Current inflation concerns look nothing like the 1970s...

Current inflation concerns look nothing like the 1970s...

As we've discussed many times here at Altimetry Daily Authority, including earlier this month, part of the reason the U.S. Federal Reserve is comfortable focusing on unemployment – even in the face of inflation readings at decade highs – is that it believes current price pressures are transitory.

Unlike critics who say excessive government spending and money printing are on track to drive the sort of inflation seen in the 1970s, monetary policy makers at the Fed largely view the economy as experiencing temporary imbalances between supply and demand.

When the coronavirus pandemic first began, governments locked down their populations, and therefore economies, leading nervous consumers to cut back spending and many businesses to halt operations.

As governments rolled out stimulus checks and quarantined consumers adjusted to the new pandemic-era economy, demand wasn't only quick to bounce back... it was turbocharged, especially for "stay at home" goods and services like online streaming, houses, and outdoor leisure goods like golf clubs.

This massive ramp up in demand came as a major surprise to most manufacturers, who only months earlier were preparing for consumer spending to crater.

The miscalculation of demand for critical components like semiconductors has left producers without enough parts to make their finished goods.

One of the clearest ways this can be seen is by looking at the effect of inventory drawdowns on gross domestic product ("GDP") over the past quarter, which as Bloomberg highlights, missed estimates by a long shot. Economists anticipated that the economy would expand by 8.4% as the economy recovered. Instead, it only grew by 6.5%.

This is because inventories were drawn down by $166 billion in the U.S., signaling that both consumers and businesses spent faster than suppliers could keep up with new production.

Inflationary pressures will subside when supply chain issues are resolved...

Inflationary pressures will subside when supply chain issues are resolved...

One of the most important ways to resolve supply chain issues and get production back to pre-pandemic levels is to get inventory from point A to point B as fast and cheaply as possible.

Right now, given the tightness in the various freight markets – where container shipping costs are around all-time highs and still rising – cheap, on-time delivery is nearly impossible.

For companies like C.H. Robinson Worldwide (CHRW) however, which provides freight transportation services and logistics solutions, the current environment creates massive opportunities.

By offering businesses "less than truckload" transportation services, ocean freight, air freight, and traditional full truckload freight, the company helps match supply and demand by getting goods where they need to be.

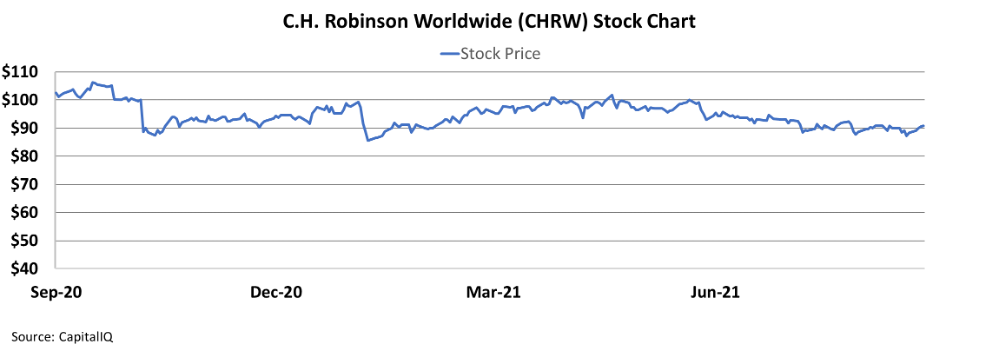

Interestingly, while supply chains have been disrupted for many months now, which should clearly benefit C.H. Robinson by allowing it to charge higher prices for its freight services, the market hasn't shown the stock much love over the past year...

