During a recession, there's a reason governments tend to send stimulus to those with lower incomes...

During a recession, there's a reason governments tend to send stimulus to those with lower incomes...

Not only are these folks more likely to struggle during an economic downturn, but any benefits sent their way are also likely to have a stronger "multiplier effect" in the economy. This means that for $1 sent to a low-income individual, it's likely that entire dollar will make it back into the economy immediately and continue to pass through the system, thus boosting GDP.

Lower-income households are more likely to need an incremental dollar in their pockets – either to survive and get basic essentials, or for some consumption they've delayed because of income limits.

On the other hand, much of the stimulus to wealthy people is unlikely to make it into the economy. Earlier this month, Bloomberg examined just how much of the wealthiest Americans' spending is truly discretionary and can be cut in short order.

The article highlighted a study from Harvard showing that high earners cut their expenditures significantly more than others in the midst of the pandemic. The study looked at trends of layoffs in businesses that service wealthier people, as well as credit-card spending habits.

The data showed that high earners cut more spending – seeing it drop by almost 40% in early April – versus low-income earners, who cut their spending by a max of around 30%. And the difference was even more striking during the reopening...

By mid-June, low-income earners had seen spending almost entirely recover to prior norms. For the highest earners, spending was still around 17% to 20% below normal levels.

This is also part of the reason watching the recovery in unemployment will be so important to understanding how fast some areas of the economy come back. With lower-income jobs more affected by the recession in general, that means lower-income spenders may have a slower recovery than others.

And as more of their income ends up back in the economy via spending, that could hold back the overall economy's recovery.

To market the Apple Watch, the tech giant played Jetsons clips...

To market the Apple Watch, the tech giant played Jetsons clips...

There's always a market of early adopters for any technology product. These initial users are willing to buy an untested product to feel like they're on the cutting edge of the latest technology. Five years ago, Apple's (AAPL) marketing team understood this in structuring the marketing for the company's Apple Watch...

By showing clips of classic science fiction shows come to life, Apple hoped to spark the joy of science fiction with first adopters. By selling to these people and proving the value of the Apple Watch, the company was able to then pivot to selling to the wider market.

This is when Apple teamed up with high-fashion businesses Hermès and Louis Vuitton to sell the Apple Watch as a luxury item. Once the use and the value were proven, Apple was able to broaden the market for its wearable technology.

In contrast, fellow tech giant Alphabet's (GOOGL) Google was unable to make this jump for its Google Glass. While the early adopters were in love with the functionality of Internet-connected glasses, the broader market wasn't interested.

For smart investors, the big question for tech companies is whether a product will enter the mainstream market like the Apple Watch, or be doomed to be a passing fad like Google Glass. For the consumer robot maker iRobot (IRBT), it appears that investors have already made a decision...

In 2003, the company pioneered the Roomba – a computer-operated vacuum cleaner that drives around your house. iRobot has also branched out into self-driving mops, and is developing a self-driving lawn mower called Terra.

The company rightly marketed itself as an innovator of future technology since the turn of the millennium... but investor sentiment remains bearish. Looking at as-reported metrics, it's clear why people are skittish about iRobot's future.

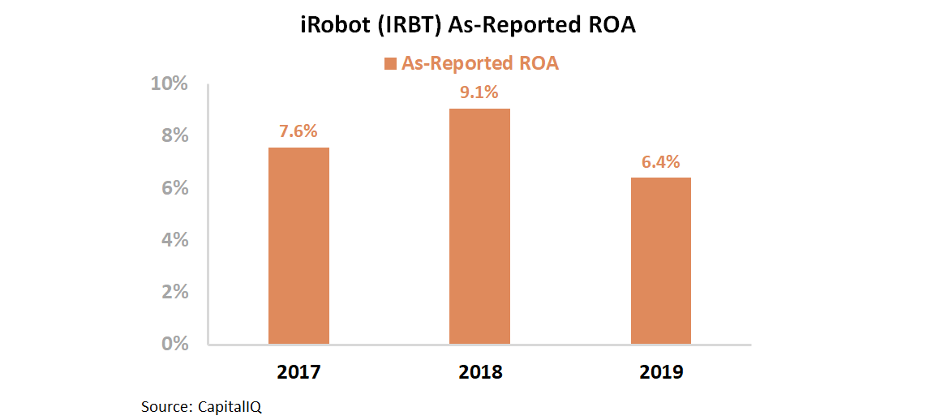

Over the past three years, iRobot's as-reported return on assets ("ROA") has floated between 6% and 9% – hardly revolutionary for a company creating the robots of the future.

