The coronavirus pandemic has shifted consumer spending to the home...

The coronavirus pandemic has shifted consumer spending to the home...

In the wake of social distancing and lockdown restrictions, people have been forced to spend more time at home – whether working or entertaining themselves. It's part of what we've termed the "At-Home Revolution"... And it has led to surging demand for home improvement and homes themselves.

After months of lockdown early in the pandemic, many city dwellers had second thoughts about their living conditions. After restaurants, bars, and other desirable aspects of urban life were shuttered, folks who never thought they would leave the city fled.

Promises of more permanent "hybrid" or full-time work-from-home models meant the traditional downsides of suburban and rural living were no longer an issue.

In particular, prior to the pandemic, millennials were historically unwilling or unable to purchase a home. Instead, they enjoyed apartment-style city life.

However, many millennials who delayed buying homes finally fled to the suburbs in 2020.

Now, people of all ages across the country – and the globe – have shifted to more suburban living.

For example, home prices have increased 8% and 9% over the past year in the U.K. and Germany, respectively. In the U.S., home prices have jumped 11% year over year.

This has been the fastest growth rate in the past 15 years.

Home supply is incredibly tight... And demand can't catch up fast enough.

Online real estate platform Zillow (ZG) even gave it a name – the "Great Reshuffling" – as quiet suburban locations are now leading home prices higher. Prices are no longer being driven by city supply and demand.

As a result, many companies have scrambled to reposition themselves and take advantage of the shifting demand...

As a result, many companies have scrambled to reposition themselves and take advantage of the shifting demand...

For example, retailers like Home Depot (HD) have done well thanks to the jump in remodeling and home construction.

Homebuilders are the other beneficiaries of this surge in demand as home inventory has continued to plummet.

They're scrambling to build homes fast enough to meet this new level of demand. The new living preferences also provide great opportunities for homebuilders, as location doesn't matter as much as it used to when building new homes.

As long as homebuilders are putting up houses outside of cities, they'll print money.

Right now, the big concern is simply building homes in large enough volumes.

The largest homebuilder in the U.S. is naturally riding this wave of demand...

The largest homebuilder in the U.S. is naturally riding this wave of demand...

I'm talking about Lennar (LEN).

As Uniform Accounting shows, the company had a banner year for profitability in 2020.

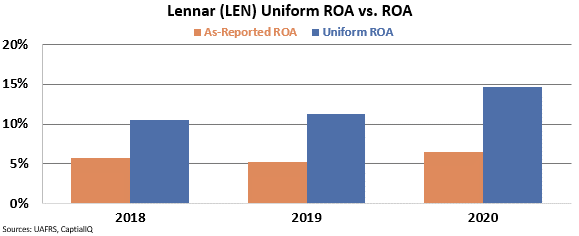

The distorted GAAP metrics show that the company's return on assets ("ROA") only moved slightly higher in 2020 after a roughly stagnant prior two years. But as you can see in the chart below, Lennar's Uniform ROA expanded from 11% in 2018 to 15% last year...

And yet, based on what the market is pricing in, investors don't appear to be getting the memo...

And yet, based on what the market is pricing in, investors don't appear to be getting the memo...

Most investors determine stock valuations using a discounted cash flow ("DCF") model. This takes assumptions about the future and produces the "intrinsic value" of a particular stock.

However, as regular Altimetry Daily Authority readers know, models with garbage-in assumptions only come out as garbage. Therefore, here at Altimetry, we've turned the DCF model on its head with our Embedded Expectations Framework. We use the current stock price to determine what returns the market expects.

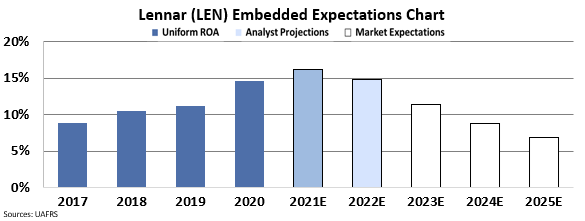

In the chart below, the dark blue bars represent Lennar's historical performance in terms of ROA. The light blue bars show Wall Street's expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift in the next five years.

Wall Street analysts are expecting Lennar to continue to print money. They anticipate the company's Uniform ROA to remain around 15% through 2022. But despite this expected strong profitability, the market is pricing in Lennar's Uniform ROA to collapse to 7% by 2025. Take a look...

Considering the strong surge in demand – along with the potential for the trend to hold steady for years to come – these expectations could be overly pessimistic.

Uniform Accounting shows how profitable Lennar has been as people move out of cities and into the suburbs. And if the trend continues, LEN shares could be poised to move higher.

Regards,

Joel Litman

April 21, 2021

The coronavirus pandemic has shifted consumer spending to the home...

The coronavirus pandemic has shifted consumer spending to the home...