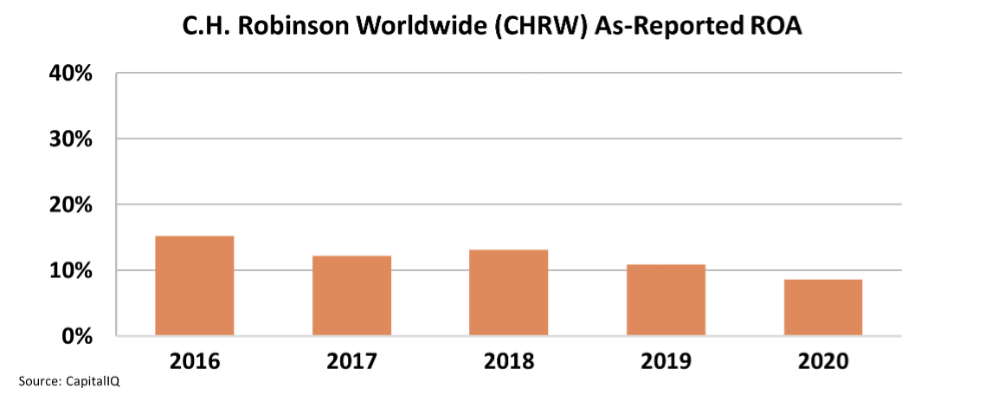

Perhaps this is because as-reported financial metrics show a company that has seen its return on assets ("ROA") decline over the past year from low double-digit levels to 9% in 2020, as you can see in the chart below...

This seems to suggest that even an "asset light" transportation service provider, with a business model based solely on matching supply and demand, isn't very profitable. If it were, we would expect to have seen profits surge as supply chains seized up in 2020.

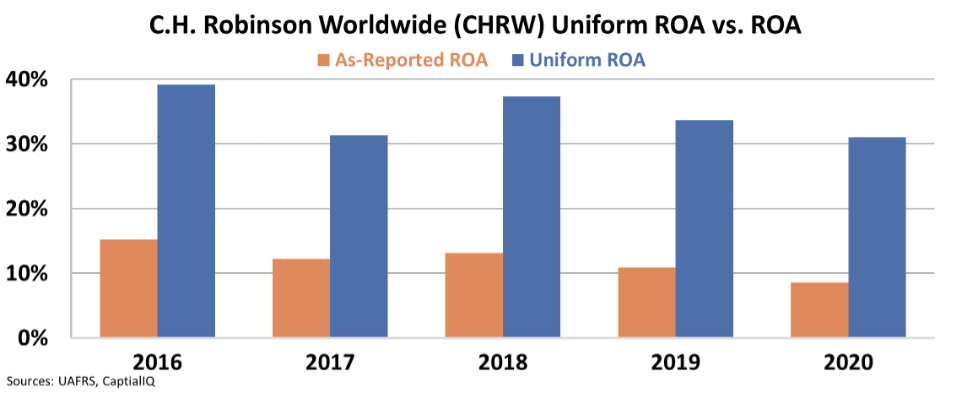

However, by using Uniform Accounting metrics, we can see that the market may actually be missing the real story with C.H. Robinson. Once we look past the financial "noise" and clean up the accounting distortions, we can see that the company has produced a Uniform ROA consistently above 30% over the past few years. Take a look...

While returns did compress slightly in 2020, C.H. Robinson is actually running an impressive business model with few assets – allowing it to be more efficient in generating value for shareholders.

More important, as one of the companies best positioned to help solve the problem of tight supply chains, C.H. Robinson's stock could be in for a revaluation once the market realizes the company's true profitability as a transportation service provider.

Through the power of Uniform Accounting, we can use the financial distortions to our advantage for finding stocks poised for big upside ahead...

Through the power of Uniform Accounting, we can use the financial distortions to our advantage for finding stocks poised for big upside ahead...

Our team makes more than 130 adjustments to a company's income statement, balance sheet, and cash flow statement. By eliminating the discrepancies, we determine the real earnings, assets, liabilities, and many other important metrics.

Each month, in our Altimetry's Hidden Alpha service, use this analysis to identify large-cap, safe stocks that still have the opportunity for big gains as the market comes to its senses. Thanks to understanding the real numbers, the Hidden Alpha portfolio boasts four holdings with triple-digit gains and 14 holdings with double-digit gains.

To learn more about Hidden Alpha – including how to save 75% off the first year of a subscription – click here.

Regards,

Joel Litman

September 22, 2021

Current inflation concerns look nothing like the 1970s...

Current inflation concerns look nothing like the 1970s...