This past weekend, we taught a course on corporate strategy...

This past weekend, we taught a course on corporate strategy...

And once again, as usual, we learned something new.

The class, which we call "Return Driven Strategy" ("RDS"), is focused on understanding the key tenets of a successful long-term value-creating corporate strategy. Uniform Accounting is essential to identifying "RDS companies," as we call them. These are firms with sustained high returns that can also consistently grow their businesses year in and year out.

During each class, a big reason we always learn is because we make the students present on different companies that fulfill the RDS framework.

In this most recent session, one of the student groups presented on China-based Tencent (TCEHY). The company has hit one of our top RDS tenets well: "Dominate Its Target Market."

We didn't realize just how well Tencent has done this in the gaming industry not just in China... but around the world.

Tencent owns mobile-gaming company Supercell, which makes Clash of Clans... It owns 40% of Epic, which makes the wildly popular Fortnite multiplayer game... and it also owns League of Legends and rights to another highly popular multiplayer game in China, PlayerUnknown's Battleground.

Part of the reason Tencent earns sustainable high returns is because the network effect of these top-tier games locks players in to the company.

It also helps push gamers in China to use Tencent's other offerings – further solidifying the network effect of the company's chat, payment, and other offerings. But investors using as-reported metrics would have no idea how profitable this is... Tencent's as-reported return on assets ("ROA") is a measly 7%, far below its true Uniform ROA of 124%!

Using as-reported accounting, you wouldn't be able to correctly identify which companies actually generate strong returns and are reinvesting in their businesses. But once we use the Uniform data, it becomes obvious which companies qualify.

These businesses have genuine assets – meaning they can do things others can't. In turn, this means they can price their offerings based on value, not marginal cost. These companies are focusing on partnering deliberately, branding offerings, fulfilling otherwise unmet needs, and most important, maximizing wealth ethically.

That last one is at the top of the pyramid.

If a business can maximize wealth but doesn't do it ethically, it's unsustainable. Questionable activities will catch up with them eventually, and the empire will eventually crumble... even if they fulfill every other tenet in the RDS framework.

That focus on maximizing wealth ethically is a core component of our analysis in Altimetry's brand-new Microcap Confidential offering. If you don't know which companies are playing games with investors and regulars – especially in the wild west of the microcap space – you can easily end up buying stocks that can sink your entire portfolio.

But if you know which companies to avoid, you can start to focus on the microcaps that have massive upside. The microcap companies that fulfill the RDS framework need to do little to see their stocks rocket higher.

With Microcap Confidential, we're finally providing individual investors with the analysis to separate the microcaps poised for disaster from the ones with big upside potential.

And right now, because we're opening access for the first time ever, we've cut the price in half for a special charter offer. You can learn more about Microcap Confidential – and a special bonus – by clicking here.

A one-two punch is threatening the tech supply chain...

A one-two punch is threatening the tech supply chain...

Last year, investors' largest concern in the tech industry was the trade war with China. The market saw significant volatility around the growing trade tensions and how electronics would be tariffed.

Those sure seemed like simpler times... Today, the electronics supply chain is under further strain from the coronavirus pandemic.

The entire tech industry has a network that strings throughout Asia – from Japan to Korea, to Taiwan, to Singapore, to mainland China, and beyond.

Over the past two decades, globalization has encouraged firms to spread their supply chain across the world to take advantage of cost savings – especially in the tech sphere. The pandemic and the trade war have called into attention just how sprawling the tech supply chain is.

All of these forces have now come together to put heavy pressure on the reasoning behind this complex network. Some analysts believe the trend of increased spread could partially reverse after 2020.

Costs are rising due to tariffs and constricted transportation. Concerns about slowing flow of components through the supply chain are raising issues with complexity. And all this is cutting into margins and cash flow.

While creating a global supply chain once helped eliminate cost, now it's bringing headache to tech manufacturing.

At the heart of this market are the electronic manufacturing (fabrication) companies in Asian markets who take all those components and assemble them for the original equipment manufacturers ("OEMs") like Apple (AAPL), Dell Technologies (DELL), Samsung, and others.

One fabrication company is a perfect storm of market pressures. Jabil (JBL) makes computer parts for OEMs in more than 28 countries, and services supply chain networks for other fabrication companies.