While a low ROA in 2003 or 2004 could have been explained by iRobot's early stage in its lifecycle, investors have begun to view the Roomba as the next Google Glass... not the next Apple Watch. The product has made its rounds for early adopters, but isn't getting much further.

Furthermore, iRobot management has spoken to the need to retool its global marketing strategy, thus depressing returns further in 2019.

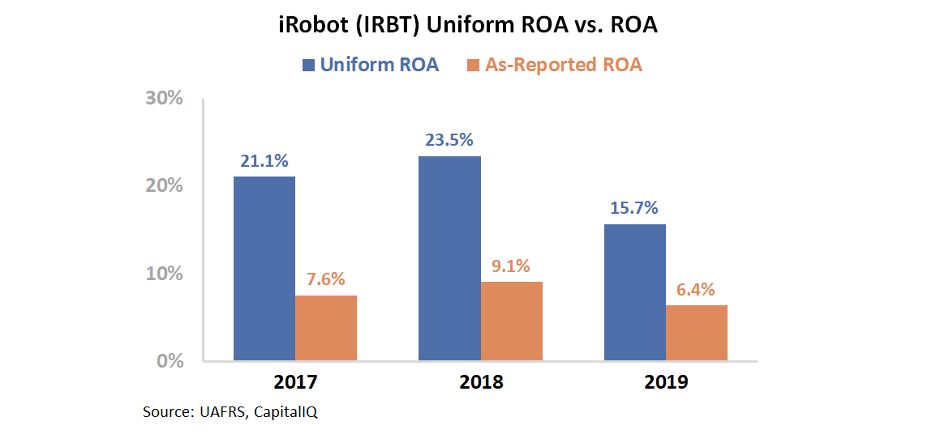

And yet, this regressing image of iRobot's performance is seen only in the GAAP numbers. By peeling away the distortions inherent in as-reporting accounting, we can see whether iRobot has truly stagnated over the past few years.

By adjusting for stock option expenses and research and development (R&D) capitalization, we can see that iRobot has actually seen double-digit profitability in recent years – hitting nearly 24% in 2018! Since 2017, the company's profitability has been strong with the exception of the one-year dip in 2019 due to marketing investments.

It's clear that iRobot has realized sizable profitability with still minimal penetration in the homecare market. However, due to its perception as a struggling technology company, investor expectations are bearish.

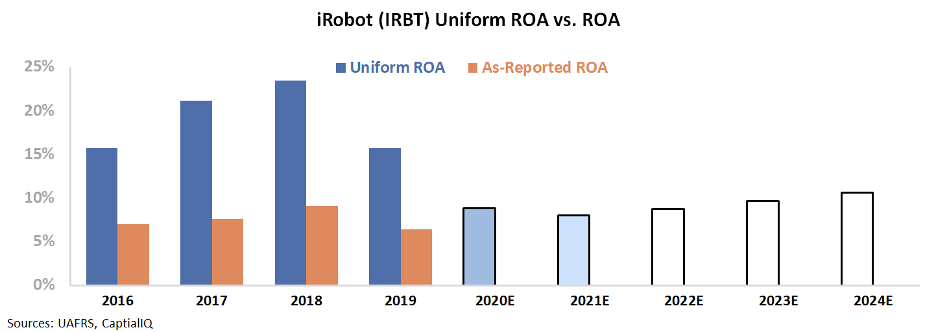

The chart below shows iRobot's historical profitability in terms of Uniform ROA (dark blue bars) compared to what analysts expect in the next two years (light blue bars), and what the market is pricing in at current valuations (white bars).

Investors currently see iRobot as continuing to slide, with the company's ROA falling to a 10-year low of 10% in 2024. Take a look...

Clearly, investors have written off the Roomba as the next Google Glass – a fad tech product that's unable to sell in the mainstream market. The market is pricing in the temporary headwinds of 2019 from iRobot's marketing investment and 2020 from the coronavirus pandemic as the beginning of a long slide in profitability.

However, historical performance has shown that the company has been able to profitably expand its homecare products. With strong returns, iRobot is already following the path of the Apple Watch... and many investors have no idea.

The market is pricing in the most bearish case. But as Uniform Accounting shows, upside is likely as iRobot continues to innovate and create new products.

Regards,

Joel Litman

July 1, 2020