For those folks lucky enough to keep their jobs in 2020, there may be another hurdle to cross as tax season approaches...

For those folks lucky enough to keep their jobs in 2020, there may be another hurdle to cross as tax season approaches...

April is never fun for working out how much to pay the government, and this year promises to add new complexities.

Due to the coronavirus pandemic, millions of employees are now working from home – turning their residences into workspaces.

The new working situation comes with complications if an employee's home isn't in the same state as his office. This doesn't even take into account those folks who took advantage of the opportunity to work from anywhere and decamped to a different state for a breath of fresh air during the pandemic.

And now, employees are trapped in a battle between states. Many taxpayers are seeing multiple states trying to tax their income.

Each state's regulations are different for recognizing taxable income. Some states require citizens to pay incomes taxes even if they worked there for just a day or two. In others, it's 60 days.

States like Massachusetts and New York are filing emergency legislation requiring those who would normally commute into the state to pay taxes, even if they never worked a day there.

As Bloomberg reported last month, New Jersey would lose up to $1.2 billion in revenue were this legislation to pass... and the state is teaming up with New Hampshire and Connecticut to block the move on behalf of residents. Meanwhile, New York and Massachusetts claim that they're simply maintaining the status quo in an unprecedented time.

Until the states hash out an agreement, taxpayers will be forced to deal with the ambiguities of a particularly ugly tax season.

Back in 2019, we highlighted one company that can help see through the tax 'noise'...

Back in 2019, we highlighted one company that can help see through the tax 'noise'...

Intuit (INTU) is one of the country's leading financial, accounting, and tax-preparation software providers.

The company's popular TurboTax product helps employees break down what they owe the state and federal governments and what the federal government owes them for the year.

With such a complex tax season coming up, more folks than ever will be turning to programs like TurboTax to wrap their heads around what they owe.

Furthermore, Intuit isn't just a one-trick pony. Products like QuickBooks help small businesses manage their accounting without needing to hire professionals.

This type of software business powered by domain expertise promises strong competitive moats... And it's why Intuit has been a favorite of investors for years. However, to understand how good the company's fundamentals actually are, we need to take a closer look at Intuit's financials...

GAAP financial metrics are riddled with inconsistencies and distortions...

GAAP financial metrics are riddled with inconsistencies and distortions...

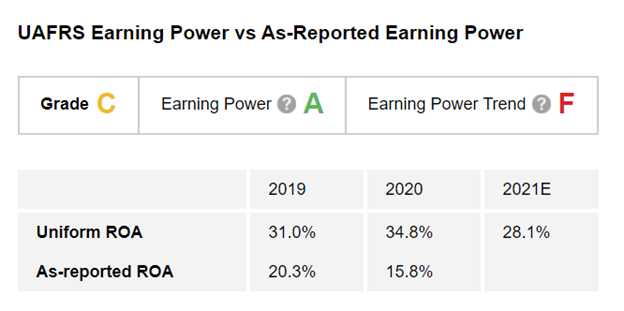

Using the power of Uniform Accounting – which eliminates those distortions in as-reported metrics – our Altimeter tool shows users easily digestible grades to rank stocks based on their real financials.

After making adjustments though Uniform Accounting, we can see that Intuit's real return on assets ("ROA") has been healthy thanks to the company's strategy – it came in at 35% in 2020. That's more than double the as-reported 16% figure.

Uniform metrics show the value in helping people with complex accounting or tax work. This is why Intuit earns an "A" grade for its earnings power in The Altimeter.

On the other hand, the company's earnings per share ("EPS") and ROA are forecasted to take a step back in 2021 due to the reduction in demand for the QuickBooks product. With small businesses across the country forced to slash costs or close, sales are falling.

Therefore, despite returns expected to stay well above corporate averages, Intuit gets an "F" for its earnings power trend.

That said, if the complexity around taxes spurs further TurboTax adoption and the newly passed stimulus gives small business a shot in the arm, this has the potential to turn around.

Of course, while Inuit is highly profitable, that alone doesn't mean it's a good stock to buy...

Of course, while Inuit is highly profitable, that alone doesn't mean it's a good stock to buy...

If the market is already pricing in a recovery – and even further upside – it may be a name to avoid.

That's where The Altimeter can also help you see through the noise of as-reported valuations to determine a stock's real price-to-earnings (P/E) ratio... and thus if a stock looks cheap or expensive.

To learn how to gain instant access to Intuit's grade for valuations – as well as the full grades of more than 4,000 publicly traded companies across industries – click here.

Regards,

Rob Spivey

March 11, 2021

For those folks lucky enough to keep their jobs in 2020, there may be another hurdle to cross as tax season approaches...

For those folks lucky enough to keep their jobs in 2020, there may be another hurdle to cross as tax season approaches...