Breaking cabin fever sometimes just requires a little fresh air...

Breaking cabin fever sometimes just requires a little fresh air...

Unfortunately, "cabin fever" has become a popular phrase to throw around in the midst of the coronavirus pandemic. Since it's on the top of everyone's mind, we're highlighting tips that the Mayo Clinic has recommended to fight against it.

As we explained yesterday, the first tip is to prioritize exercise.

Mayo Clinic's second piece of advice seems intuitive... Get out of the cabin! Go outside.

The clinic spoke to the power of short breaks from working to step outside and get some fresh air. We often become so caught up in our daily responsibilities that we forget the importance of taking breaks to "reset" our body.

A break as simple as a short walk down the street does an amazing job in achieving this. It gives us a nice change of scenery and a chance to clear our mind, and it also allows us to get some oxygen.

In a normal world, a great way to reset isn't just to take a walk... It's to take a trip.

In a normal world, a great way to reset isn't just to take a walk... It's to take a trip.

Even if you don't want to stay overnight, going to a theme park is a phenomenal way to escape from the normal day-to-day routine and forget about any stress at hand.

Six Flags Entertainment (SIX) has been one of the most successful theme parks of the past decade. Its strategy hasn't been to have a handful of big flagpole destinations like Disney (DIS) or Universal boast...

Instead, Six Flags has built theme parks that are close enough for anyone to go to easily, without a big trip across the country.

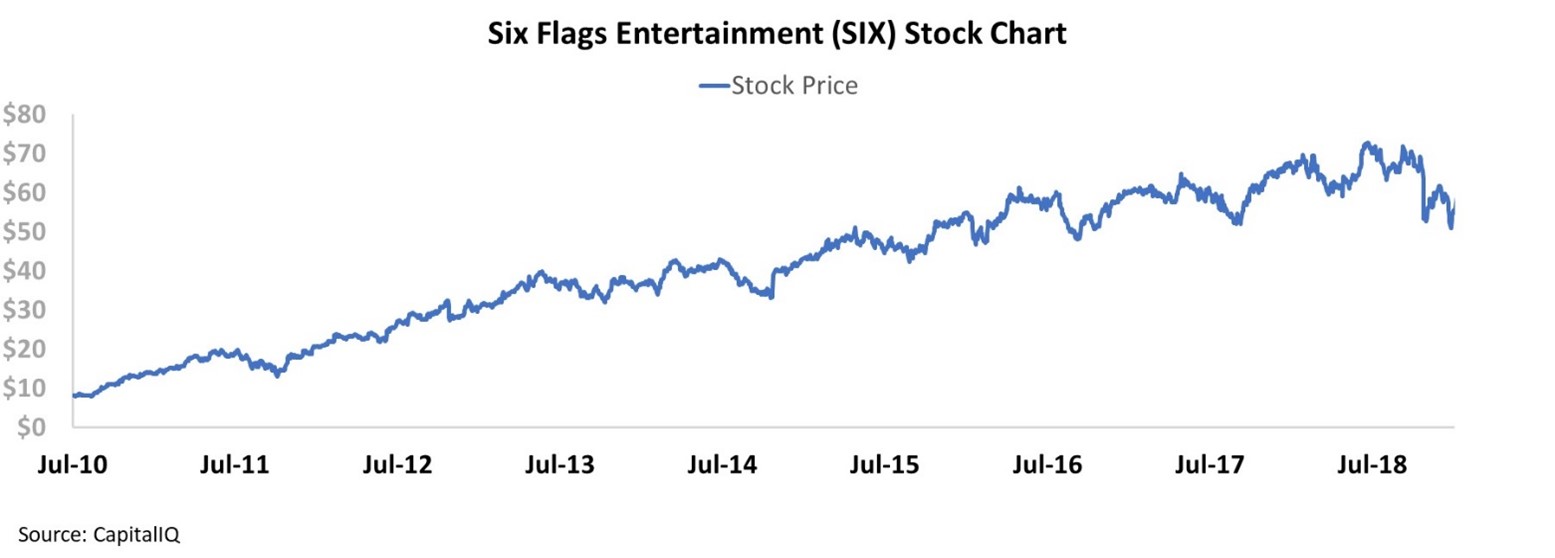

This strategy has played into one of the main drivers for the company's success after the Great Recession in 2008 – a success that saw SIX shares rise by 8 times from 2010 through 2018.