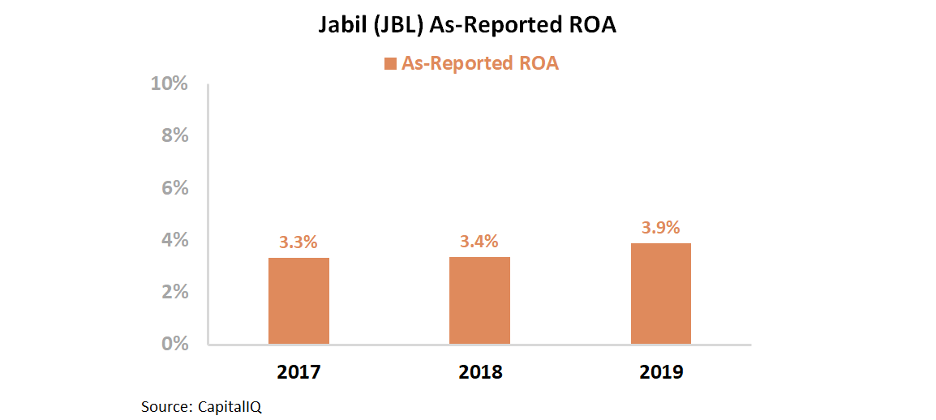

Under GAAP accounting, Jabil already is a poor performer that's potentially coming under more strain. Looking at Jabil's as-reported ROA, the company has failed to see returns exceed its cost of capital over the past three years...

Jabil is currently under massive pressure from the headwinds facing the industry... and it appears to have little earnings to spare.

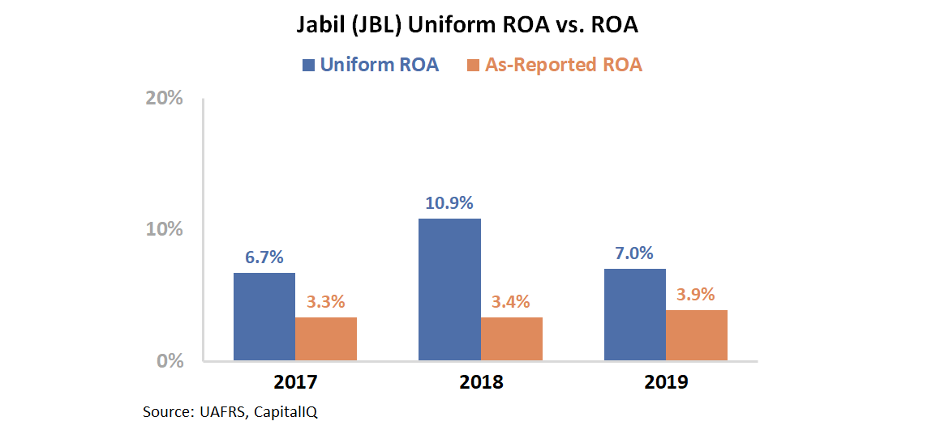

However, as we peel back the veil of as-reported accounting, we can see the real story in Jabil's financials. Due to the GAAP treatment of interest and stock option expenses and other issues, the company's earnings have been seriously misstated.

Rather than suffering from below cost-of-capital returns, Jabil has seen its ROA more in line with corporate averages – hovering between 7% and 11%. Take a look...

In reality, Jabil is a profitable company... and the market has missed this due to an inability to see the real numbers. Of course, the recent dip in returns last year shows the pressure from the trade war issues, but Jabil is still a strong firm.

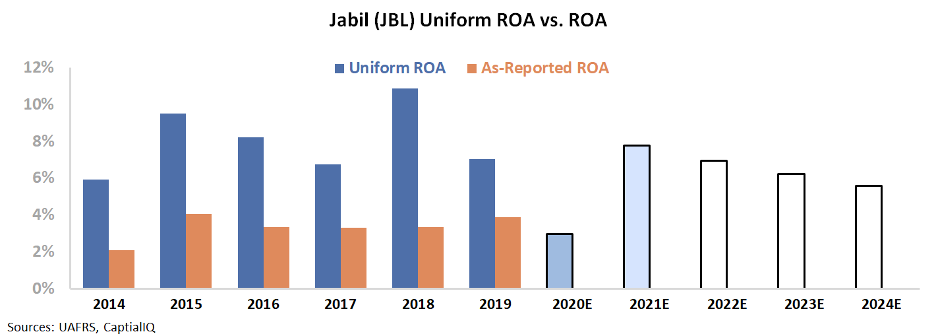

Furthermore, using the Embedded Expectations framework, we can understand what the market anticipates for Jabil going forward.

The chart below highlights Jabil's historical profitability outlined above, in comparison to what Wall Street analysts think the firm will do over the next two years (light blue bars) and what the market is pricing in at current stock prices (white bars).

As you can see below, analysts have bearish expectations for 2020. However, estimates are for a full recovery in 2021 as Jabil reconstructs its supply chain network. Meanwhile, the market is pricing in long-term pressures on Jabil's ROA.

With the as-reported numbers as a guide, it's no wonder Wall Street has sworn off Jabil. Furthermore, the market headwinds for Jabil will be significant in 2020.

Perhaps current market pessimism is warranted... after all, Jabil may face ongoing trade war headwinds along with short-term pandemic disruption. However, as we can see using Uniform Accounting, the market is already pricing in a highly pessimistic scenario for a quality firm. If Jabil can manage through these issues, its stock would likely rise.

By allowing the news to dominate investment choices, rather than business fundamentals, investors may have missed the mark for this tech company.

Regards,

Joel Litman

July 17, 2020

This past weekend, we taught a course on corporate strategy...

This past weekend, we taught a course on corporate strategy...