted one company that's particularly exposed to the At-Home Revolution and could be a big winner.

Chuck also put a few ideas to Rob that his readers had asked about, and Rob gave some color based on our Uniform Accounting data and fundamental signals that might make the names long or short possibilities. If you care about any of these companies:

- Essex Property Trust (ESS),

- United Therapeutics (UTHR),

- LabCorp (LH),

- Nintendo (NTDOY), or

- Walmart (WMT)...

You might want to listen to the call to hear what Rob had to say.

You can generate sustainable 'excess returns' only a few different ways...

You can generate sustainable 'excess returns' only a few different ways...

In the free market, everybody is chasing after one thing – profit.

If you've ever taken an economics course, you're probably familiar with the concept of "excess returns" (also known as "economic profit").

The type of market a company is part of dictates how much excess return it can generate... and for how long.

In a perfectly competitive market – such as with commodity products, like food or basic chemicals – it's hard to generate excess returns. A company might be able to generate a year or two of above average profit, but competition will quickly enter until the market is back at equilibrium.

On the other hand, monopolies have stable excess returns because they have a captive audience and no competitors. They're mostly outlawed by the government, but a few examples of modern monopolies exist with utility companies.

Utilities are granted a geographic monopoly to build out their infrastructure, but the government heavily regulates how much they can charge consumers to cap their excess returns.

Just under monopolies, there's a category of where some competition exists, but the market is concentrated enough that only a handful of companies are involved: an oligopoly.

In this market, if the government doesn't regulate the environment, the players can use the limited competition to control supply... and therefore control prices.

One of the most famous examples of an oligopoly today is oil cartel OPEC.

The group was specifically created because as an oligopoly in the oil sector, it had enough scale to control the global oil supply and maintain pricing power for large oil-producing nations. Through this model, OPEC maintained sustainable excess returns in the oil market for significant periods over the past 50 years.

Though OPEC isn't a group of public corporations, some public firms have achieved oligopoly status by dominating their markets.

In the December 13 Altimetry Daily Authority, we highlighted MSCI (MSCI) – one of the two main players in the index-provider space. MSCI has maintained sustainably high returns by being a dominant index-provider.

And its main competitor, S&P Global (SPGI) has also had excess returns.

S&P Global doesn't generate these big returns just from the index market, though... The company has managed to benefit from oligopolies in three different markets at the same time.

Not only is S&P Global the other main player in the index world, but it's one of three competitors in the ratings-agency market and one of a handful of financial-data providers.

S&P Global is three oligopolies wrapped up in one.

The company has sufficient market share in three markets to dictate pricing, which should be sufficient for sustainable excess returns.

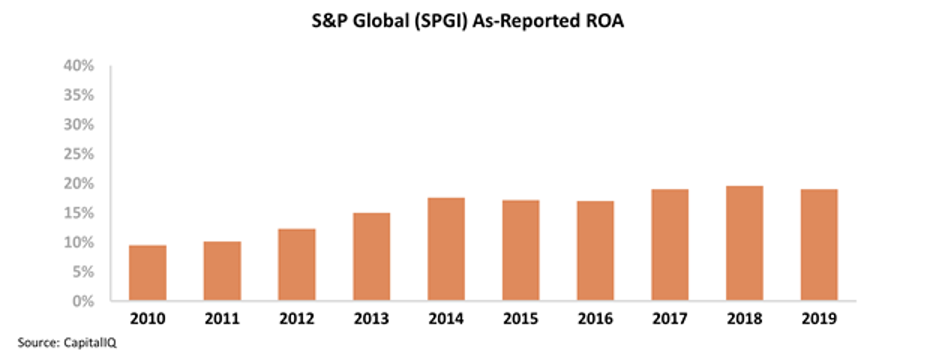

That said, looking at S&P Global's as-reported financial metrics, it doesn't look much like an oligopoly... let alone a three-in-one.

The company's as-reported return on assets ("ROA") has been strong and stable around 17% to 20% since 2014. That's above current U.S. averages of around 12%... but certainly not world-beating.

It's puzzling how a leader in three financial markets would only generate returns about 1.5 times higher than corporate averages. Oligopolies tend to generate much greater returns than this... sometimes by factors of 10 times corporate averages.

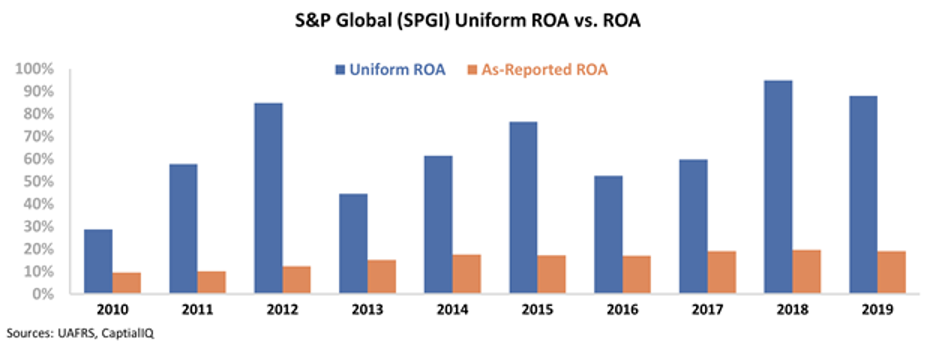

A closer look at the financials shows the issue. In reality, S&P Global seems like a true oligopoly... but this is only visible through the right data – Uniform Accounting.

After applying our Uniform metrics – which adjust for misleading accounting principles like the effect of goodwill, excess cash, and operating leases – we can see that S&P Global's profitability is more in line with what we'd expect from a member of an oligopoly.

Over the past decade, the company's Uniform ROA has remained at or above 29%... and reached as high as 95% in 2018. Take a look...

Now this is the level of profitability we'd expect from a three-headed oligopolist. With these levels of profitability, it's clear that S&P Global has built its business for sustainable excess returns.

S&P Global's consistent high ROAs highlight why the company's stock has more than tripled over the past five years... and the Uniform data show the real numbers.

Regards,

Joel Litman

June 9, 2020

Valens Research is on the radio...

Valens Research is on the radio...