Joel's note: The Altimetry offices are closed on Monday for Martin Luther King Jr. Day, so look for the next Altimetry Daily Authority on Tuesday, January 19.

Mosaics matter...

Mosaics matter...

This week on our global call, our teams discussed how more than one factor goes into how we pick stocks and look to achieve high performance in general.

Despite the power of Uniform Accounting and having a massive database of economically accurate financial data, we would never rely on Uniform Accounting alone for our stock analysis. We incorporate many different fundamental and proprietary models and analyses that contribute to the whole of our decisions.

Over more than a decade, our investment committee has provided some uncanny calls for the stock market, both up and down. The macroeconomic analysis foundation for our market calls rests on a combination of many signals across corporate performance, valuation, credit research, government intervention, and important factors for the economy and the stock market.

These many signals together create a full mosaic of information – one that provides our investment committee with decision-making capabilities that would be lost if we only relied on a few factors.

These signals combine to create a sum that's greater than the researched parts.

This mosaic idea also applies to human performance...

This mosaic idea also applies to human performance...

We're two weeks into the new year... and that means many folks are trying to keep up big resolutions such as changing their weight, quitting smoking, or developing other healthy habits.

Having goals is incredibly important. However, focusing on one goal above all else can be a detriment to your life.

It usually isn't any one individual major thing that makes a huge difference. Instead, consider the many small acts you do every day – every moment – that contribute to your health, family, and career. These include small yet super-meaningful acts of kindness for other individuals around you.

This also means acts of kindness for yourself, like foregoing that extra sweet treat or can of soda.

All those little things add up to make sizable differences in your life. The summation of all those tiny acts adds up to something far greater than the parts.

In doing so, focusing on all those little things in each individual moment actually makes up the whole of you. Your life becomes a mosaic – a true work of art.

That's the message I shared with our global teams as we seek to keep up our New Year's resolutions. See how the little improvements you make every day help build into a better you, as opposed to worrying about some big change you need to conquer. Recognize your mosaic.

One company revolves around helping people with small improvements to reach big goals each new year...

One company revolves around helping people with small improvements to reach big goals each new year...

WW International (WW) – better known by its former name, Weight Watchers – is focused on providing education and group support for folks trying to lose weight or keep it off.

By training its members on how to think about eating healthier as opposed to selling them a quick-win diet plan – as well as giving them support resources to reach their goals – WW seeks to make longer-lasting impacts on peoples' lives.

WW uses both physical locations and its online business to help customers achieve their goals. The company has aggressively grown its online business by more than 50% in the past five years. This has helped to offset some of the declines in its legacy franchise and company-owned store businesses.

This online focus has also allowed WW to weather some of the severe challenges brought about by the coronavirus pandemic.

With such an "asset light" business model with low expansion costs, investors would expect the company to be immensely profitable. After all, WW also sees steady demand as people are always seeking to lose weight, which should drive growth.

However, when looking at as-reported metrics, this isn't the case.

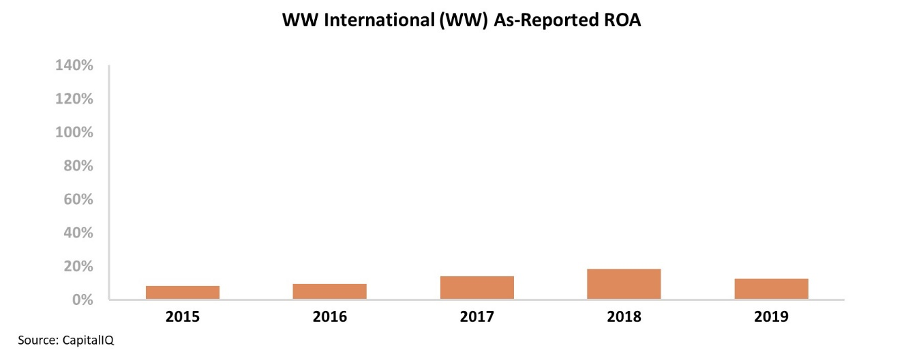

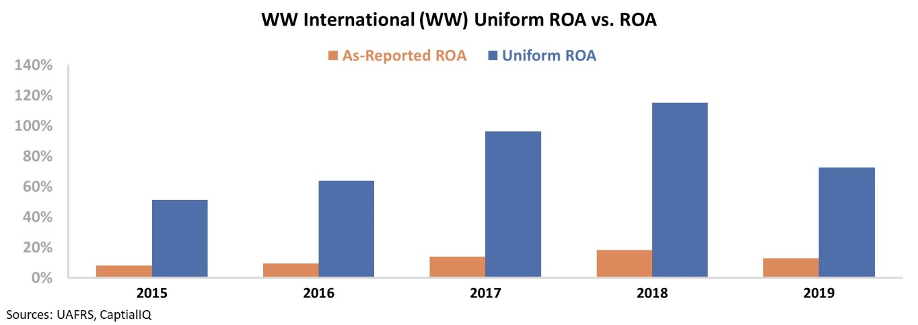

In fact, WW's as-reported return on assets ("ROA") is relatively weak – at only 13% in 2019. Although the company saw ROA spike to almost 20% in 2018, profitability has remained at or below current levels throughout the past five years.

But this is about as accurate as the promise that a quick diet plan will help you magically take inches off your waistline and keep it off without work.

In reality, WW isn't underperforming expectations... Its earnings power appears weak due to bad data.

In reality, WW isn't underperforming expectations... Its earnings power appears weak due to bad data.

As-reported metrics are misrepresenting the company's true profitability. When looking through a Uniform Accounting lens, it becomes clear that WW's asset-light business model and fundamental growth drivers have led to a Uniform ROA that has consistently exceeded 50% in each of the past five years.

In 2019, the company's Uniform ROA was an impressive 73% – highlighting that the business of helping people shed unwanted weight can be incredibly lucrative.

But without Uniform Accounting, investors see WW as a company with average returns instead of one with impressive profitability.

As WW further shifts online and continues to expand its asset-light model, we can see why WW and its shareholders might be excited about the start of a new year.

Regards,

Joel Litman

January 15, 2021

Mosaics matter...

Mosaics matter...