Six Flags was one of the first well-established businesses to push customers to come back more regularly to clear their heads from work.

The company also helped originate the trend for experience businesses focusing on a season-pass model...

The company also helped originate the trend for experience businesses focusing on a season-pass model...

Before it started issuing season passes, Six Flags would make a small amount of revenue each time a visitor walked through the gates of a park... And the company regularly had to focus on initiatives to get those folks to come.

The season-pass model flips that pattern on its head. Instead of constantly selling new customers, Six Flags would seek to upsell existing customers. The season-pass model sells unlimited access for the cost of a certain number of day trips.

The price of the pass would be sufficiently higher than the price of a single-day pass – meaning that Six Flags takes in more revenue while incentivizing folks into thinking they can get a "deal" by going more times than they would have paid for individually.

Customers often justify the purchase by seeing the potential savings if they did come back regularly, even if they don't actually end up attending that often.

And if customers do "beat" the system and come back regularly enough to save money on the season pass, Six Flags still benefits.

It's likely that when pass holders come, they'll bring friends who will buy tickets... which those friends wouldn't have bought otherwise.

Additionally, the more often people come, the more they spend on items like food and beverages while inside the park.

Steadily, as more people take up season passes, Six Flags can see revenue and utilization grow...

Steadily, as more people take up season passes, Six Flags can see revenue and utilization grow...

More season passes lead to friends buying more season passes. And as the company steadily raises prices "with inflation," it gets little bumps each year.

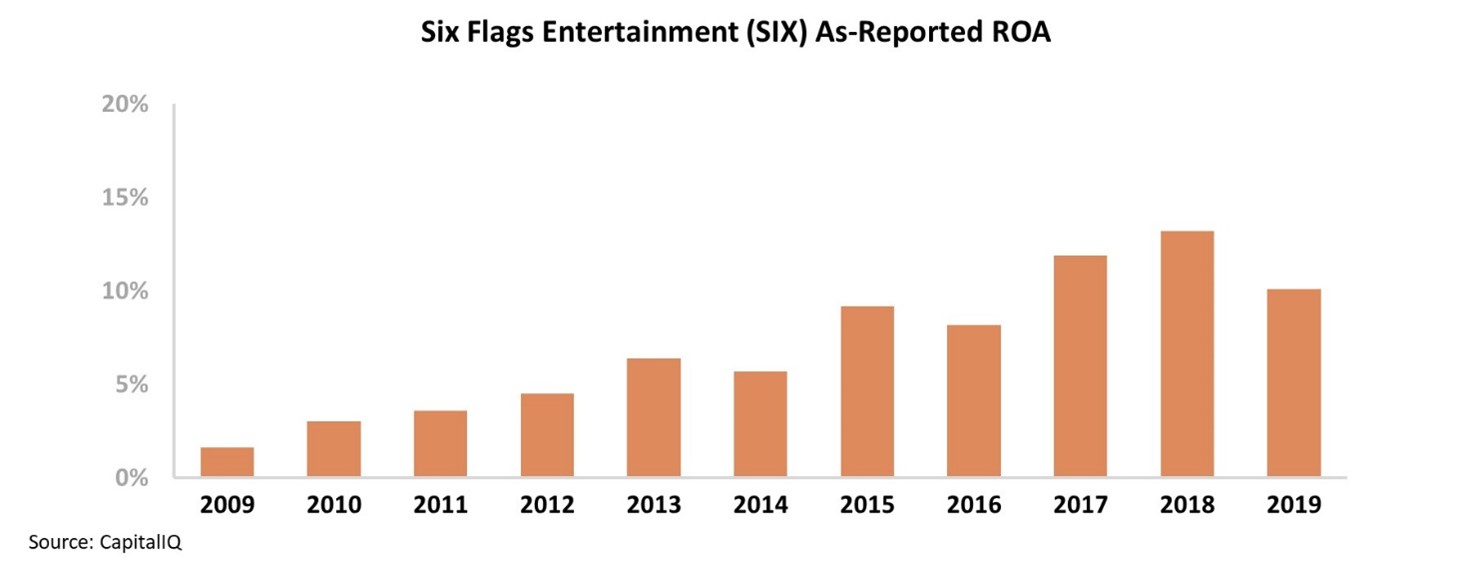

From the as-reported metrics, investors can conclude that the model led to a steady 10-year tailwind for Six Flags' profitability.

