If it were all about the money, nobody would ever leave Goldman Sachs (GS)...

If it were all about the money, nobody would ever leave Goldman Sachs (GS)...

The mega-investment bank is known as one of the best-paying companies in the financial world. First-year analysts often start at six-figure salaries. And the average Goldman employee made upwards of $400,000 in 2021.

It's very common for finance students to spend their first two years out of college at high-paying investment banks. What might come as a surprise, though, is that it's just as common for them to leave as soon as their analyst contracts are up.

It seems odd at first... Those banking salaries are some of the best a recent grad could ask for. Yet studies show that banks have incredibly high turnover rates, despite their high-paying job offerings.

Goldman has a 15% turnover rate for all its positions. That's much higher than the national average, which is closer to 9%. It's likely a lot higher for those investment banking analysts.

As it turns out, the reason is quite simple. Good pay alone isn't enough to motivate employees. When companies put too much emphasis on the money itself – and not enough on engaging their workers – it can cause a lot of problems for the business.

And as I'll explain today, it doesn't only apply to recent college graduates... This phenomenon goes all the way to the top.

Money matters... to a point.

Money matters... to a point.

I'm not saying that companies should routinely underpay their employees. That's one of the fastest ways for folks to lose motivation.

However, money alone doesn't guarantee performance. We see this with corporate management teams all the time.

Regular readers are familiar with the theory we call "incentives dictate behavior" ("IDB"). In short, people will do what they're motivated to do based on promised rewards.

It doesn't matter if you're a first-year analyst or a CEO with decades of experience... IDB applies to pretty much everyone.

That's why, when we analyze possible recommendations in our monthly advisories, we don't focus on how much executives are paid. They're almost certainly getting enough to keep them happy in that sense.

We care more about how they're paid. The metrics behind executive compensation will drive the decisions they make for the company.

We look at two main factors. The first deals with what management has to do to get paid. Is the CEO guaranteed his full salary no matter what... or does the company have to hit certain metrics, like revenue or earnings growth, for him to earn his bonus?

The second factor has to do with how long-term-oriented management is. Does the team get paid cash bonuses every year, or does it take stock that accumulates over time?

When picking stocks, we want to make sure management teams have the company's and shareholders' interests in mind.

For instance, if a company needs to grow, we'd prefer a management team that gets paid stock based on three-year average revenue growth... as opposed to an annual cash bonus for maximizing earnings per share ("EPS").

The team focused on revenue growth will be motivated to invest for three years to keep growing. The team focused on one year of EPS might use cash to buy back shares. Or it might conduct harmful layoffs to minimize costs and get the most out of short-term earnings.

Management compensation is telling for investors...

Management compensation is telling for investors...

It's easy to see when management isn't being paid the right way. Sooner or later, those problems are going to become apparent in the company's performance.

Every quarter, my team and I put together a Do Not Buy list for subscribers to our Microcap Confidential advisory. This is a list of small companies that investors should avoid at all costs, for one reason or another.

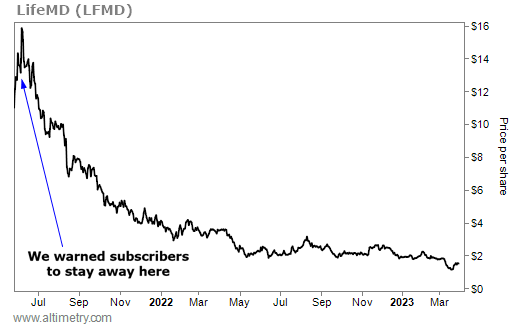

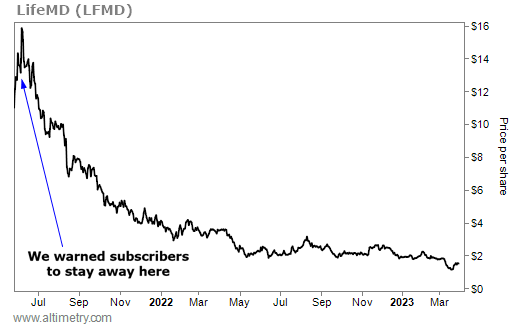

When we analyze these businesses, one of our favorite places to look is management compensation. That's exactly what we did with telehealth business LifeMD (LFMD)...

Back in June 2021, we warned subscribers that LifeMD execs seemed to be getting paid without having to focus on the business. The previous year, two executives had an agreement that could net each of them $37 million... as long as the stock price was above $3.75 for 90 days straight.

Lo and behold, the stock easily cleared $3.75 for 90 days straight. That's what management was being motivated to do, after all.

After management's payout, it had no reason to keep shares high. We warned readers to stay far away from LifeMD's stock... and it has been in freefall ever since.

Take a look...

LifeMD stock traded for $14.32 per share when we told subscribers to steer clear. It closed at $1.50 yesterday... an incredible 90% drop.

That's the power of motivation at work. Management will do what it's paid to do, no more and no less.

You can do this type of analysis for any public company. We like to start with the DEF 14A – a proxy filing that lays out exactly how management earns its keep.

Be wary when compensation isn't indicated clearly. There's no reason management needs to play games or hide how it's getting paid. And if you don't see a reason for company leaders to act in your best interest... they probably won't.

Wishing you love, joy, and peace,

Joel

March 31, 2023

P.S. LifeMD is just one of the dozens of companies we've warned Microcap Confidential subscribers about since 2020. Of the 40-plus stocks currently on our Do Not Buy list, two-thirds underperformed the market last month. The median stock is down more than 70%. And our work isn't finished yet...

We're getting ready to release our latest quarterly Do Not Buy list tonight. It features four more companies that investors should steer clear of at all costs... each of which has the potential to torpedo your portfolio. If you want to learn more about how to access the Do Not Buy list – and get Microcap Confidential for 50% off the regular list price – get started right here.

If it were all about the money, nobody would ever leave Goldman Sachs (GS)...

If it were all about the money, nobody would ever leave Goldman Sachs (GS)...