The 'cashless society' keeps consolidating...

The 'cashless society' keeps consolidating...

Back in October, we mentioned how credit-services giant Mastercard (MA) has profited from the move towards electronic payments. Not to be left out, competitor Visa (V) acquired fintech startup Plaid for $5.3 billion last week.

Plaid's network allows for a seamless connection between a customer's accounts. For major players like Visa and Mastercard, acquiring these smaller startups allows the larger companies to move further into the electronic-payments space. This is a rapidly growing industry built on top of the existing credit-card infrastructure.

While as-reported metrics indicate that these firms have seen stagnant profitability, the Uniform numbers tell another story... Visa and Mastercard have both seen rising Uniform returns on assets ("ROA") as part of their investments in electronic-payments companies.

It's yet another example of how Uniform metrics clearly show underlying business trends.

This isn't news to Altimeter subscribers. We've covered the distortions between Visa's as-reported numbers and the real numbers before... and there's more to it than most investors think. Last month in our Altimeter Weekly, we explained the whole story (Altimeter subscribers can catch up right here).

If you're not a subscriber and are interested in learning more about Visa – and the 1,867-plus stocks in the entire database – you're in luck... For the next few days, we're offering a 90-day, risk-free trial to The Altimeter. Click here to find out how to gain access.

One equity class trades like a bond...

One equity class trades like a bond...

President Theodore Roosevelt was known for creating the national parks and building the Panama Canal, but he's most famous for his aggressive antitrust legislation.

Roosevelt sought to break up the large monopolies of the 19th century that exploited the average American. As these trusts dominated their markets, they could charge a higher price to helpless consumers. This trust busting came to a head in 1911, when Standard Oil was deemed harmful for the consumer in a landmark court case and was split into 34 separate companies.

However, there was one industry that Roosevelt never attempted to bust... These companies just became regulated, and underwent a century of further consolidation.

We're talking about public utilities, which are still monopolies to this day.

Competition among utilities is protected by U.S. law, making it illegal for competitors to lay down power lines or water piping where an existing utility operates. However, the government has final say on the prices that utilities can charge and the profit they can retain.

Utilities companies rarely see huge moves in their stocks, their growth prospects are limited, and their cash flows have high visibility. However, they also pay out a significant dividend from the profits they aren't allowed to keep. Together, these factors mean that utilities trade much closer to bonds than other stocks.

For many investors, these traits make utilities attractive investments. With a large asset base and a product that's relatively immune to recession, the yield on these companies can serve as a steady source of income.

If utilities trade closer to bonds, this means that their dividends are usually close to the "risk free" rate of return. Here at Altimetry, if a utility stock's dividend trades far from the norm, we pay attention...

Duke Energy (DUK) currently sports a 4% dividend yield – well above the risk-free rate. As the market demands a higher return for a larger risk, it's clear that Wall Street views Duke Energy to be riskier than its peers.

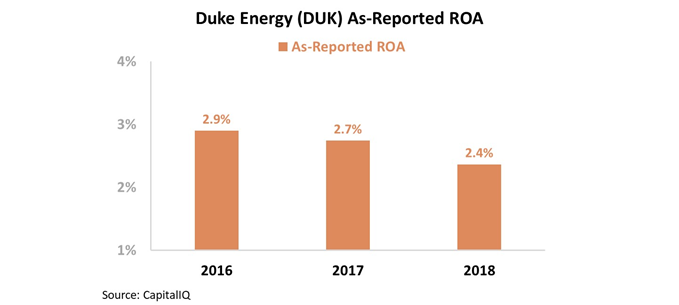

And looking at Duke Energy's as-reported metrics, why wouldn't you? As you can see, the company has seen its as-reported ROA fall steadily from 2.9% in 2016 to 2.4% in 2018.

For a utilities company, this erosion of ROA is significant... Any difficulty in making regular dividend payments directly affects profitability. Therefore, analysts have written off Duke Energy as a risky investment in an industry that shuns risk.

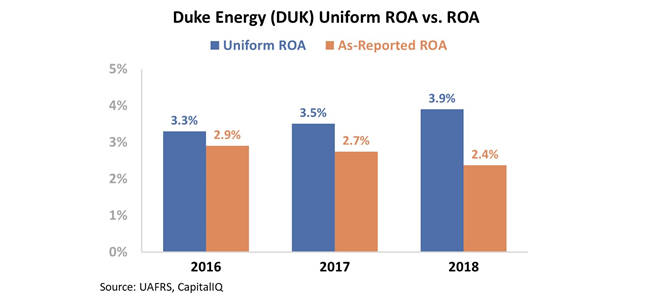

However, this view on DUK is unfounded – it's built on the flawed standards of GAAP reporting. Once we apply our Uniform Accounting framework – adjusting for issues such as interest expense and treatment of property, plant, and equipment (PP&E) – a different picture emerges...

Rather than seeing its returns contract, Duke Energy has improved its ROA over the past three years. As the company has invested in new PP&E, its profitability metrics under GAAP have been suppressed. Duke Energy has seen its Uniform ROA jump from 3.3% in 2016 to 3.9% in 2018. Take a look...

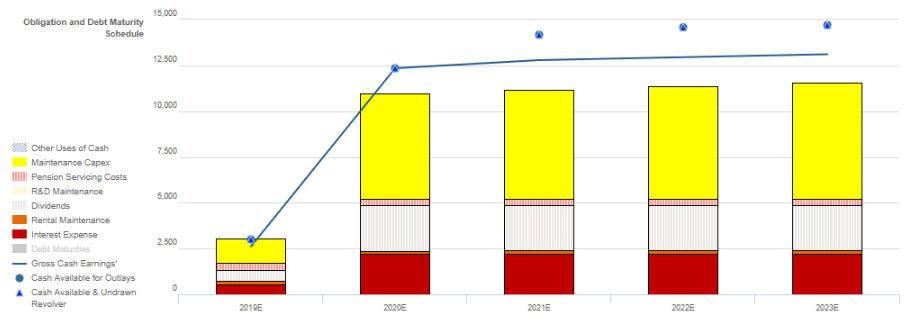

Furthermore, by having a sound understanding of the credit side of the business, we can look at Duke Energy's business risk from all angles. The chart below shows the company's cash flow over the next five years, represented by the blue line. In each yearly column are the obligations that Duke Energy needs to pay out.

Here, we can see that the company's cash flows will meet every obligation through 2023, assuming it will regularly refinance its debt. As a utility, Duke Energy can generally get access to credit markets at very favorable rates, so this is likely. Take a look...

If Duke Energy has no issues in handling its obligations, that means the dividends are safe. And it also means the dividend yield is too high right now. For value investors looking for a healthy and safe dividend yield, Duke Energy might be an interesting name to pay attention to.

Regards,

Joel Litman

January 21, 2020

The 'cashless society' keeps consolidating...

The 'cashless society' keeps consolidating...