Specifically, the company's as-reported return on assets ("ROA") jumped from 2% in 2009 to 13% in 2018, before dipping to 10% in 2019. Take a look...

But in reality, this rise in as-reported ROA misrepresents the actual path of Six Flags' transformation...

But in reality, this rise in as-reported ROA misrepresents the actual path of Six Flags' transformation...

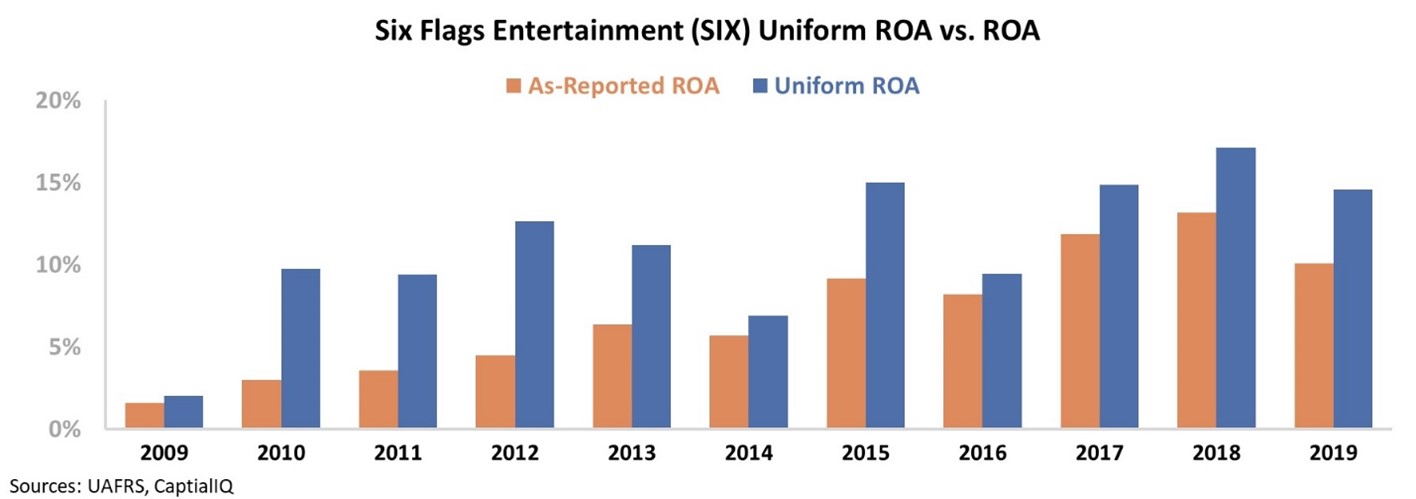

Distortions in accounting such as the treatment of goodwill and interest expense have suppressed the company's profitability over time. When looking through a Uniform Accounting lens, it becomes clear that Six Flags' business model is even more successful than it seems... and that the inflection happened faster.

As you can see in the chart below, the company's Uniform ROA has risen from the same 2% in 2009 to 17% in 2018. Even with the slight dip in 2019 to 15%, Six Flags is still returning approximately well above the corporate average of 12%. On top of that, it didn't actually take 10 years for the fundamentals to accelerate. Management was already seeing big gains from the strategy as soon as 2010.

As-reported metrics make it seem like Six Flags is just an average operator, with a management team that had to wait to see a big payoff from a change in strategy.

But after transforming the business into a season-pass model, Six Flags put itself on a path for strong profitability before the pandemic... and Uniform Accounting shows it. Without looking at the real numbers, investors might overlook Six Flags after the headwinds of the pandemic begin to subside.

Regards,

Joel Litman

January 26, 2021

Breaking cabin fever sometimes just requires a little fresh air...

Breaking cabin fever sometimes just requires a little fresh air...